Friend.tech, a decentralized social media platform built on the Base, the Ethereum layer-2 scaling solution backed by Coinbase, generates more fees, and thus, revenue than Bitcoin. This transactional platform allows users to move value.

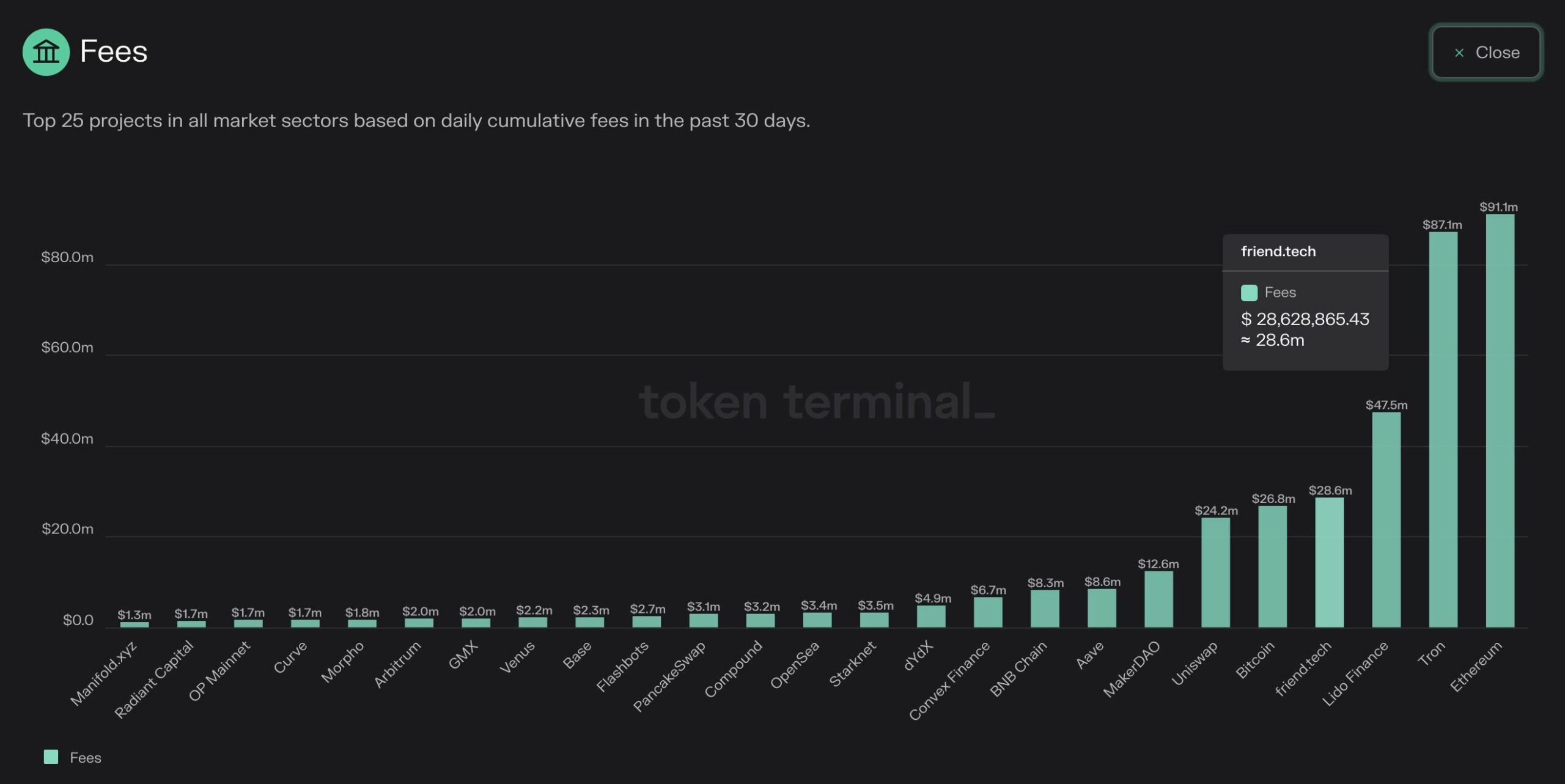

According to Token Terminal data on Oct. 6, Friend.tech generated $28.6 million in fees, above Bitcoin’s $26.8 million. This spike is noteworthy, considering the decentralized social media portal is launched on a layer-2 platform.

