Request Price Predictions 2023-2032

- REQ Price Prediction 2023 – up to $0.16

- REQ Price Prediction 2026 – up to $0.36

- REQ Price Prediction 2029 – up to $1.16

- REQ Price Prediction 2032 – up to $3.66

Why should you invest in REQ in 2023? Primarily, the Request gateways reduce the complexity of interaction with the blockchain. There is no need to manage different contracts, specific libraries, and gas (the calculable fee for every operation on the Ethereum network). Let’s take a look at Request Price Prediction to get a panoramic view of REQ prices.

Here’s an update on developments:

The simplicity comes from interoperable financial apps where the users have the power over their data. The Request Network ecosystem is just starting to grow. Request Finance’s double-digit monthly growth shows the potential for building other interoperable applications on top of Request Network’s open-source payment request technology.

Gateways enable blockchain interactions as quickly as any other SaaS through HTTP APIs. By bringing a variety of protocols and systems together, Request combines their strengths. Let’s see why REQ should be — or not — a part of your crypto portfolio after going through the complete history and background for the Request price predictions.

How much is REQ worth?

Today’s Request price is $0.112389 with a 24-hour trading volume of $3,526,563. Request is up 0.61% in the last 24 hours. The current CoinMarketCap ranking is #262, with a live market cap of $112,369,948. It has a circulating supply of 999,830,316 REQ coins and a max. supply of 999,877,117 REQ coins.

How does the Request platform work?

Request is a platform that allows anybody to make quickly, share, and fulfill payment requests. When making a payment request, the user specifies which address the payment request should be sent to and the balance owed. REQ is an ERC-20 token used to power Request Network’s payment requests.

The user can add contract terms to the payment request, transforming it from a simple payment request to an invoice. After creating the Request for billing, it allows users to share it with the other person to ensure that it gets paid. All of these stages are logged and saved on the Request network, making it simple for everyone involved in keeping track of their payments, receipts, and invoices for (personal) recording transactions.

The Request platform eliminates the need for 3rd parties, resulting in a more cost-effective and secured payment method that accepts all global currencies.

When they submit a payment request, users decide which address the money should be paid to or what it should cost. To convert a simple proposition into an invoice, the user can also provide payment terms and restrictions. After that, the user can communicate with their counterparties about their payment request.

Source: Request

Payments for requests are handled by simply sending an invoice via the blockchain. The counterparty can then identify the Request and charge it with a click of a peer-to-peer button.

Payments are created using a push process instead of a pull mechanism, one of the Request’s advantages. Users are not obligated to disclose their login credentials to others. By eradicating the need for third-party processors, blockchain technology lowers transaction costs.

Each step is recorded and captured on the Request network, allowing everyone involved to record all receipts for recording transactions quickly.

When creating and paying digital currency invoices, there is a difference between invoice and payment currencies. The invoice currency is the one you choose to issue the invoice during creation, mainly based on what is required to comply with your local tax & accounting laws.

The payment currency is the one that you end up receiving when issuing an invoice or spending when you’re on the recipient side of an invoice. These can be traditional currencies like EUR, USD, or GBP, which you receive in your bank account, or digital currencies (cryptos) like ETH or DAI that you receive in your digital wallet. Read more here.

Request price prediction Overview

REQ-compatible wallets

Focus on keeping your digital currencies secure when storing them. The following are some wallets that are highly recommended to buy/store REQ:

- Atomic Wallet

- Jaxx Liberty

- Trust Wallet

- Metamask

- MyEtherWallet

- Ledger hardware wallet

- imToken

- Trezor hardware wallet

How to buy REQ

The top exchanges for trading in Request are currently Binance, Huobi Global, Mandala Exchange, OKEx, and Coinbase Exchange. Buying in exchanges is simple:

Step 1: Set up an account on Binance.

Step 2: Buy Bitcoin (to exchange for Request).

Step 3: Trade Bitcoin for Request using the Binance exchange.

If you’re in the US, here’s how to buy REQ. If you bought REQ in 2017, your investment would have shrunk by 50%. If more recent, like 2021, the ROI would be much reduced so it’s not a good time to be selling REQ if you’re holding on to some.

Request Network New Developments

The Request Network is constantly in the news for its innovative take on blockchain technology and its potential applications. The team behind the project has been working diligently to improve the platform and make it more user-friendly. Request Network recently announced to its followers on Twitter that Request Finance had established an escrow feature using smart contracts for crypto payments to ensure the safety of user funds.

