Good morning Americans – too early to catch up on the crypto industry? I don’t think so. While the American markets were asleep – here is what the rest of the world was up and about doing. To start off – The Kenyan government is not having the tale-benefit talk about Worldcoin – the coin is on a halt.

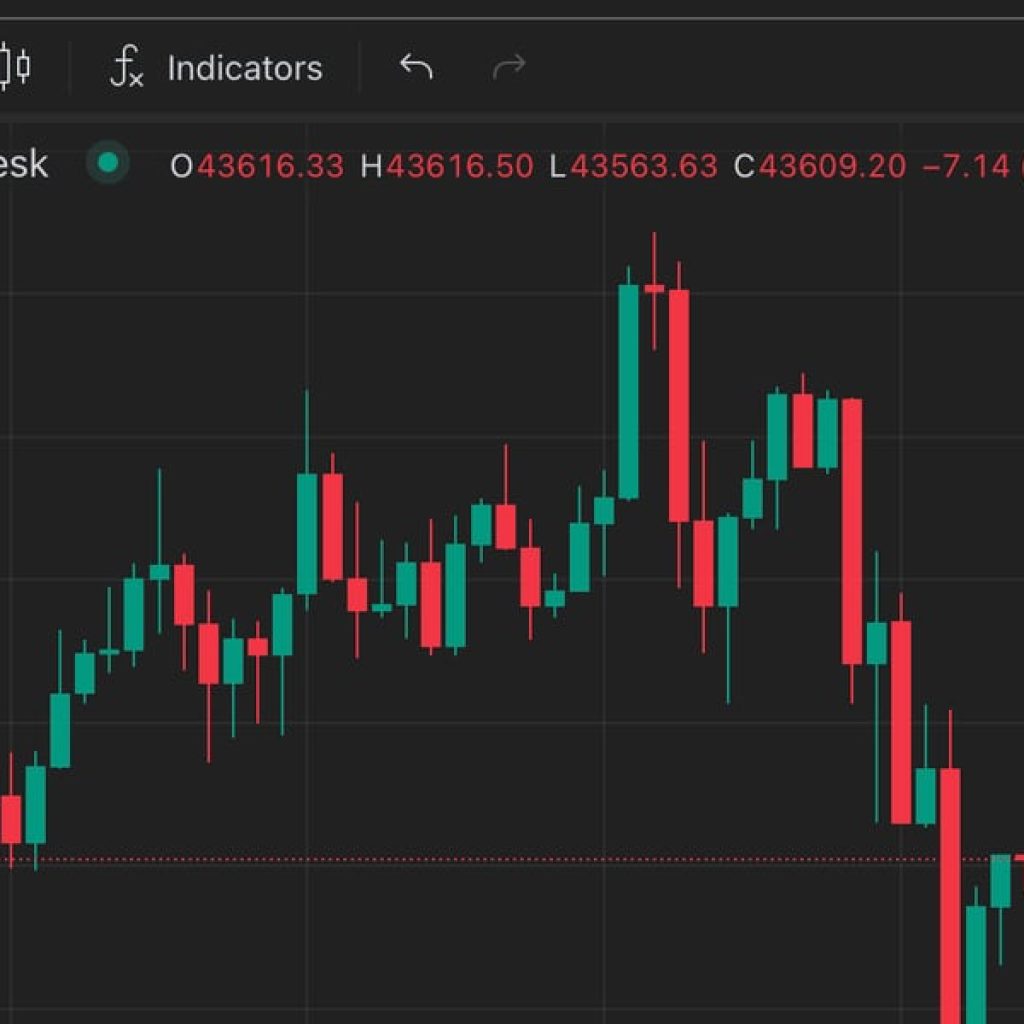

Crypto markets August outlook – tough start?

Worldcoin has taken over global crypto conversations in the last week. The coin has everything from benefits and controversy to go by. As reported by Cryptopolitan, Kenya’s Ministry of the Interior has suspended the operations of Worldcoin within the country.

