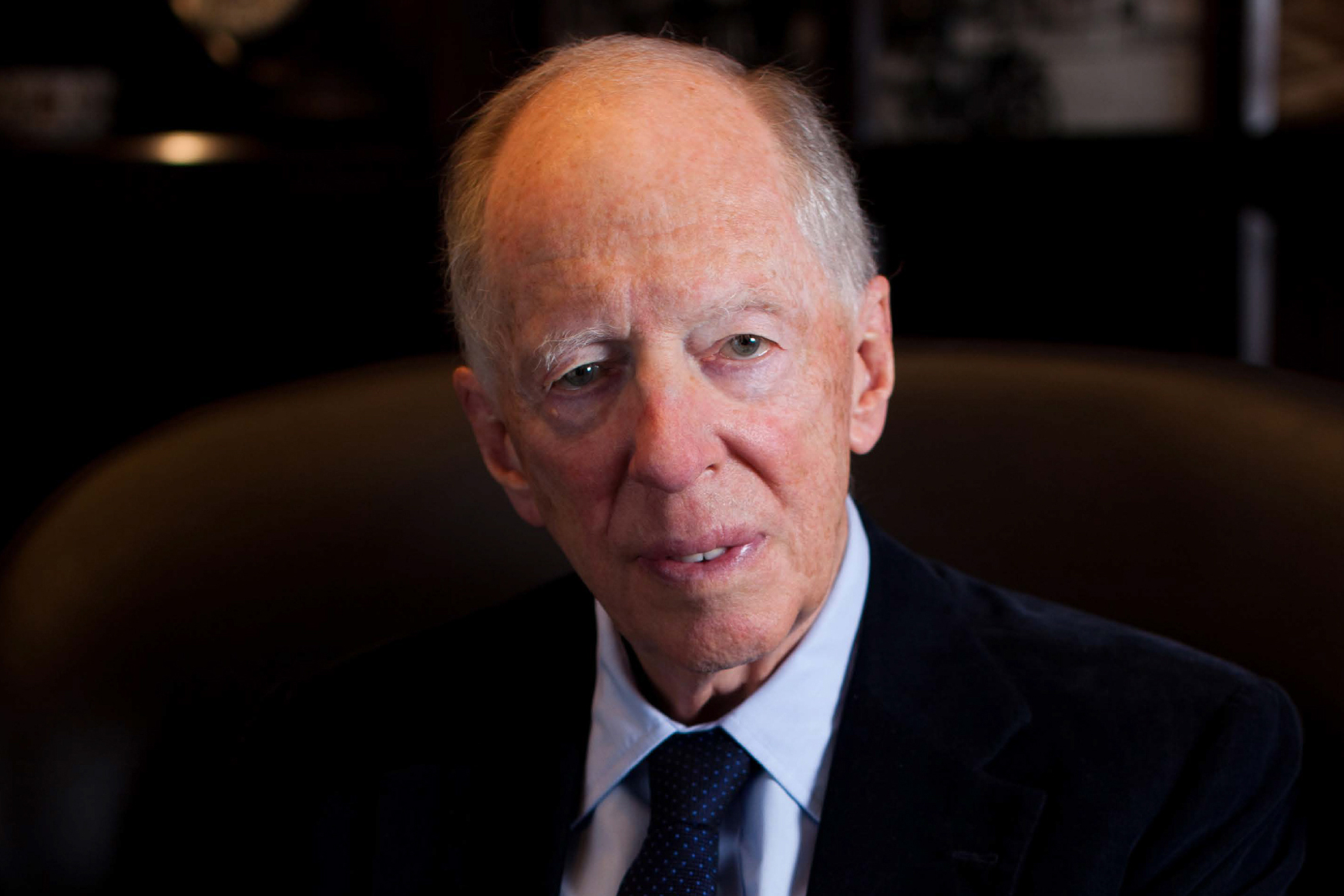

Lord Jacob Rothschild, a venerable figure in the world of finance and a scion of the Rothschild banking dynasty, passed away at 87. Born into a lineage that shaped the contours of global banking, Rothschild’s career spanned various sectors, including investment banking, the arts, and philanthropy.

After starting his career at NM Rothschild & Sons in 1963, he co-founded the J Rothschild Assurance Group, which evolved into St James’s Place, a prominent wealth management firm based in London. His role in founding and leading RIT Capital Partners underscored his foresight in investing across various industries, ranging from hedge funds and cryptocurrency to clean technology start-ups, cementing his reputation as a diversified investor.

Rothschild’s impact extended well beyond the financial markets. As a patron of the arts and a trustee of Britain’s National Gallery from 1985 to 1991, he played a pivotal role in nurturing cultural institutions. His philanthropic efforts, particularly towards charitable causes in Israel and Jewish culture and his commitment to environmental causes, showcased a multifaceted approach to public service.

Notable figures such as Ed Vaizey, Britain’s former culture minister, paid tribute to the investment tycoon.

Pioneering investments in cryptocurrency

Under Lord Rothschild’s leadership, RIT Capital Partners ventured into the field of cryptocurrency and blockchain technology. This strategic pivot began to draw significant attention around 2016 when the Rothschild family reportedly started diversifying away from the U.S. dollar towards other currencies, including potential investments in Bitcoin. However, it was not until 2021 that RIT Capital Partners officially marked its entry into the crypto sphere with an $8.8 million investment in Aspen Digital, a Hong Kong-based blockchain platform. Further investments in key players within the cryptocurrency and blockchain industry, such as Animoca Brands, Kraken, and Dapper Labs, underscored Rothschild’s vision of embracing digital transformation in finance.

Despite the challenges faced by the cryptocurrency market, including the notable collapse in 2022 triggered by the FTX/Alameda incident, RIT Capital Partners’ engagement in the sector reflected a trend of traditional investment trusts recognizing the potential of blockchain technology. Rothschild’s foray into this space diversified RIT’s portfolio and positioned the trust at the forefront of financial innovation, indicating a forward-thinking approach to investment that blended traditional banking principles with new digital frontiers.