The development team is also working on adding new features to the platform such as multi-currency support, invoicing, and integration with popular e-commerce platforms such as Shopify. Request Network went live on Thursday 22nd Sep in the Request Discord (?Main Stage), with the team of RequestFinance and protocol developers. The team took questions from the community and discussed various topics such as the recent launches on Ethereum, partnerships, and upcoming features. This was an opportunity for their community to get instant clarifications and hang out with their team members.

Request Network has several unique features that give it an advantage over its competitors. The Request Fund will provide a new way for businesses to access the liquidity they need in order to expand and grow. It allows businesses of all sizes to easily request investment capital from a broad pool of investors, without having to go through traditional channels such as banks and other financial institutions.

Following the success of Request Finance as a web3 invoicing payment solution, we are looking to support new builders using Request technology. The objective of the fund is to build an investment program that builds a financial system that promotes transparency and real-time reporting.

Based on the predictions of several experts and market analysts, we can conclude that Request Network is a solid investment in the long term. Many other coins offer higher returns on investment, but REQ could be an excellent choice for investors looking to build a long-term portfolio.”

Overall, there is a lot of optimism surrounding the future price of Request Network. Although predicting prices is never easy, the REQ price prediction looks very promising for long-term price growth. Based on current projections, it could be well worth accumulating some REQ might be a good investment.

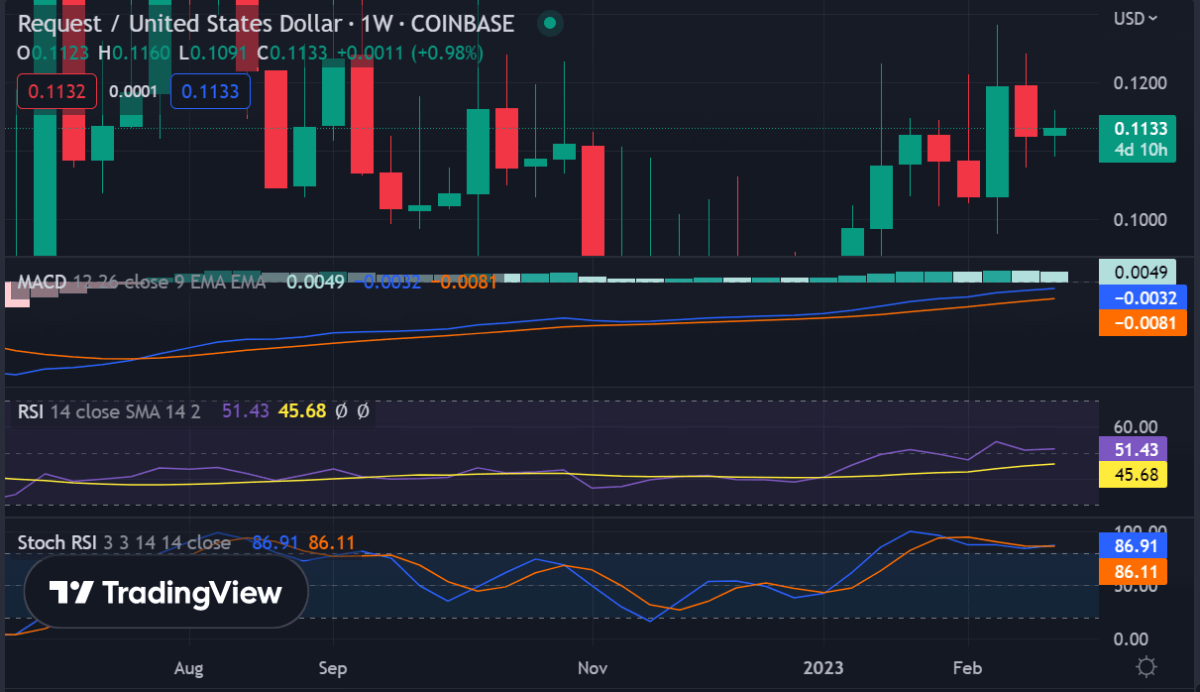

Request Technical Analysis

Request cryptocurrency technical analysis reveals REQ coin has been trading inside a horizontal channel ranging from $0.1082 to $0.111 since the start of February 2023. The price has been consolidating within this range for nearly a month and is currently trading near its resistance level of $0.111.