The Kenyan government expressed concern over Worldcoin’s ongoing activities, which include gathering eyeball or iris data to register citizens. The suspension was implemented immediately, according to a statement posted on the ministry’s Facebook page and signed by Minister Kithure Kindiki.

Kenya is the first nation to completely suspend Worldcoin operations while its local agencies investigate the project’s legitimacy and data protection.

Prior to the suspension, Nairobi, the capital of Kenya, had become a significant market for Worldcoin. By December 2022, over a quarter million people had signed up. The news is a significant setback to Worldcoin, which had previously touted Nairobi as a city with high demand.

The suspension in Kenya is not a one-off occurrence. Several European regulatory agencies, including the Bavarian data protection agency that oversees the company, have launched investigations into Worldcoin. Nonetheless, the escalation to a complete suspension in Kenya is indicative of heightened scrutiny of the company’s operations.

Worldcoin sells global governments a sweet deal – how safe are the investors?

Since the onset of Bitcoin – crypto was created to stand far above the reach of governments. The ongoing struggles between SEC and crypto entities tell that much – they don’t have control over this market. What Worldoin creators are doing is a snitch affair.

In an effort to onboard more users, Worldcoin reportedly intends to enable governments and businesses to use its iris-scanning and identity verification technology.

Ricardo Macieira, general manager for Europe at Tools For Humanity, the company behind the Worldcoin initiative, stated that the company’s mission is to build the largest financial and identity community possible.

Macieira disclosed in a Reuters report that the company’s mission is “building the biggest financial and identity community.” Macieira added that:

The idea is that as we build this infrastructure and that we allow other third parties to use the technology.

Ricardo Macieira

In addition, Worldcoin intends to potentially permit businesses to use its digital identity system, thereby eradicating the need to collect personal information.

MicroStrategy backs BTC once more

MicroStrategy, one of the biggest corporate holders of Bitcoin (BTC) in the United States, returned to profitability in the second quarter of 2023 in response to Bitcoin’s price increase and disclosed it now holds $4.4 billion worth of the cryptocurrency.

MicroStrategy’s second-quarter earnings report, released on August 1, revealed a net income of $22.2 million, in stark contrast to the $1.1 billion net loss documented in the second quarter of 2022.

Our bitcoin holdings increased to 152,800 bitcoins as of July 31, 2023, with the addition in the second quarter of 12,333 bitcoins being the largest increase in a single quarter since Q2 2021.

MicroStrategy CFO Andrew Kang

The company incurred $24.1 million in digital asset impairment losses during the quarter, compared to $917.8 million in Q2 2022.

According to a filing with the Securities and Exchange Commission on August 1, MicroStrategy plans to raise $750 million through the sale of stock and has implied that it may use the proceeds to purchase even more Bitcoin.

Terraform Labs is set to subpoena FTX entities

U.S. Bankruptcy Judge John Dorsey has authorized Terraform Labs to serve subpoenas on FTX Trading and FTX US, which could aid the company’s defense against Securities and Exchange Commission (SEC) misconduct allegations.

Attorneys for the FTX debtors did not object to the court order, according to court documents. Terraform Labs is requesting digital wallet records from entities associated with FTX in order to ascertain whether the exchange conducted a coordinated attack on the defunct Terra Luna ecosystem.

The implosion of the TerraUSD stablecoin in May 2022 sparked the next phase of the crypto bear market, which culminated in November with the implosion of FTX. Do Kwon, co-founder of Terra, is presently serving a four-month sentence in Montenegro for traveling with forged documents.

The likelihood of Bitcoin ETF approval surges to 65%

Bloomberg ETF analysts Eric Balchunas and James Seyffart said in a recent statement that the likelihood of approval for a Bitcoin exchange-traded fund (ETF) has increased significantly over the past month due to new market developments and the resubmission of ETF applications by companies such as BlackRock.

Seyffart remarked that a great deal would depend on the timing of the Grayscale case dates, and their recent increase in approbation will be contingent upon Grayscale’s victory against the SEC in federal court. He added that Grayscale’s victory against the SEC could result in the simultaneous approval of all Bitcoin ETF filings by the end of this year’s fourth quarter.