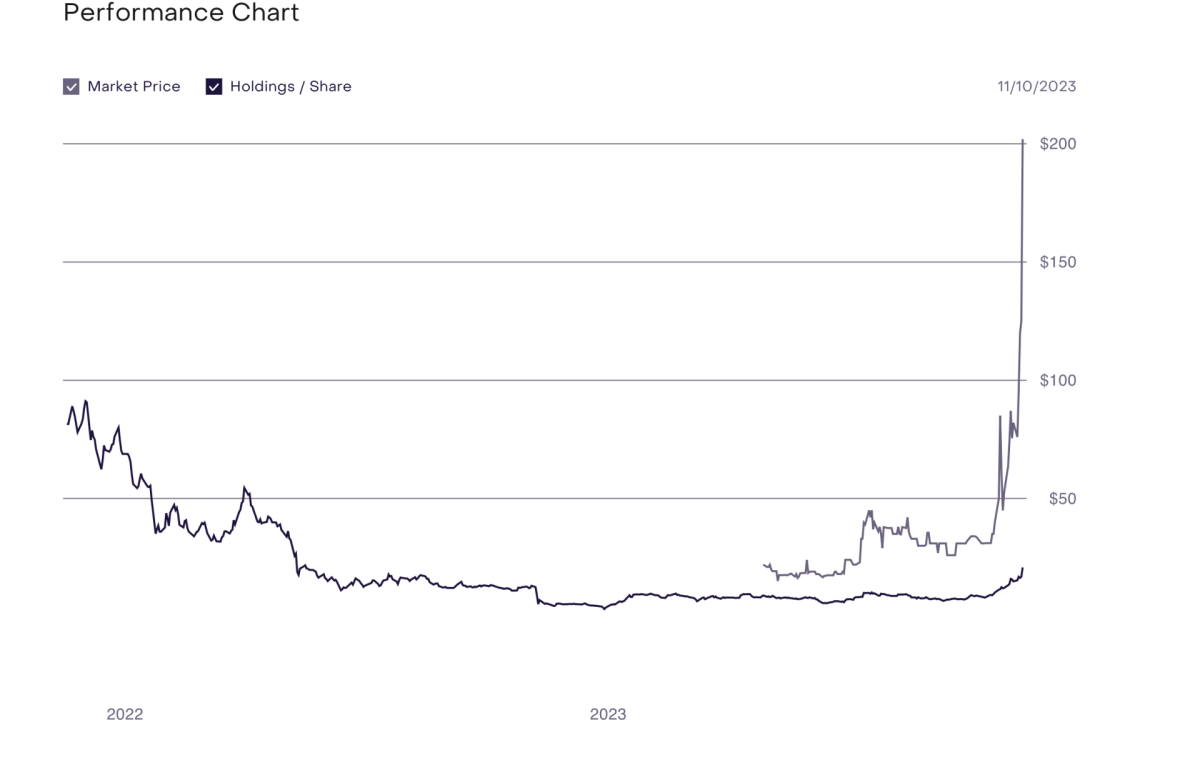

Grayscale’s Solana Trust Shares (GSOL) has recently undergone a significant surge in value, a development that has caught the attention of investors and market analysts. Within the past week, shares have more than doubled, reaching a high of $202. However, this surge places GSOL at an impressive 784% premium, with Solana token price at $55 at the time of press.

It is important to know that Grayscale’s Bitcoin Trust (GBTC) once peaked at a 43% premium in July 2019. The recent spike in GSOL’s value is seen as indicative of heightened institutional interest in Solana following a 40% increase in the cryptocurrency’s value in the past week.

Grayscale’s role in the cryptocurrency market

Grayscale is recognized as a key player in the U.S. for institutional cryptocurrency access. The company’s trusts allow institutional investment in digital assets through traditional financial mechanisms. However, unlike exchange-traded funds, Grayscale trusts often do not reflect the direct market value of the underlying assets, resulting in significant premiums or discounts.

Grayscale’s trusts are primarily available to accredited investors, leaving retail investors to navigate the fluctuations in the secondary market. Despite a smaller asset base of $6.3M in GSOL, compared to $23B in GBTC, the Solana Trust is gaining significant attention.

The trajectory of Grayscale’s trusts is under scrutiny as the company shows interest in converting these into ETFs. The firm’s initial attempt to transition its Bitcoin Trust into a Bitcoin ETF faced setbacks from the SEC in 2021. However, a recent court ruling has reopened the conversation about potential ETF conversions. This development coincides with BlackRock’s application for a spot Bitcoin ETF, indicating a possible shift in the regulatory landscape and methods of digital asset investment.

GBTC shares have outperformed spot Bitcoin in recent months, with a year-to-date gain of 200%, while BTC gained only 10% over the same period. Also, GSOL is paralleled by similar trends in other Grayscale assets, such as MANA and GLINK, highlighting a general bullish sentiment in the cryptocurrency market.

Institutional Interest in Solana

Grayscale’s valuation of its SOL Trust Fund implies a significant interest in Solana among traditional financial entities. With each GSOL share representing 0.38 SOL but trading at $202, the market is effectively valuing Solana significantly higher than its current trading price. This is notable considering Solana’s competitive stance against other cryptocurrencies like Chainlink and XRP. Solana’s growing influence in the decentralized finance (DeFi) sector, amid Ethereum’s challenges, is attracting attention from institutional investors.

The remarkable performance of Grayscale’s Solana Trust Shares shows that Institutional investors are increasingly engaging with digital assets, driving up values and premiums in investment products like GSOL. The Solana Trust’s performance, in particular, underscores a diversifying interest in cryptocurrencies beyond the traditional focus on Bitcoin.