The Neutral Ultimate Oscillator is currently reading a neutral 47.62, suggesting that the coin could move in either direction. The Money Flow Index is at 67.05, indicating that the buying pressure is stronger than the selling pressure, and the market sentiment remains bullish.

The Relative Strength Index (RSI) has been oscillating within the neutral range of 40-60 and is currently indicating a bullish bias at 60, suggesting that uptrend momentum may be increasing. The Moving Average Convergence Divergence (MACD) indicator displays a bearish crossover, with the MACD line crossing below the signal line, indicating a shift in momentum from bullish to bearish.

Given the current technical outlook for REQ, traders may want to consider taking profits off the table at current levels near $0.111 or wait and see if the price can break above resistance at $0.111 and test its next major resistance level at $0.118.The Williams %R oscillator and Stochastic Oscillator both remain at overbought levels, with higher highs set at around 80, suggesting that the price is at risk of reversing its uptrend.

As such, analyzing the current price trend using the moving averages, a potential bounce off towards $0.1082 may be expected if the price does not break above its resistance level at $0.111.In a bearish scenario, traders may want to look for a break below the support level at $0.1082 and set their next target at the major support level at $0.098.

To better assess the ongoing market sentiment around REQ, the price movement hasn’t been intense, as the volatility has been relatively low. The Average True Range for the REQ coin is 2.4, and the Bollinger Bands have been relatively narrow for the past few days, with the lower band at 0.0992 and the upper band at 0.1113, respectively.

Looking ahead, the short-term support levels for the REQ coin are present at $0.1082, $0.105, and $0.098. Further, the resistance levels are seen at $0.111, $0.118, and $0.123, respectively. A breakout above $0.111 could lead to a strong bullish movement in the price of REQ coins, while if it fails to break above this level, prices may consolidate further within the range.

