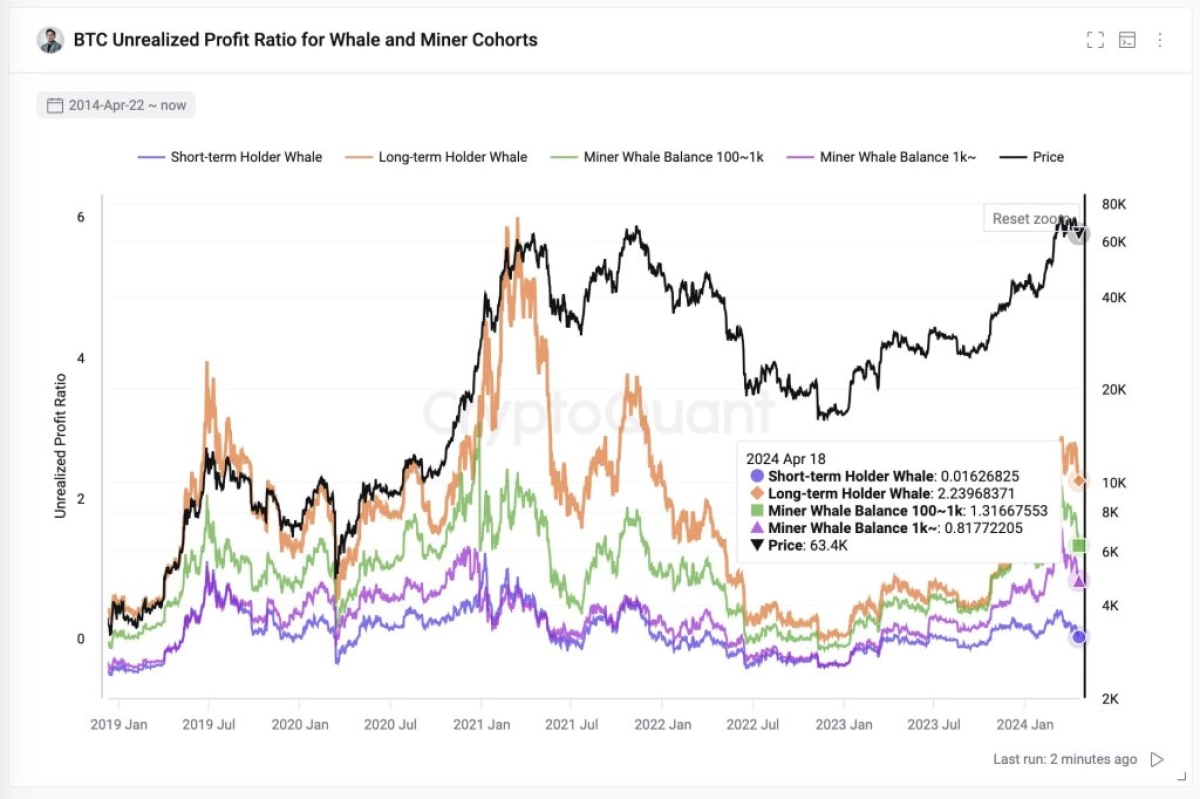

Capitulation in crypto refers to a sudden surge in selling pressure on trading platforms. Crypto analysts predict that due to the sudden fall in Bitcoin’s price below the support level, many long-term Bitcoin holders may opt to sell their crypto to cut their losses. A massive selling action would then occur, leading to a massive sell-off from long-term holders that could see Bitcoin’s price plummeting even further down.

The largest cryptocurrency by market cap, Bitcoin has recently experienced a surge in selling pressure from traders. For a long time, the cryptocurrency has maintained its price range between the $20k and $25k mark in recent weeks. However, yesterday, there was some blood on the streets as the BTC/USD trading pair price broke below the support level, and it’s currently trading at $18,750.

The sudden price drop could be linked to Monday’s US Labor Day holiday. The crypto market’s 24/7 nature might have gained more volatility as the stock and bond markets were closed for the holiday.

Explained: Bitcoin price movements within the last 24 hours

Within the last 24 hours, the market has been bleeding for Bitcoin and other cryptocurrencies. Bitcoin price has recorded a 5.28% price fall to trade at $18.750. The cryptocurrency traded at $18,510 earlier today, marketing its lowest price within 24 hours.

The trading volume has increased by 31.4%, indicating a surge in trading activity on exchanges. Traders placed several sell orders below the support level at $20k to cushion them from massive losses. As a result, panic selling happens, and the market trends continue in a downward spiral until the price hits its next support level.

The ripple effect leads to the surge in selling pressure, as investors rush to cut losses and quit, referred to as capitulation in crypto.

Looming capitulation in crypto and how to prepare for it

The $20k price for Bitcoin is a crucial support level. In 2017, Bitcoin made headlines for hitting the $20k mark for the first time, and it sparked an interest in crypto for so many people. A high volume of Bitcoin holders got in around the $20 mark and have held the token ever since. Breaking below such a vital support level would undoubtedly lead to a bloody market as most investors would want out, leading to a surge in selling pressure across the entire crypto space, thus, capitulation in crypto.

Currently, the BTC/USD pair is already trading below the $20K mark; there is indeed a possibility of further price decline. However, the Labor day holiday played a significant part in Bitcoin’s price increase. The resumption of regular trading days may attract more Bitcoin buyers who perceive this as an opportunity to buy the dip.

Suppose the prices continue to decline in subsequent days. In that case, undoubtedly, the predicted capitulation in crypto could happen, and massive sell activity could take place until the Bitcoin price next support level.