In merely eight days, the number of Ordinals inscriptions on the Bitcoin network nearly doubled from 2.5 million to 4.78 million. Initially, the Ordinals protocol was used to mint images as non-fungible tokens (NFTs). However, users soon realized that they could use text-based inscriptions to create fungible tokens, similar to how the ERC-20 token standard on the Ethereum (ETH) network mints fungible tokens.

Ordinals cause a grave market tank

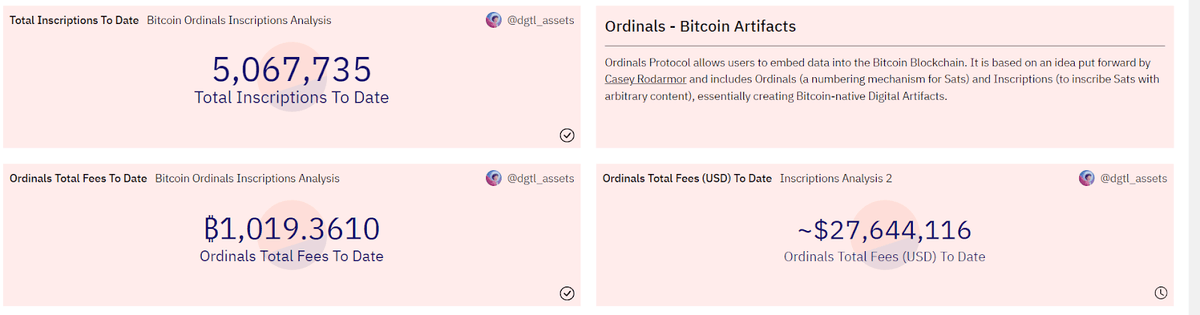

According to data from Dune Analytics, the overwhelming majority of Bitcoin ordinals’ inscriptions consisted of text-based inscriptions, also known as the BRC-20 token standard. At the time of writing, its dominance accounted for 86.52 percent. Image-based inscriptions, on the other hand, left a footprint of 9.5% reduced.

At the time of writing, the total market capitalization of BRC-20 tokens was estimated to be $690 million. There are currently 14,200 new tokens hosted on the Bitcoin blockchain. Even a Bitcoin-based version of the meme coin rose to the third position in terms of market capitalization, riding the buzz of PEPE. The first two positions were held by “ordi” and “nals” Bitcoin-based tokens.

Ordinal Inscriptions are digital assets comparable to NFTs that are engraved on a satoshi in the Bitcoin network, a process made possible by the activation of Taproot in 2021. Its introduction has expanded the network’s utility beyond simple value transfers.

Implications of Ordinals on Bitcoin’s future

According to reports, the network hash rate reached a record high of 356 million TH/s on Friday. However, it must be questioned whether the influx of ordinals and BRC-20 tokens detracts from Bitcoin’s central purpose – solid money. Some users have labeled the increased network activity as a DoS (denial of service) attack.

In theory, malicious agents might spend millions of dollars minting BRC-20 tokens and ordinals indefinitely to strain the network, making it prohibitively expensive for regular users. Nonetheless, this is a personal preference.

All that is occurring is that consumers have to pay extra to get their transactions included in miner blocks. As a result, Bitcoin’s self-correcting incentive system functions as designed. Anything other than BTC on the Bitcoin network, on the other hand, could be considered useless and redundant.

Bitcoin Lightning network to the rescue?

Bitcoin, like the Ethereum blockchain, requires multiple layer-2 networks to transfer traffic. Lightning Network has a capacity of 5,456 BTC ($159 million) across 74,000 unique channels that connect its nodes.

Lightning Network reduces traffic by maintaining open and off-chain transaction channels. When channels are closed, aggregated transactions are returned to Bitcoin’s mainnet for confirmation. In addition, these transactions are nearly instantaneous and incur negligible fees, as there is no need to disseminate each transaction to miners as it is executed.

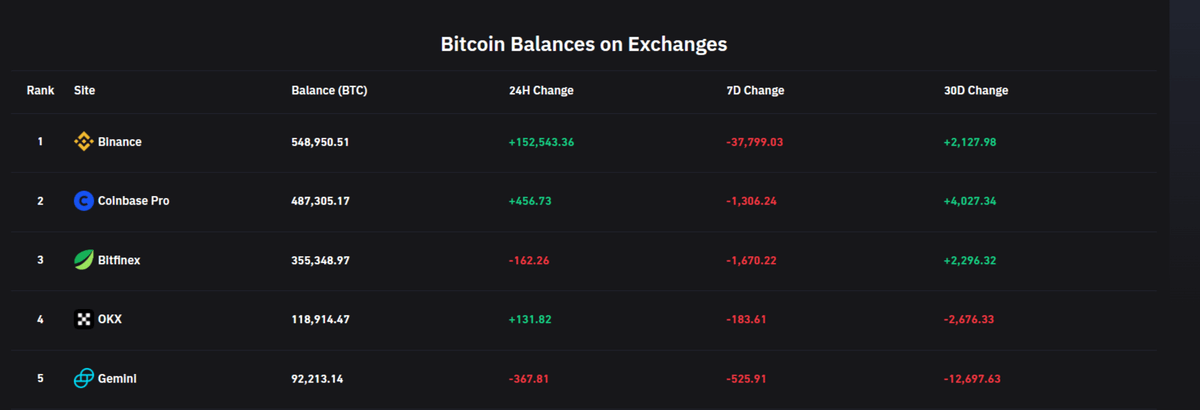

For widespread Bitcoin adoption, ordinals included, the LN’s capacity must be significantly increased. This is something that centralized exchanges will also be required to do, beginning with Binance’s announcement at the start of the week

Following an upsurge in Bitcoin fees and record-high unconfirmed transactions, the world’s largest exchange temporarily halted BTC withdrawals early Monday. Bitcoin withdrawals resumed as Binance boosted transaction fees to expedite them.

Except for Binance, Coinbase, and Bithumb, practically all exchanges, including Jack Dorsey’s Cash App, have already included Lightning functionality.

Bitcoin miners are on the winning side

For the first time since 2017, some bitcoin (BTC) miners are being paid more to process transactions on the blockchain than they are for creating new BTC, which could be a welcome move given the industry’s recent thrashing. Ordinals appear to explain at least part of the shift.

The recent large increase in transaction processing income may thus be a welcome development, especially given the extreme pain – including many bankruptcies – that has rocked the mining business during this crypto winter. On numerous occasions on Monday, mining pools such as Luxor Technologies and AntPool received larger transaction fees from newly added blocks than the 6.25 BTC mining incentive.