Polkadot price analysis reveals that the DOT/USD depreciated to $ 4.61 after a bearish run. The coin has lost 1.26% in the last 24 hours as the bearish momentum continues. The chart shows that DOT/USD has been in a downward trend since it hit its all-time high of $5.32 on December 13th, and from then the price has been declining. The coin has been facing strong resistance around the $4.70 mark while its immediate support is present at the $4.60 level, however, it may be difficult for the coin to breach this level.

The total market capitalization for DOT/USD stands at 5.30 billion USD, with a 24-hour trading volume of 104 million USD.

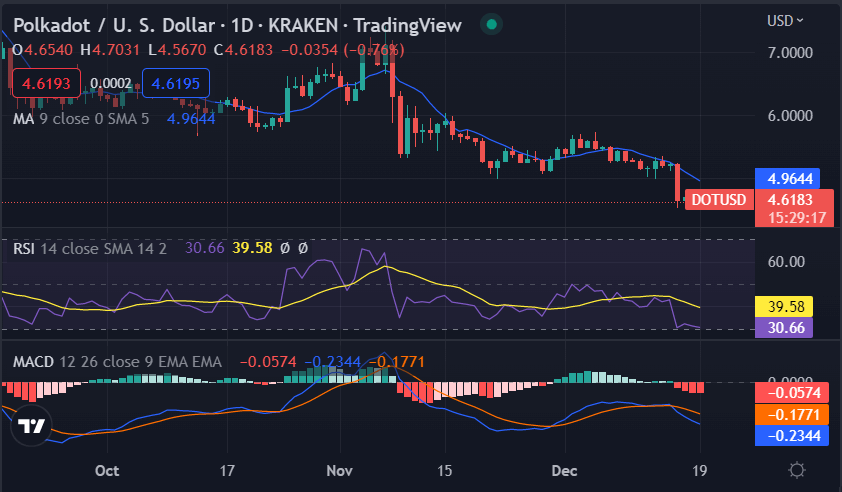

Polkadot price analysis 1-day price analysis: Price action remains bearish

Polkadot price analysis on a 24-hour indicates that the token started the day at $4.67 and continued to depreciate throughout the day, reaching a low of $4.60. The price currently trades around the $4.61 level, with bearish pressure still affecting the token’s price movement. However, the bullish momentum was strong enough to push the price back up to $4.70 earlier today, but the bulls were not able to sustain this level and the token declined again.

The MACD indicator supports the bearish sentiment for DOT/USD as it shows a bearish crossover in the 24-hour chart. The RSI indicator is also flashing a bearish signal as it currently stands at 39.58. Overall, DOT/USD is still in a bearish trend and could potentially dip further if the bears maintain their pressure. The moving average(MA) also supports the bearish sentiment as the 50-day MA is below the 200-day MA.

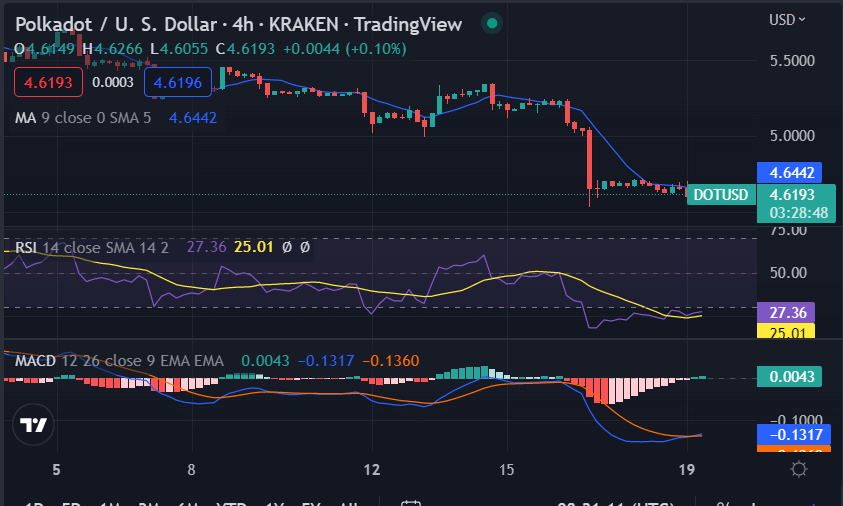

DOT/USD 4-hour price analysis: Polkadot price consolidates at $4.61

The hourly Polkadot price analysis shows that the token is currently trading in a range-bound zone between the $4.60 and $4.70 levels. The price has been consolidating around the $4.61 level over the past few hours, indicating that there is a lack of direction in the short term. The red candle on the hourly chart suggests that bearish sentiment still dominates the market.

The MACD indicator is flashing a bearish signal as it shows a bearish crossover in the 4-hour chart. The RSI indicator is also showing bearish sentiment as it currently stands at 25.01, which is in the oversold region. The 50-day MA is also below the 200-day MA, indicating a bearish sentiment for the token.

Polkadot price analysis conclusion

Overall, the Polkadot price analysis shows that the coin is currently facing bearish pressure and is trading at $4.61. The hourly and daily chart show bearish movements, and the indicators point to a continuation of this trend in the short term. However, the Polkadot price may see growth in the near term as it continues to gain traction in the decentralized storage market.