Today’s Polkadot price analysis shows DOT is trading in a downward trend, and there is no indication of a potential reversal any time soon. The digital asset started the day at $6.54 and declined to the current price of $6.26. The price has been range-bound since the start of a new month, with the lower boundary reaching as low as $5.7 before rebounding back up to around $6.2.

Polkadot’s trading volume is currently at $236,470,83, while the market cap is around $7,275,278,624 billion, according to market data from CoinMarketCap.The technical analysis further confirms the bearish sentiment surrounding the digital asset. DOT is currently trading in a descending channel, which indicates that the price could decline towards the lower boundary of $6.0 if bears maintain their grip on the market.

Polkadot price analysis on a daily chart: DOT follows a bearish trend

Polkadot price analysis on a 1-day timeframe reveals the bears have countered the bulls in the market. The digital asset created lower lows and lower highs, indicating that a continuation of the bearish trend is likely. The EMA lines are currently located in the red zone, and a crossover of the two could lead to further losses. The 21-day and 50-day EMA lines are both trending downwards, suggesting that the bearish sentiment is still strong. The RSI indicator is currently below the 50-level and could potentially move into the oversold zone in the coming days if DOT continues to follow a downward trend.

The support levels lie at $6.0 and $5.7, while resistance lies at $6.3 and $6.5. A break below the lower boundary of $6.0 could see DOT move toward the next support level at $5.7, while a breakout above the higher boundary at $6.5 could open up upside potential for the digital asset.

The Ichimoku Cloud indicator is currently in the red zone, indicating that the bearish trend is likely to continue. The Tenkan-Sen line has also moved below the Kijun-Sen line, further confirming a downward move for DOT.

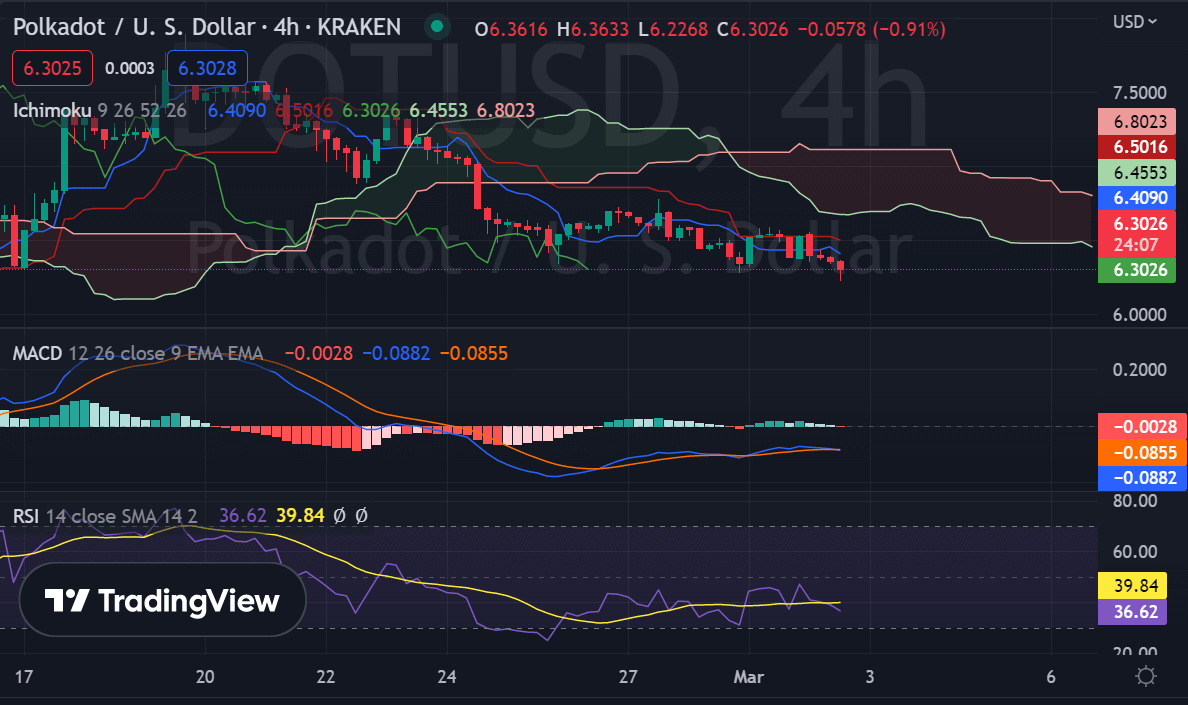

Polkadot price analysis in a 4-hour timeframe: DOT trades in a range-bound pattern

Polkadot price analysis on a 4-hour timeframe reveals that the digital asset is currently range-bound between $6.2 and $6.5. The bulls have been unable to push past the upper boundary of the channel, while the bears are also struggling to break below the lower boundary.

The MACD indicator is currently in the negative zone, with the MACD line and signal line both trending downwards. This suggests that the bears are still in control of the market. However, a bullish crossover could occur if buyers start accumulating positions at these levels. The RSI indicator is also below 50, confirming bearish sentiment in the market.

The primary support level lies at $6.0, while the primary resistance level lies at $6.5. A break above the resistance could open up upside potential for DOT, while a break below the support could see further losses as bears continue to dominate the market.

Polkadot price analysis conclusion

Looking ahead, Polkadot price analysis suggests a bearish outlook for DOT in the days ahead, with a potential target of $6.0. The digital asset is currently trading in a descending channel, and there is no indication of a reversal any time soon. However, buyers could gain control of the market if they manage to push past the upper boundary at $6.5 and reclaim the $7.0 mark.