In an era where digital currencies are making their profound impact on the global financial landscape, the realm of cryptocurrency is not immune to its share of shadows. Unseen, lurking in the obscurity of the cyber world, malicious actors are orchestrating elaborate schemes to exploit this burgeoning market. The incident involving the recent exploit of Euler Finance and last year’s breach of Axie Infinity’s Ronin Network may have been shocking, but it is not isolated. The discovery of a possible connection between these incidents has sent ripples through the crypto community, raising questions about the traceability and security of digital assets.

A wallet address linked to the Euler Finance exploit sent 100 Ether, amounting to $170,515, to a wallet associated with the Ronin Bridge exploiter, a party believed to be linked with the infamous North Korean hacker group, Lazarus Group. These incidents serve as a stark reminder of the cyber threats that lie within the crypto space, potentially undermining its integrity and safety.

But there’s a silver lining in this cloud. The detection of these connections also highlights the power of blockchain technology in tracing and potentially mitigating these threats. As we venture further into this article, we will unravel the complexities of crypto hacking and discuss how we can effectively get ahead of such dubious threats.

What’s Crypto Hacking?

In the simplest terms, crypto hacking refers to the unauthorized access to and theft of digital assets stored in cryptocurrency wallets and exchanges. It’s a form of cybercrime that specifically targets the blockchain ecosystem, exploiting vulnerabilities in software, hardware, or human behavior to illicitly obtain cryptocurrencies.

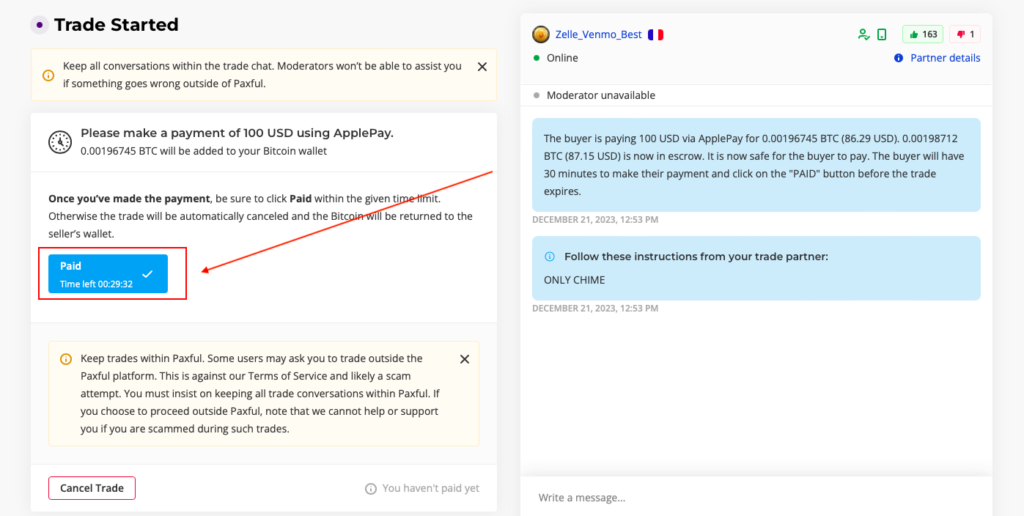

There are several methods employed by crypto hackers. One of the most prevalent is phishing, where the hacker masquerades as a trusted entity to trick individuals into revealing sensitive information, such as private keys or login credentials. Another common technique is the use of malware or ransomware, designed to infiltrate systems and either directly steal crypto assets or demand them as ransom.

However, crypto hacking isn’t limited to these methods. Hackers target hot wallets of crypto exchanges, which are more vulnerable to attacks than cold wallets.

The recently reported exploits of Euler Finance and the Ronin Network fall under this category. They represent what are known as DeFi exploits. DeFi platforms, such as Euler Finance, operate on smart contracts – self-executing contracts with the terms of the agreement directly written into code. While these smart contracts offer many advantages, including transparency and reduced need for intermediaries, they can also have bugs or vulnerabilities that savvy hackers can exploit.

In both the Euler Finance and Ronin Network cases, the hackers could manipulate weaknesses in the platforms’ underlying smart contracts, siphoning off significant sums of cryptocurrency. The recent incidents prove that no blockchain platform is immune to crypto hacking, emphasizing the need for security measures and vigilance from all crypto ecosystem participants.

