Yesterday’s Federal Reserve (FED) FOMC meeting turned out to be more hawkish than many Bitcoin investors and the financial market expected. As anticipated, the FED raised interest rates by 0.5 percentage points on Wednesday. This brings the interest rate to a range of 4.25-4.5%, the highest level in 15 years.

However, overall, central bankers expect the rate to be higher next year than initially expected, which may have been the biggest influencing factor in yesterday’s bitcoin and crypto market reaction.

FED Is More Hawkish Than Expected

The revision to the FOMC dot plot showed that, on average, the monetary policymakers expect to raise the rate up to 5.1% in 2023 before lowering it to 4.1% in 2024. That means the Fed will have to raise the fed funds rate another 0.75 bps in 2023. Whether that will happen in three steps or less is something Powell declined to commit to on Wednesday.

“More important than speed is the question of how high interest rates will ultimately have to rise and how long we will remain at that level,” Fed Chairman Jerome Powell said.

During yesterday’s FOMC press conference, the Fed chairman proved to be extremely hawkish. At least, he tried to emphasize this again and again.

Investors had hoped that interest rates would rise less sharply in the coming year and are now worried that the Fed could trigger a recession in the U.S. with its policy. However, Powell stressed that the FED is “determined” to bring the inflation rate back to the target of 2%. However, “there is still a long way to go before that happens.”

In addition, the FED chair emphasized that he wished there was “a pain-free way” to fight inflation. But “there isn’t.”

Economists React To Powell’s Speech

The fact that the Bitcoin price did not plunge lower after Powell’s comments yesterday could also be due to the fact that the market does not believe Powell’s words.

The Fed’s hawkish policies increase the risk of sending the economy into a recession. In this case, “political pressure on Powell would increase,” former FED governor Frederick Mishkin indicated. After all, Mishkin asserted, it would then be particularly difficult to raise interest rates further when the economy was already doing badly.

Star investor Jeffrey Gundlach of Double Line Capital expects a recession in the first half of 2023 when the Fed would “do an about-face and cut rates again,” he said Monday at an online event.

The concern that monetary policymakers could do great damage to the economy outweighs the will to fight inflation, he said. “Even if central bankers are saying something else at the moment.”

Lisa Abramowicz of Bloomberg Surveillance described the sentiment of many analysts on Twitter as follows:

The Fed: We’re hawkish! We have more work to do! The market: Got it, so you’re doing another step-down to a 25bp rate hike in February and will be cutting rates by later in the year. Got it.

Abramowicz bases this assumption on the fact that Powell repeatedly spoke of the Fed’s “best estimates as of today.” Powell may have thus given the green light for a 25 basis point hike in February.

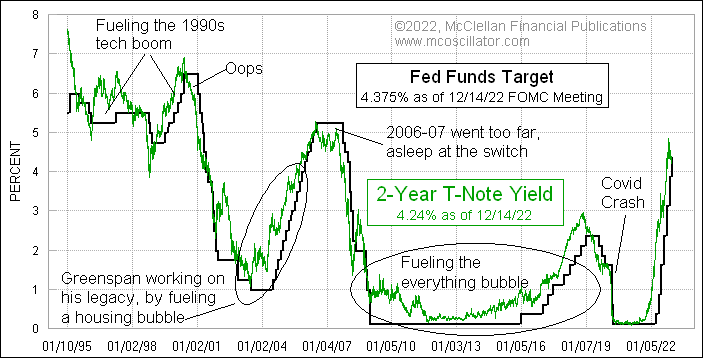

Tom McClellan from “The McClellan Market Report” wrote via Twitter that the Fed’s rate hike cycles usually end when the fed funds rate reaches the level that the 2-year yield has already reached.

“We have that condition now. So the Fed should stop, but there is no indication that they know that, based on the post-meeting announcement,” McClellan wrote, referring to the chart below.

Bitcoin Rejected At Major Resistance

The Bitcoin price has seen a strong run ahead of the FOMC meeting but has held up very well despite a hawkish Powell. A look at the daily chart reveals that BTC is somewhat overextended and was rejected at $18,220.

Therefore, it seems likely that Bitcoin will have a consolidation, for the time being, looking for a higher low. The area to hold is currently $17,200 to 17,400.