Coinspeaker

Genesis Global Receives Court Approval to Sell $1.6B Worth of Grayscale Shares

A judge has given bankrupt lender Genesis Global Trading the permission it needs to sell its shares of Grayscale Investments spot Bitcoin exchange-traded fund (ETF), the GBTC. The motion granted on Wednesday allows Genesis to begin selling their shares as they like, without any limit to number of shares, or timeline.

Genesis Can Sell GBTC and Other Grayscale Shares

According to Judge Sean Lane, Genesis can exchange the shares for Bitcoin (BTC) or cash. It can also collaborate with a broker to make decisions related to the sales. However, the judge refused a request for parent company Digital Currency Group (DCG) to consult on the shares. While Judge Lane explained that he did not blame DCG for trying to protect its interests, he noted that the company cannot ideally offer any “advice untainted by its own interest”.

A Genesis lawyer confirmed that the company’s Grayscale shares are currently worth $1.6 billion. According to a February filing, Genesis has 35 million GBTC shares, 8 million Grayscale’s Ethereum Trust (ETHE) shares, and $3 million worth of the Grayscale Ethereum Classic Trust (ETCG).

The DCG is trying to delay the sale until whenever the court decides to approve a debt repayment plan. The parent company confirmed that it does not contend with the plan to sell the shares. However, the DCG is worried that the sale could be premature in the event that the judge does not approve the debt repayment.

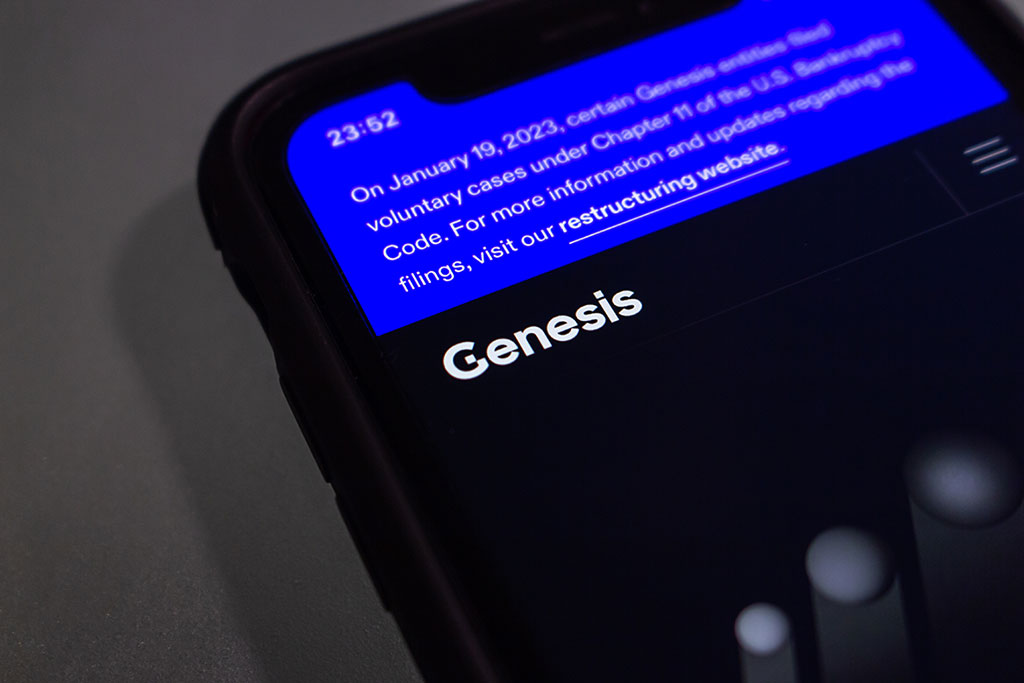

Genesis had filed a motion to sell its shares earlier this month at the United States Bankruptcy Court for the Southern District of New York. The company’s problems began after FTX and Alameda Research collapsed in 2022. Genesis eventually filed for Chapter 11 bankruptcy protection last January after attempts failed to resolve the situation with creditors outside the court system.

Genesis, the NYDFS, and Gemini

The United States Securities and Exchange Commission (SEC) charged Genesis Global for offering and selling unregistered securities. On February 1, Genesis announced a settlement with the SEC, agreeing to pay a civil penalty of $21 million for the “unregistered offer and sale of securities” in the Gemini Earn program.

In January, Genesis also agreed to a settlement with the New York Department of Financial Services (NYDFS). In a press release, the NYDFS stated that Genesis is guilty of compliance failure that violated the Department’s virtual currency and cybersecurity regulations. According to the NYDFS, Genesis’ failure to comply caused problems for the company:

“Genesis Global Trading’s failure to maintain a functional compliance program demonstrated a disregard for the Department’s regulatory requirements and exposed the company and its customers to potential threats.”

Last November, Genesis sued the Gemini crypto exchange for over $689 million. According to Genesis, Gemini made heavy withdrawals in the months before Genesis’ bankruptcy filing that were detrimental to other creditors. Last September, Coinspeaker reported that Gemini moved $282 million from the Earn program to its liquidity reserve.

Genesis Global Receives Court Approval to Sell $1.6B Worth of Grayscale Shares