2022 was the biggest year for crypto hackers

In 2022, Chainalysis reported $3.8 billion worth of cryptocurrency thefts, reflecting a 15% increase from 2021’s $3.3 billion and a staggering rise from the $0.5 billion taken in 2020. The surge in the general public’s interaction with digital currencies has caused a corresponding swell in online holdings, making them more appealing and accessible targets for cybercriminals.

Chainalysis pinpointed De-Fi protocols, crucial code components that underpin significant cryptocurrency exchanges and businesses, as the primary focus of cyberattacks in both 2023 and 2022. In 2022, De-Fi protocols represented 82% of all hacking incidents, up from 73% the previous year.

Decentralized finance and its associated protocols aim to supplant traditional financial institutions with software enabling direct transactions between users through blockchain technology, the digital foundation of cryptocurrencies. As the data shows, De-Fi protocol-based smart-contract hacks pose a significant risk to investors, second only to losses incurred from price speculation. Recovering funds from a compromised smart contract is typically impossible.

North Korea remains unmatched in its commitment to cryptocurrency hacking. According to Chainalysis, NK-affiliated cybercrime organizations, such as the Lazarus Group, pilfered $1.7 billion in 2022, accounting for almost half of the global annual total. A recent United Nations report on cyberattacks concurs NK stole more digital currency in 2022 than ever before, though their valuation of stolen assets varies.

The Conversation reveals that North Korea utilizes the purloined cryptocurrency to finance its sanctioned nuclear program, suggesting that its hacking endeavors are unlikely to diminish in the near future. Chainalysis’ year-over-year analysis highlights a substantial spike in hacking activities in 2022 compared to previous years.

Who is the Lazarus Group?

Lazarus Group is suspected in exploiting Euler Finance and breaching Axie Infinity’s Ronin Network last year, sending chills down cybersecurity experts’ spines. Their reputation as an advanced persistent threat (APT) is not unfounded, with a string of high-profile cyber-attacks attributed to them.

Tracing its origins back to North Korea, the Lazarus Group is believed to be state-sponsored, acting as a cyber arm for the isolated regime. They gained notoriety in 2014 after the Sony Pictures hack, which leaked confidential data and caused significant harm to the corporation’s reputation and finances.

In the world of cryptocurrency, the Lazarus Group is known for its persistent and aggressive attacks, primarily targeting South Korean cryptocurrency exchanges and users. Their modus operandi involves a blend of sophisticated social engineering, spear-phishing emails, and malware attacks to gain access to their targets.

The group’s activities have evolved over time, in line with the changing geopolitical and economic landscape. They have been increasingly focusing on the crypto sector, believed to be driven by the North Korean regime’s need to circumvent economic sanctions and amass funds. The suspected involvement of the Lazarus Group in the Euler Finance and Ronin Network breaches suggests that their interest in cryptocurrencies is far from waning.

The Lazarus Group’s reputation as a formidable and elusive adversary underlines the serious challenges faced by individuals, businesses, and governments in securing their digital assets. Yet, their audacious activities also underscore the growing importance of enhanced cybersecurity practices and the development of robust deterrents against such high-profile threat actors.

What deterrents can be used for hackers?

The rise of crypto hacking incidents and the audacious activities of groups like the Lazarus Group underscores the urgent need for effective deterrents. To combat these threats, a multi-faceted approach that combines technological, legal, and educational strategies is required.

Technological deterrents

In the face of advanced persistent threats, robust cybersecurity measures are the first line of defense. This includes the use of secure, updated software, firewalls, and strong encryption for all data transfers. The use of multi-factor authentication (MFA) can also add an extra layer of protection against unauthorized access.

In the realm of DeFi, regular audits of smart contracts by third-party security firms can help identify and rectify vulnerabilities before they can be exploited. Additionally, the use of bug bounty programs, where ethical hackers are rewarded for finding and reporting software vulnerabilities, can be an effective strategy to preemptively uncover potential security flaws.

Legal deterrents

Legal deterrents are another crucial aspect of combating crypto hacking. This involves the development and enforcement of strict laws and regulations that punish cybercriminal activities. However, the decentralized and borderless nature of cryptocurrencies can complicate jurisdictional issues and enforcement.

