According to Louis Tsu, the CEO of Venom Foundation, governments that are seeking to introduce central bank digital currencies (CBDCs) are not being driven by the fear that privately issued digital currencies may soon become the preferred method for cross-border and micropayments. Instead, some countries view CBDCs as a technology that could make their countries “more economically and financially efficient” and this ultimately improves their competitiveness.

Regulated Digital Assets ‘a Requirement for Mass Adoption’

While stablecoins issued by private entities such as Tether are increasingly seen as the go-to digital currencies when moving funds across borders, Tsu told Bitcoin.com News that CBDCs may turn out to be a better option because they are underpinned by regulation. According to the CEO of Venom Foundation — a platform that aims to create a bridge between traditional finance and the Web3 world — such an attribute can be a key “requirement for mass adoption and harmonization of markets and economies.”

When asked about claims that CBDCs could be used by governments to exercise greater control over people’s financial lives, Tsu insisted that the issue is not necessarily about the technology but those in control of it. To support his argument, Tsu pointed to Paypal, a privately owned entity that recently announced the launch of its own stablecoin — the PYUSD.

The CEO said Paypal can unilaterally freeze or pause the transfer of PYSUD if this is in line with its fiduciary and legal responsibilities. He suggested that the same argument can also be applied to central banks when it comes to their ability to censor CBDC transactions.

Meanwhile, in other answers to questions sent to him via Telegram, Tsu also offered his thoughts on how governments can use CBDCs to lower the cost of sending remittances. He further offered his views on what he sees as challenges that could hinder the adoption of CBDCs. Below are all of the Venom Foundation CEO’s written answers to questions sent.

Bitcoin.com News (BCN): Why do governments and central banks around the world feel the need to introduce CBDCs? Is it driven by the fear of crypto becoming the go-to mode of cross-border payments and micropayments?

Louis Tsu (LT): It is not fear of crypto that is driving this massive interest in CBDCs. Sovereign nations see a far greater opportunity to access new digital asset classes, be more economically and financially efficient and ultimately raise the competitiveness of their country.

This is game theory in full swing, no country wants to miss the boat. The smart money already played their hand. There are hundreds of billions of dollars of tokenization projects already live. What’s a token? There are non-fungible tokens, NFTs, which could represent a financial product like a bond or fungible tokens which is a unit of value that can represent a dollar or a euro. CBDCs are a subset of this bigger opportunity and I believe governments want in, this can be analogous to the last time when fibre optics were being laid down, the digital currency or the CBDC is the final crucial component.

BCN: Why would users — both institutional and retail — want to adopt CBDCs when they already have stablecoins to serve this purpose?

LT: As we are not yet in this scenario, I can only assume how this future will unfold. For centuries we have had private money issued by individuals and companies which went into steep decline as central banks were formed and more so since the Modern Monetary Theory (MMT) garnered more support. Nevertheless, this trend is going in reverse with the advent of the internet and blockchain technology progressively private money has come back into circulation.

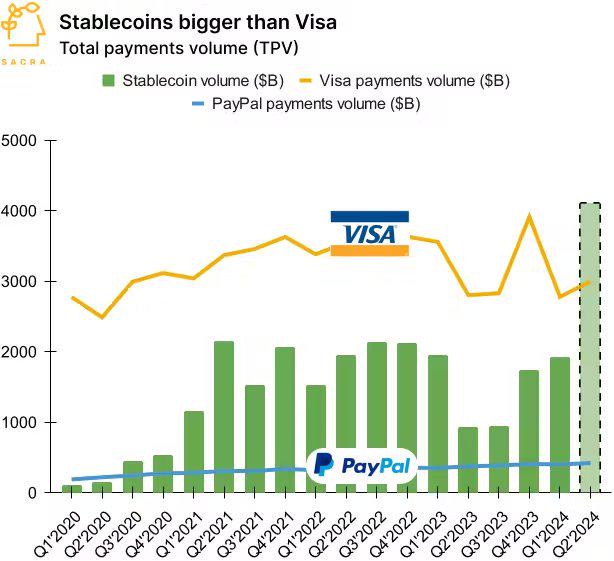

My definition of private money is not exclusively stablecoins like USDT which alone has risen from nothing to about $150 billion in a few years. Let’s take the JP Morgan coin used by its clients to settle transactions since 2019. It has already handled $300 billion worth of transactions. There are multiple commodity stablecoins backed by various precious metals. Tokens both fungible and non-fungible are daily being created to represent value that touches all different parts of our economy.

Many of these instruments are ahead of regulation and thus self-regulating. As CBDCs roll out at both retail and wholesale levels, they will not be in isolation but underpinned by regulation and this is a requirement for mass adoption and harmonization of markets and economies.

