Dogecoin price analysis continues to show bearish reading as yesterday’s decline fell further with price lowering down to $0.1164, recording a 5 percent decrement. A further 12 percent decline could be in place for DOGE after bullish growth in October stretched price up to $0.1572. Resistance is set at $0.135 over the current trend as Dogecoin price trades at $0.126 at the time of writing. If selling pressure persists, price could drop down to the $0.11 support over the next 24-48 hours of price action.

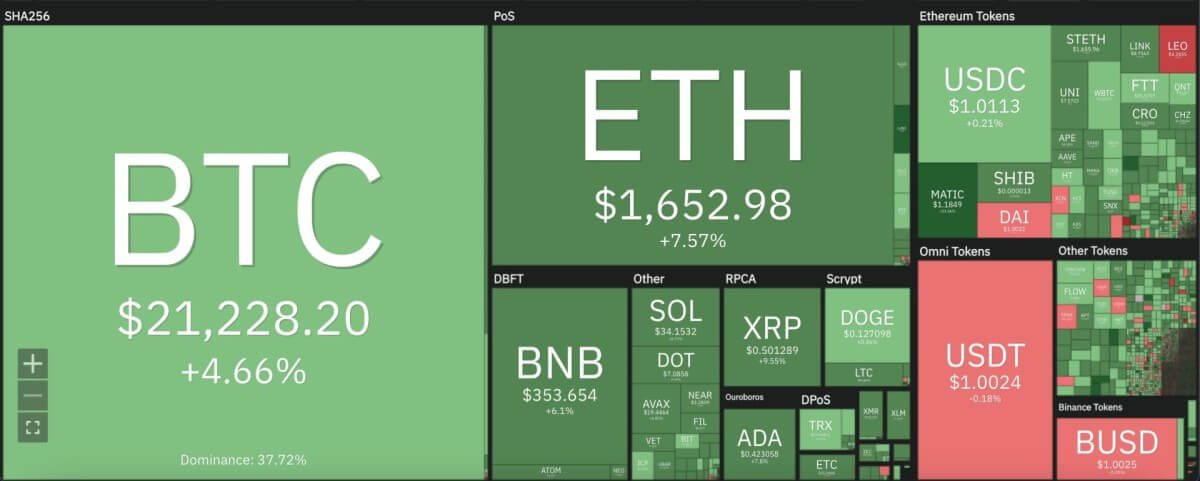

The larger cryptocurrency market showed signs of significant increments across the board, led by Bitcoin’s revival to cross the pivotal $21,000 mark with a 5 percent increase. Ethereum launched 8 percent to set at $1,600, whereas major Altcoins also followed the trend. Ripple rose more than 9 percent to move as high as $0.50, while Cardano moved up to $0.42 after making an 8 percent jump. Meanwhile, Solana shot up by 9 percent to sit above $34, whereas Polkadot made a similar jump to move above $7.0.

Dogecoin price analysis: DOGE offers discounted entry points for buyers on daily chart

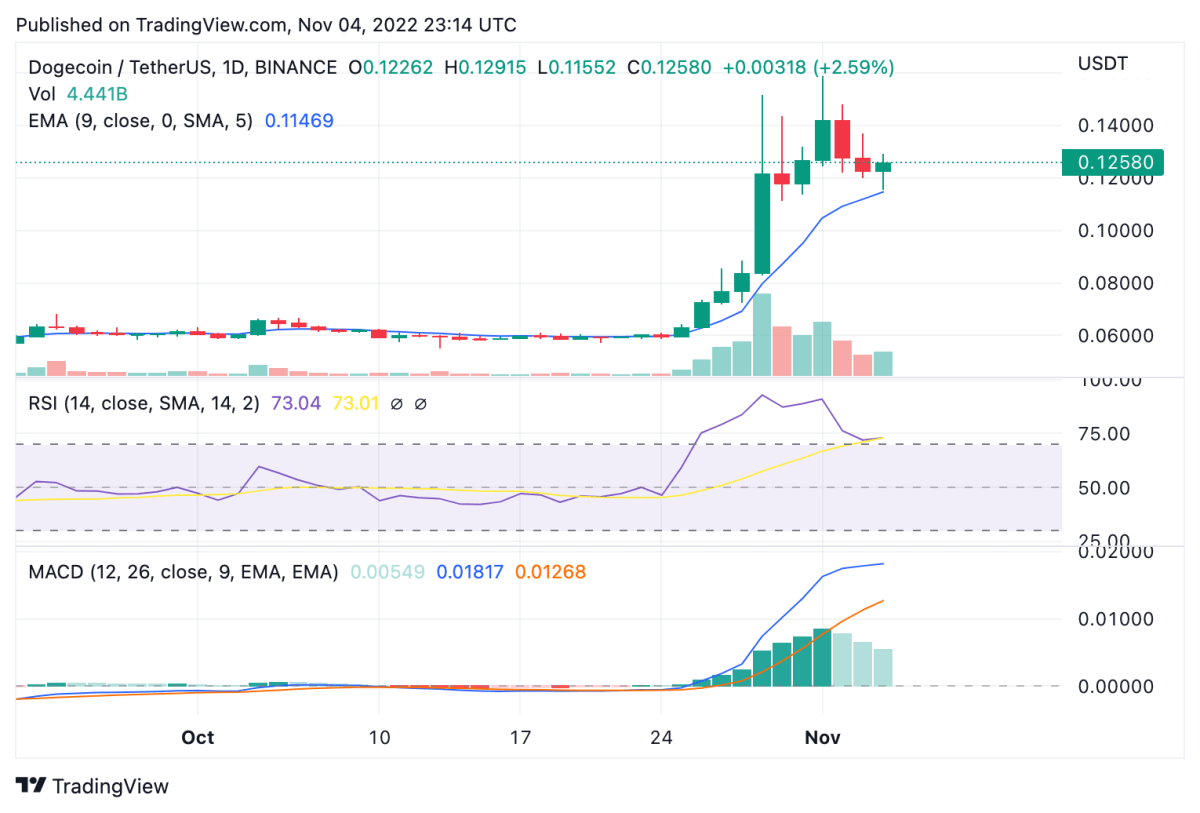

On the 24-hour candlestick chart for Dogecoin price analysis, price can be seen in continuous decline since November 2, which has seen lows around the $0.11 support. Bulls may attempt to rescue price in the short-term, but DOGE could be in line for a further 12 percent correction on the daily chart, as suggested by the overbought relative strength index (RSI) at 73.08. Price also keeps just above the 9 and 21-day moving averages, along with the crucial 50-day exponential moving average (EMA) at $0.114.

With the current downtrend in place, DOGE offers buyers a chance to enter the market in a state of dip at discounted prices. In this scenario, a bullish breakout past the $0.135 resistance could trigger an increment up to $0.152. The moving average convergence divergence (MACD) curve in this case offers encouragement in showing a bullish divergence above the neutral zone.

Disclaimer. The information provided is not trading advice. Cryptopolitan.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.