Despite these challenges, there have been instances where hackers have been apprehended and prosecuted, such as the infamous Silk Road case, demonstrating the potential of legal deterrents. International cooperation among law enforcement agencies, alongside the application of blockchain forensics, can play a key role in tracking down and bringing these cybercriminals to justice.

Educational deterrents

Finally, education is a powerful deterrent. The human factor is often the weakest link in cybersecurity, and individuals can be easily tricked into revealing sensitive information or engaging in risky behavior. Thus, raising awareness about the common tactics used by hackers, promoting safe online behavior, and teaching individuals how to protect their digital assets are crucial steps in preventing crypto hacking.

How to retrieve “lost” crypto?

The notion of “lost” crypto can be disconcerting to any digital asset owner. Whether the loss is due to a forgotten password, a misplaced private key, or a hacker’s exploit, the decentralized and immutable nature of blockchain can make recovery of these assets seem impossible. However, depending on the circumstances, there may be options to explore.

Report to law enforcement and crypto services

In cases of hacking, the first step is to report the incident to local law enforcement and to the involved crypto platform or service. They may be able to assist in tracking the transaction or freeze the associated accounts, preventing further illicit activities.

Blockchain analysis

The traceability of blockchain transactions can sometimes help in retrieving stolen assets. Blockchain analysis firms use sophisticated software to trace the movement of crypto assets across different addresses. If these assets end up in a regulated exchange, it might be possible to freeze and reclaim them.

This method, however, has its limitations. Savvy hackers may use mixing services or coin tumblers to obfuscate the trace of stolen cryptocurrencies, making the recovery process significantly more challenging.

Legal assistance

If the stolen assets are significant, it might be worth seeking legal advice. Some law firms specialize in crypto-related issues and can help navigate the complex landscape of crypto law. They can guide victims through the process of reporting to law enforcement, liaising with blockchain analysis firms, and potentially filing a lawsuit.

Cybersecurity firms

There are cybersecurity firms that specialize in retrieving lost or stolen crypto. They employ a range of techniques, from negotiating with hackers to exploiting vulnerabilities in the hackers’ systems. However, this route can be expensive, and success is not guaranteed.

Prevention is the best cure

While there are some avenues for retrieving lost crypto, the process is difficult, expensive, and often unsuccessful. The best course of action is to prevent such losses in the first place. This means implementing strong security practices, such as using hardware wallets for storing crypto, enabling multi-factor authentication, regularly updating and securing all associated devices, and being vigilant against phishing attempts.

It’s important to remember that in the world of cryptocurrencies, security is paramount. As the saying goes, “Not your keys, not your coins.” It is up to each user to protect their own assets.

Can cyber criminals be tried in court?

The short answer is yes. Despite the seemingly nebulous and borderless world of cryptocurrencies, cybercriminals can and have been prosecuted for their actions. However, this is no easy feat and involves overcoming several substantial hurdles.

Jurisdictional challenges

One of the biggest challenges in prosecuting cybercriminals is the issue of jurisdiction. The internet has no borders, and cryptocurrencies are decentralized by nature. This means a hacker in one country can easily target a victim in another. Identifying, apprehending, and extraditing these criminals can be a complex and time-consuming process, often requiring international cooperation between law enforcement agencies.

Identifying the criminals

Another significant hurdle is identifying the culprits behind the crime. Hackers often use sophisticated methods to hide their identities and locations. They might use anonymous browsers, VPNs, and other tools to cloak their activities. Tracing the path of stolen cryptocurrencies can also be a complex task, particularly when criminals use techniques such as coin mixing to obfuscate the trail.

Legal frameworks

The legal frameworks for dealing with crypto-related crimes are also evolving. Not all jurisdictions have clear laws and regulations regarding cryptocurrencies, making it difficult to prosecute crimes related to them. However, this is gradually changing as more countries recognize the need for such regulations and start to implement them.

Known crypto hackers serving prison sentences

As our understanding of crypto-related cyber crimes deepens, it’s worth noting that, despite the borderless and anonymous nature of cryptocurrencies, law enforcement agencies have been able to bring some crypto hackers to justice. This serves as a deterrent to potential criminals and a reminder that the anonymity of cryptocurrencies is not absolute.

