Nine Bitcoin exchange-traded fund (ETF) issuers are gobbling up the crypto king, accumulating billions of dollars worth of BTC less than two weeks after launch, according to an expert.

Bloomberg analyst Eric Balchunas tells his 230,600 followers on the social media platform X that he’s keeping a close watch on the movement of capital in and out of the nine recently launched Bitcoin ETFs.

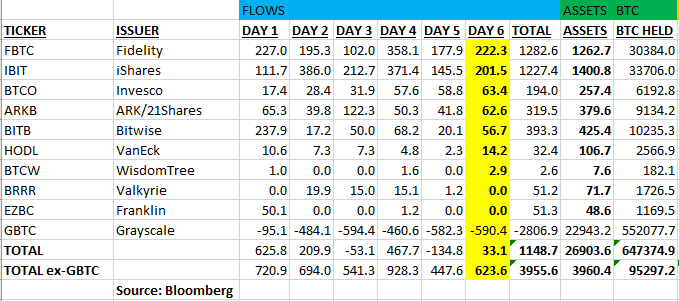

According to Balchunas, nine Bitcoin ETF issuers including Fidelity (FBTC), iShares (IBIT), Invesco (BTCO), ARK/21Shares (ARKB), Bitwise (BITB), VanEck (HODL), WisdomTree (BTCW), Valkyrie (BRRR) and Franklin Templeton (EZBTC) collectively hold a total of 95,297.2 BTC worth about $4 billion as of January 19th.

Leading the pack is iShares with 33,706 BTC worth over $1.4 billion, followed by Fidelity holding 30,384 BTC worth $1.262 billion. At number three is Bitwise with 10,235 BTC worth $425.4 million under management with ARK/21Shares not far behind accumulating 9,134.2 BTC to the tune of $379.6 million.

Invesco takes the fifth spot as the firm holds 6,192.8 BTC worth $257.4 million, followed by VanEck with a stash of 2,566.9 BTC worth $106.7 million and Valkyrie with a trove of 1,726.5 BTC worth $71.7 million.

Franklin Templeton lands at number eight, snapping up 1,169.5 BTC worth $48.6 million with WisdomTree rounding up the list holding 182.1 BTC worth $7.6 million.

Balchunas also says that the buying activities of the nine Bitcoin ETF issuers have been outpacing the selling of crypto titan Grayscale (GBTC).

“LATEST: despite GBTC seeing a -$590 million outflow gash Friday, the Nine overwhelmed it with +$623m (3rd best day).

IBIT and FBTC both >$200 million while BTCO and HODL had their best hauls to date. Total net flows stand at +$1.2 billion as Nine’s asset under management (AUM) hit $4 billion vs GBTC’s -$2.8 billion, upping AUM share to 14%.”

Balchunas also says that the biggest GBTC sellers are FTX and traders who accumulated shares last year when the fund was trading in deep discount territory.

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inboxCheck Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

The post Nine Bitcoin ETF Issuers Hold About $4,000,000,000 in BTC Less Than Two Weeks After Launch: Bloomberg Analyst appeared first on The Daily Hodl.