Because Base periodically bundles transactions and confirms them on the Ethereum mainnet, transaction fees should be lower. In this arrangement, for fees to be in their millions, it means Friend.tech processed tens of millions of unique transactions.

Friend.tech Activity Rising

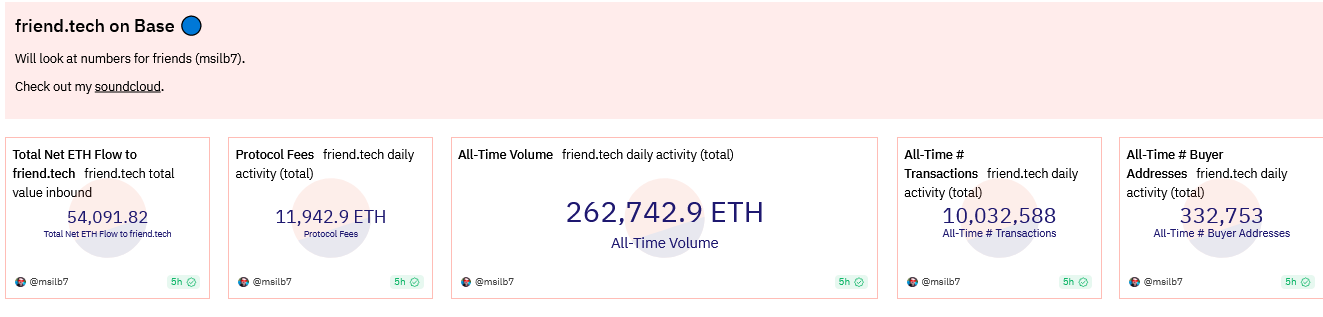

According to L2Beat, a tracker for Layer-2 scaling solutions, Base has a total value locked (TVL) of $558 million, out of which a big percentage, $267 million, is held in Ethereum (ETH). Stablecoins, including DAI and USDC dominate the rest. Parallel data from Dune Analytics shows that Friend.tech has processed roughly 10 million transactions since launch.

The more fees a platform generates, such as with Friend.tech and Bitcoin, the more promising the network’s future is. This indicates that the portal is actively used, and its solutions are in demand.

Specifically, network fees can be used to measure trading volumes, on-chain activity, and how fast the platform is onboarding new users. Typically, expanding volumes can be linked to more daily active addresses (DAA) who, in turn, choose to transfer assets or deploy smart contracts. All these on-chain activities directly drive fees accumulated in layer-1 or layer-2 platforms.

Ethereum and some of its active protocols, like Uniswap and Lido Finance, generate some of the highest fees for network validators. In the last 30 days, Token Terminal data reveals that Ethereum generated $91.1 million from gas fees. Meanwhile, Tron created $87.1 million from fees as Lido Finance and Uniswap churned $47.5 million and $24.2 million, respectively.

Friend.tech Users Lose Coins To SIM-Swap Attacks

Despite the rapidly growing social media platform revenue, there have been hitches and reports of compromise. Early this month, several users reported being victims of SIM-swap attacks.

In just under a week, four users had nearly 109 ETH, worth roughly $178,000, drained from their accounts. One user, going by the handle “froggie.eth” on X, reported being attacked on September 30.

The attacker gained control of the victim’s mobile number and intercepted two-factor authentication (2FA) codes before draining over 20 ETH. Other incidents in early October saw several users, including musician Daren Broxmeyer, reportedly lose coins via the same attack vector.