In a move that could redefine the landscape of artificial intelligence (AI) startups, OpenAI, under the leadership of Sam Altman, is actively engaging in early talks to secure new funds, targeting a valuation of no less than $100 billion. This potential development, with a minimum $10 billion increase from the previous valuation, signifies OpenAI’s ambitious expansion plans and its growing prominence in the tech industry.

OpenAI aims for new heights with Microsoft support

In a bid to solidify its standing in the tech domain, OpenAI is reportedly on the verge of securing new funding, which could catapult its valuation to a staggering $100 billion. Sources suggest that this would not only mark a remarkable $10 billion increase from its last valuation but also position the AI startup as the second most valuable startup in the U.S., trailing only behind Elon Musk’s SpaceX, valued at $180 billion.

Microsoft, a key backer of OpenAI with a 49% stake and a substantial $13 billion investment, continues to play a pivotal role in the startup’s success. The current funding talks, if successful, would signify a more than three-fold increase in OpenAI’s valuation within just 12 months, underlining the growing confidence and support it enjoys from its investors.

Chip venture and employee share sales

In a strategic move, OpenAI is not only focusing on financial gains but also exploring avenues beyond its core AI offerings. The company aims to raise funds for its chip venture, setting its sights on challenging Nvidia Corp., the market leader in AI chips. The proposed funding for the chip venture is estimated to be between $8 billion to $10 billion, signaling OpenAI’s intention to carve a significant space in the competitive chip market.

OpenAI plans to facilitate a separate tender offer, allowing its employees to sell their shares at a valuation of $86 billion. This move reflects the company’s commitment to ensuring its workforce remains an integral part of its success story, aligning their interests with the company’s financial growth.

While the details of the fundraising are yet to be finalized, reports suggest that the numbers could witness slight adjustments as the round concludes. This uncertainty adds an element of anticipation, keeping stakeholders and industry observers on the edge of their seats, eager to witness the outcome of OpenAI’s ambitious funding talks.

OpenAI’s impact and the AI frenzy

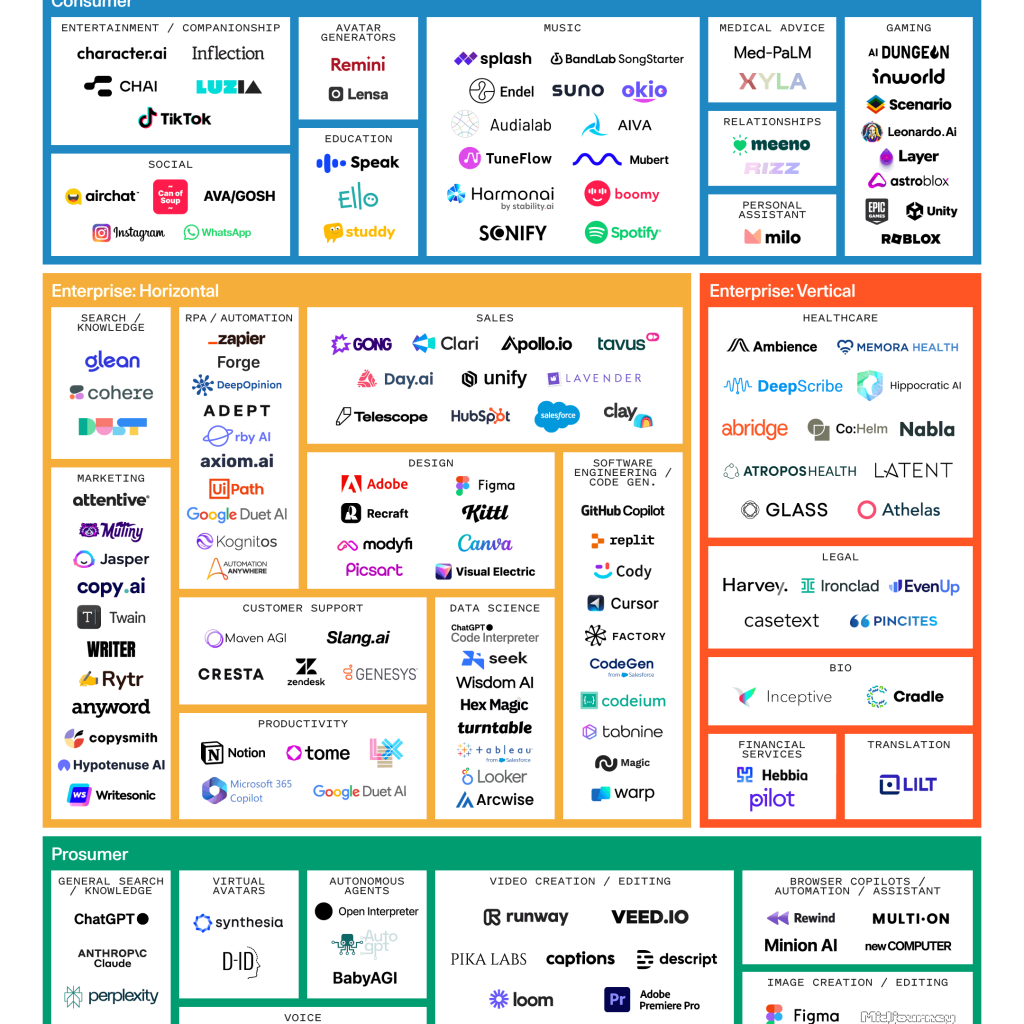

The surging valuations of OpenAI come in the wake of its noteworthy achievements in the AI realm. Post the launch of ChatGPT in 2022, the company has consistently announced upgrades, with the latest being GPT-4 Turbo. OpenAI’s success with ChatGPT has not only captivated the tech community but has also sparked a frenzy in the AI segment. Rivals like Alphabet Inc.’s Google and Meta Platforms Inc. are still playing catch up, unveiling their own projects, Gemini and Llama 2, respectively, in an attempt to keep pace with OpenAI’s advancements.

As OpenAI ventures into uncharted financial territories, the question that lingers is the extent of its influence in shaping the future of AI. Will the ambitious funding talks and the potential increase in valuation position OpenAI as the undisputed leader in the AI arena, leaving competitors in the dust? Only time will tell as the tech community eagerly awaits the outcome, anticipating the next chapter in OpenAI’s remarkable journey.