BCN: It seems cross-border payments are still complicated and expensive. When you send money to someone in another country, it goes through a complex web of interlinkages between banks. The fees for this could go as high as 6.5%, which may be a lot for the poor immigrants sending remittances to their loved ones back home. Do you foresee CBDCs getting this right?

LT: Things have already improved dramatically compared to 6.5%. My Kenyan colleagues used to send money across the country in a bus, back in the day the amount that was skimmed off the top was erratic and occasionally the envelope never even arrived!

Can CBDCs improve? Yes, they can, but this is only a part of the picture. Technology and the private industry are moving far quicker than governments can deploy CBDCs. There are an array of different types of cryptocurrencies, stablecoins and institutional tokens already on the market. The delivery mechanism to retail is via a ‘wallet’ and already we see the green shoots of a multitude of blockchain use cases, for example, aid.technology is currently delivering humanitarian aid through a digital wallet.

By the time governments start to deploy CBDCs, there will be wallets with proven applications such as remittances, lending and borrowing protocols battle-tested for the retail market. The CBDCs will play a critical role in mass adoption because they will have government backing and hence acceptance in every aspect of everyday life.

BCN: According to reports, Venom is working with the relevant authorities in Kenya, Bangladesh, and a few other countries to increase financial inclusion. Micropayments are at the heart of financial inclusion. Can you talk about how Venom is using blockchain to bring financial services to the underserved?

LT: Venom’s vision is to leverage its highly scalable technology to bring blockchain into many emerging markets including Kenya and Bangladesh. In tandem with regulation from the Abu Dhabi Global Markets (ADGM), we are seeing a smooth acceptance thus far.

Micropayments are at the heart of helping people. It can touch the lives of millions who do not even have the basics like a bank account. Through a digital wallet, small farmers who need a $10 loan for fertilizer, a refugee who wants to send $0.50 to a family member peer-to-peer, or an entrepreneur housewife working from home performing part-time remote administration services can invoice cross-border a dollar-a-day; all done with minimum transaction costs.

At the same time, this low-income category currently has virtually no option to save for the future. Once a digital wallet is in their hands, the option to ‘stake’ and earn interest on savings will become highly attractive. Especially since very small sums of money can be invested into “staking” again with little friction.

BCN: While CBDCs may offer certain benefits, many fear that they will give governments greater control over people’s financial lives and transactions. To illustrate, the Brazilian central bank recently published the CBDC pilot project on its Github profile and it is said that developers have since discovered that the central bank has the ability to freeze users’ accounts, decrease target balances, confiscate, and mint new units of the digital currency. Do you think such red flags could hurt the adoption of CBDCs?

LT: For decades, global financial systems have had AML/KYT/KYC monitoring systems and if a transaction breaches a rule or demonstrates suspicious activity, the institution has a fiduciary and legal responsibility to act. It is not the technology that is invasive, it is the policymakers and they will differ from one country to another.

All the above actions you enumerate are already possible. For example, “minting new units” has been a common practice since the 1970s by central banks. They call it quantitative easing.

These are design decisions. The following example is not a government but a private company Paypal that issued a stablecoin, PYUSD. Paypal can freeze an address, i.e. an account. They can pause all transfers and mint more tokens whenever they want.

Just like anything, give a man a hammer and he can build a house or hit someone over the head.

BCN: What are wholesale and retail CBDCs and why is there a need for two different sets of CBDCs?

LT: For the sake of clarity when I talk about CBDCs I’m also referring to digital currency, which could be a stablecoin either private, institutional or sovereign.

Wholesale is for corporate and retail is for individuals.

The difference between the two are policies. In wholesale the rules are far more complex, with multiple asset classes, vast account limits, stringent risk management, and more detailed regulation, with bigger sums of money; settlement and clearing are points of pain. For many years, companies have been using blockchain DLT to develop solutions to solve some of these issues. However, I personally see we have reached a tipping point.

It is a major advantage for a CBDC design if the technology supports account abstraction as in the Venom blockchain. Put simply, it means rules such as wholesale risk management can be natively programmed into the account.

BCN: In your opinion, what are the biggest roadblocks to large-scale adoption of CBDCs?

LT: Wealthy economies do not need digital currencies as much as developing economies, so if we slice the world in two, I would say governments and central banks in rich countries do not have the same incentives as developing countries. Developing countries view the shift to blockchain in a holistic way, it is not a currency in isolation, it is a regime of transparency, access to capital markets, improved supply chain, and tokenization of their raw assets. So I think we will see a slow lane and a fast lane in the near future.

Regulation has to be resolved for large-scale adoption and it is not any regulator trying to throw a spanner in the works. It is just a highly complex system that has to be coordinated on a global basis. Trying to harmonize different countries and regions is a time-consuming task.

What are your about this interview? Let us know what you think in the comments section below.