Crypto investment firm Galaxy Digital says a major bullish catalyst is on the horizon for Bitcoin (BTC) as accumulation soars.

However, in a recent blog post, the investment firm also says one possible bearish event looms.

“Two primary supply events loom in the future, one bullish and one potentially bearish.”

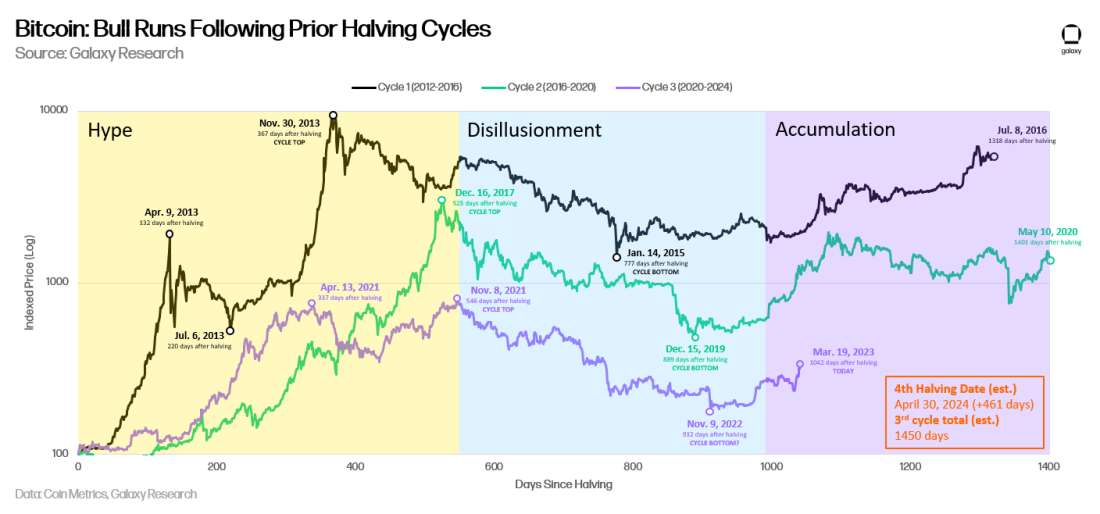

Per Galaxy Digital, the bullish catalyst is Bitcoin’s fourth halving event slated to occur in April 2024. Halving events take place every four years and reduce the amount of new BTC entering the market. The tightening of supply has historically coincided with major moves to the upside in Bitcoin’s price.

“Bitcoin’s next halving (projected to take place in April 2024) will bring the network’s inflation rate below 1% with roughly 450 new bitcoin being mined per day. Historically, Bitcoin’s three previous halvings (2012, 2016, 2020) have been pointed to as catalyzing subsequent bull runs, as existent demand quickly outstripped lower levels of new supply…

The 2024 halving should remain in focus for the simple reason that bitcoin’s inflation rate falling below 1% will place it among the hardest existing assets known to humanity, lower than historical store-of-value assets such as gold and silver.”

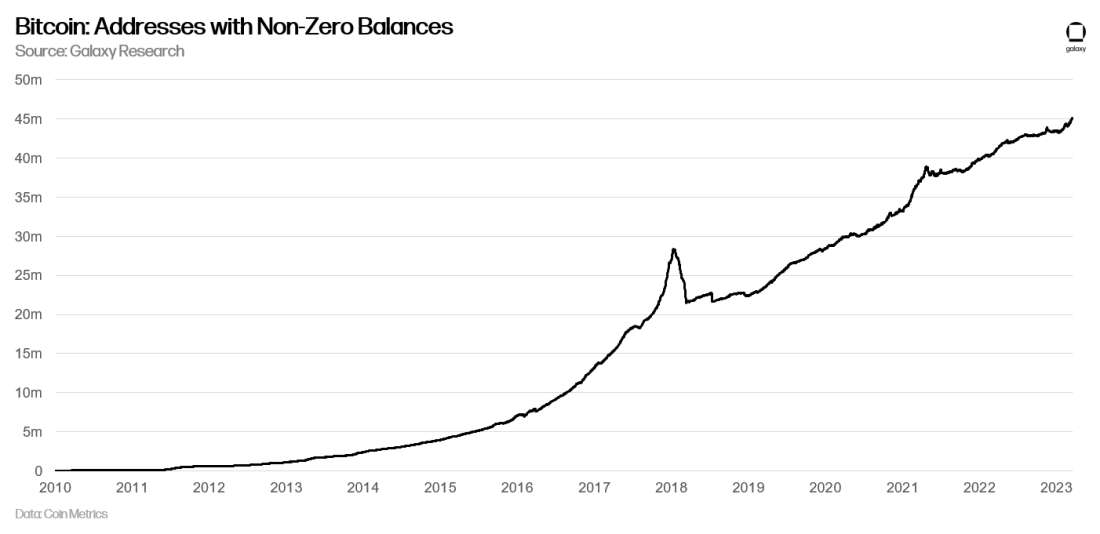

Galaxy Digital also notes another bullish trend of increasing Bitcoin accumulation.

“On-chain data suggests ongoing accumulation of Bitcoin. The total number of addresses with a non-zero balance continues to rocket higher. More than 45 million addresses hold BTC. A large number of addresses have exclusively received Bitcoin – they have never spent. The number of so-called ‘accumulation addresses’ has spiked in the last month.”

The potential bearish market trigger is the possibility that a large supply of Bitcoin from the bankrupt and defunct crypto exchange Mt. Gox could flood the market as it is transferred to creditors. However, Galaxy Digital says this seems unlikely.

“As a result of the 2014 exchange hack, the Mt. Gox bankruptcy trustee holds 141,686 BTC plus cash and BCH according to September 2019 documents. Based on our research and conversations with Gox creditors, we do not expect there to be a material supply event for BTC as a result of distributions to creditors.”

Bitcoin is trading for $28,287 at time of writing, up 3.2% in the past 24 hours.

Don't Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inboxCheck Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Tithi Luadthong

The post Massive Bullish Catalyst for Bitcoin Looming As Accumulation Spikes, Says Galaxy Digital – But There’s a Catch appeared first on The Daily Hodl.