Federal Reserve Governor Michelle Bowman says additional interest rate increases will likely be needed to get inflation on a path down to the Fed’s target. “I will also be watching for signs of slowing in consumer spending and signs that labor market conditions are loosening,” the Fed governor added.

More Interest Rate Hikes Likely Needed, Says Fed Governor

Federal Reserve Governor Michelle Bowman indicated in her remarks on Saturday at an event hosted by the Kansas Bankers Association in Colorado that the U.S. central bank may need to implement additional interest rate increases to completely restore price stability.

She also affirmed her endorsement of the rate hike decision made at last month’s Federal Open Market Committee (FOMC) meeting. In July, Fed officials raised the federal funds rate to a range of 5.25% to 5.5%, the highest level in 22 years.

Governor Bowman stated:

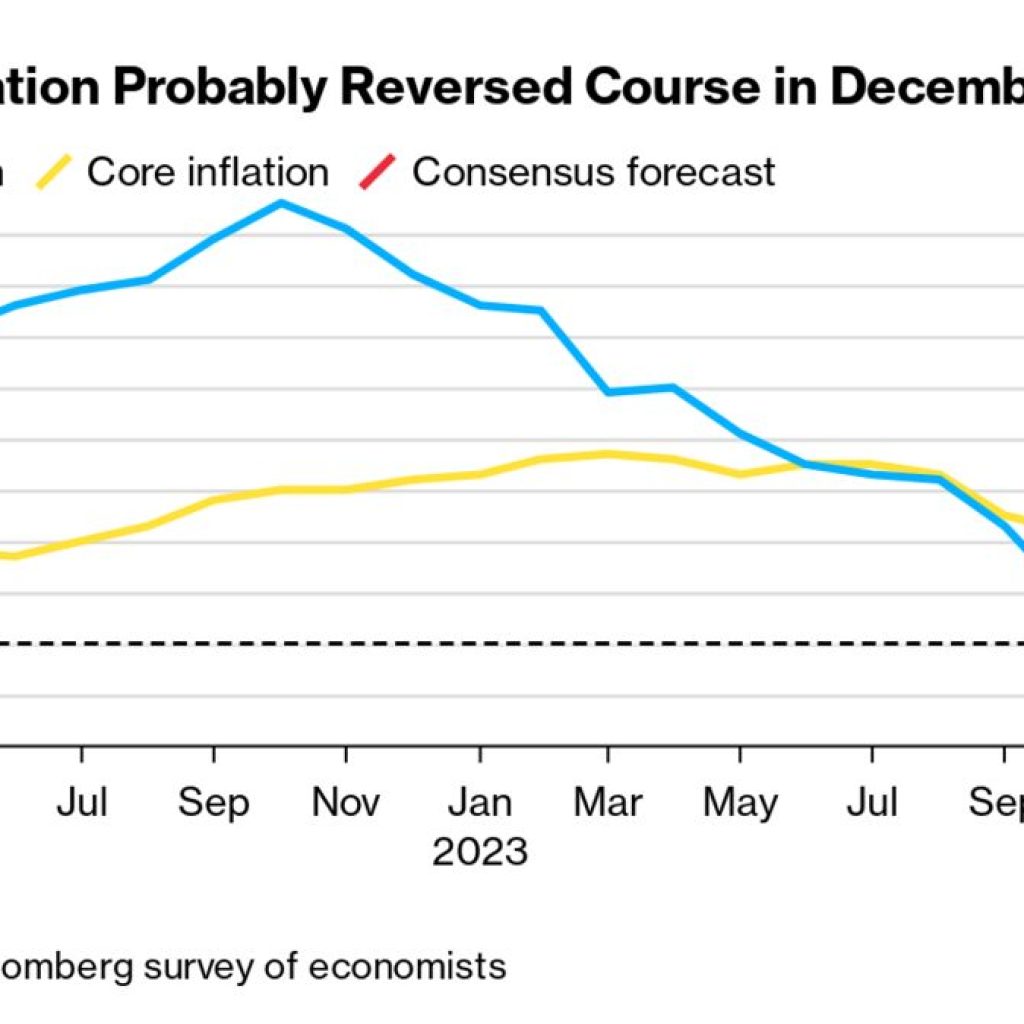

Additional rate increases will likely be needed to get inflation on a path down to the FOMC’s 2% target.

“The recent lower inflation reading was positive, but I will be looking for consistent evidence that inflation is on a meaningful path down toward our 2% goal as I consider further rate increases and how long the federal funds rate will need to remain at a restrictive level,” she detailed.

“I will also be watching for signs of slowing in consumer spending and signs that labor market conditions are loosening,” the Fed governor continued, noting that Fed policymakers will be monitoring incoming data and will be willing to raise interest rates in the future if inflation progress stalls.

Federal Reserve Chairman Jerome Powell said on July 26 after the Fed announced its latest rate hike decision that prevailing economic conditions suggest that monetary policy will likely need to be restrictive for longer. “I would say that what our eyes are telling us is that policy has not been restrictive enough for long enough to have its full desired effects,” Powell stressed, adding:

We intend to keep policy restrictive until we’re confident inflation is coming down sustainably to our 2% target, and we’re prepared to further tighten if that’s appropriate.

Do you think the Fed will raise interest rates again this year? Let us know in the comments section below.