Take, for example, the international hacking group known as “The Community.” The Justice Department announced the sentencing of the last member of this group, Garrett Endicott, in late 2021. Based in Missouri, Endicott was sentenced to 10 months in prison and ordered to pay a fine of more than $120,000 for his part in a complex cryptocurrency scheme.

Members of The Community were indicted in connection with a scheme involving “SIM hijacking” in 2019. This tactic involves taking control of the victim’s phone number and rerouting calls and texts to the hackers’ own devices. Through this method, the group members were able to gain access to email and cryptocurrency accounts on the victims’ phones, enabling them to steal between $50,000 and $9 million in total from victims across the United States.

Furthermore, Irish citizen Conor Freedman was sentenced to three years in prison by an Irish court, while Connecticut resident Ryan Stevenson was sentenced to probation. Both were ordered to pay some form of restitution. Sebastian Vachon-Desjardins, a Canadian crypto hacker, was also sentenced to 20 years in prison for his part in the notorious NetWalker ransomware attacks. He targeted some 400 victims in more than 30 countries, and collected $40 million in ransom payments.

These cases underscore the seriousness with which courts are beginning to treat crypto-related crimes. They also highlight the global nature of these offenses, with hackers and their victims often located in different countries, further complicating the investigation and prosecution processes. Nonetheless, these successful prosecutions demonstrate that it is possible to trace, track down, and legally penalize cybercriminals in the crypto space.

Does crypto insurance work?

Cryptocurrency insurance is a growing industry that aims to safeguard against losses caused by cybersecurity breaches. Recognizing the particular dangers of digital assets, most cryptocurrency exchanges provide some kind of insurance to protect against losses caused by security breaches and theft.

The dynamic nature of crypto insurance reacts to the volatility character of the asset. Lloyd’s of London was a pioneer in providing liability crypto-insurance, collaborating with Coincover to create coverage with adjustable limits to protect against damages resulting from the theft of Bitcoin stored in online wallets. The insurance plan’s maximum fluctuates with crypto asset prices, ensuring compensation for the asset’s value.

It’s essential to note that cryptocurrency is not legal tender in many places, including America, because the government does not back it. Therefore, cryptocurrencies like Bitcoin, Litecoin, and Ethereum are not subject to Federal Deposit Insurance Corporation (FDIC) or Securities Investor Protection Corporation protections.

Traditional investors in the United States who own conventional securities, such as bonds or stocks, have insurance backing from the US government or private insurance policies. However, crypto investors in the United States do not automatically have those same protections. That’s where crypto insurance steps in to provide cryptocurrency owners with protection for their investments.

The crypto insurance industry also faces many challenges. The primary issue for insurers is the underwriting process, where solid risk assessments become complicated due to a lack of cohesive regulations within the crypto-insurance industry. Gemini Crypto Insurance proved their secure exchange for digital assets, where customers can buy, sell, and store in a regulated and compliant manner.

How crypto insurance works can vary depending on the individual companies willing to take on underwriting and insurance of the digital assets. Coinbase Crypto Insurance includes legal tender in their risk portfolio when underwriting crypto insurance policies.

Conclusion

As we navigate the complex landscape of cryptocurrencies, the specter of cybercrime remains a considerable challenge. The hacker group Lazarus and its alleged involvement in the breaches of Euler Finance and Axie Infinity’s Ronin Network is a stark reminder of the vulnerability of digital assets. While law enforcement agencies and cybersecurity firms are ramping up their efforts to deter and trace these hackers, the reality is that the anonymous and decentralized nature of cryptocurrencies adds layers of complexity to these efforts.

Insurance is emerging as a potential solution for mitigating the risk of loss from cybercrimes, though it is still in its nascent stages. Crypto insurance has the potential to offer some level of protection against losses due to hacking, theft, and other cybersecurity breaches. However, the volatile nature of crypto assets and the lack of cohesive regulations make it a complicated endeavor.

Securing digital assets ultimately comes down to individual vigilance, technological advancements, regulatory frameworks, and international cooperation. As we continue to delve deeper into cryptocurrencies, the need for robust cybersecurity measures and effective legal deterrents will only grow more critical. The evolution of crypto insurance and other protective mechanisms in this rapidly changing landscape will undoubtedly play a pivotal role.