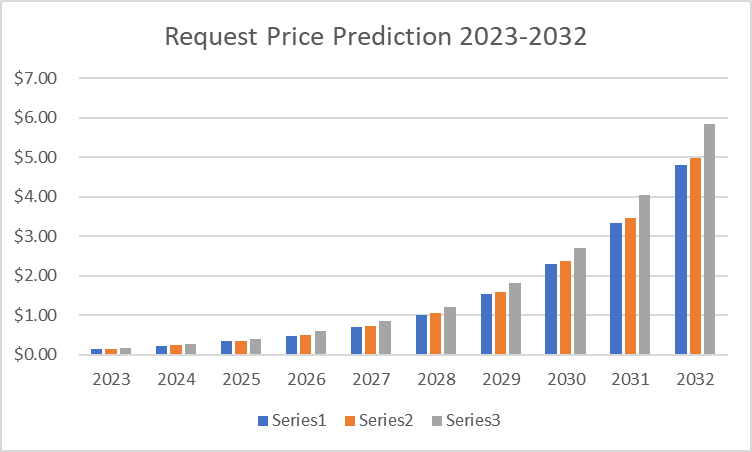

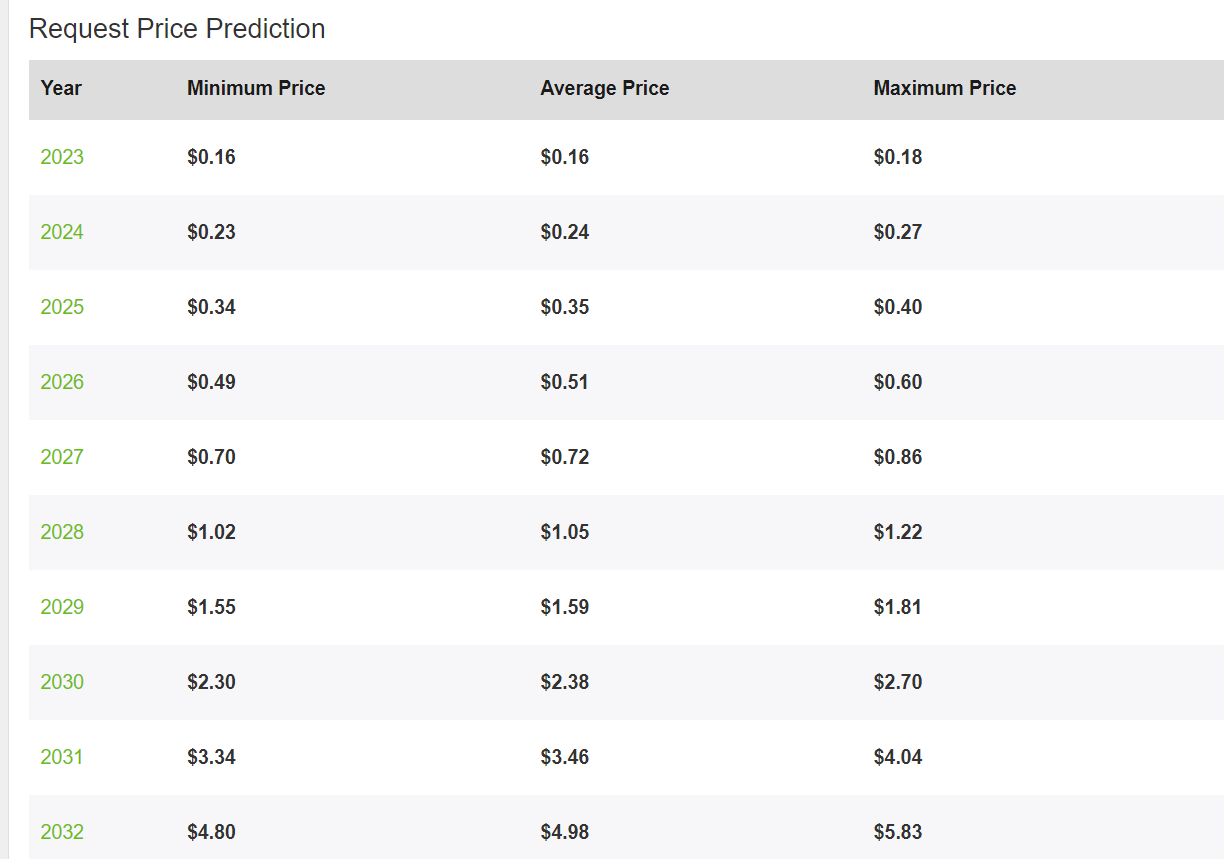

Request Price Predictions by Cryptopolitan

Request Price Prediction 2023

Our Request price forecast for 2023 suggests the REQ market will pick up on a bullish note, and the maximum price forecast of $0.18 is expected, while an average forecast price of $0.16 is possible. RERQ coin is forecasted to attain a minimum price of $0.16.

Request Price Prediction 2024

Our REQ price forecast for 2024 is $0.27 as the highest price and an average price of $0.24. Request coin might trade at $0.23 as the lowest price for 2024.

Request Price Prediction 2025

In our REQ price forecast for 2025, the maximum price of $0.40 is predicted, while an average forecast price of $0.32 is possible with a minimum estimate of around $0.34. Request coin might trade at around $0.35 as the average forecasted price for 2025.

Request Price Prediction 2026

Our REQ price prediction for 2026 is that Request may attain a minimum value of $0.49 and later hit a maximum price level of $0.60. The average forecast price is estimated to be $0.51.

Request Price Prediction 2027

In our REQ forecast for 2027, the maximum price of $0.86 is expected, while an average price of $0.72 is possible with a minimum estimate of around $0.52. The request coin might be trading at around $0.70 as the lowest predicted price for 2027.

Request Price Prediction 2028

Our REQ price prediction for 2028 is that Request may hit a maximum coin price of $1.22 and attain an average price of $1.05. The minimum value for the cryptocurrency is estimated to be $1.02 before the end of 2028.

Request Price Prediction 2029

In our REQ price forecast for 2029, the maximum price level predicted is $1.81, while the average trading price might be around $1.59. Request tokens may also trade down to around $1.55 as the minimum predicted price for 2029.

Request Price Prediction 2030

The Request Network price prediction for 2030, the maximum value might be $2.70, while the average price forecast of REQ is anticipated to be around $2.38. The minimum predicted price of Request coin by 2030 will be around $2.30.

Request Price Prediction 2031

According to the Req price prediction for 2031, the price of Request might go up to $4.04 while the average value might be around $3.46. The Request coin may also reach $3.34 as the minimum forecasted value by 2031.

Request Price Prediction 2032

Our Request REQ price forecast and technical analysis suggest the price of Request could reach a minimum level of $4.80. The REQ price can reach a maximum level of $5.83 with an average trading price of $4.98.

Request Price Predictions by Wallet Investor

Wallet Investor is mostly bearish on most of the market’s assets, offering price predictions that often differ from mainstream forecasts. They have a short-term Request price target in 14 days of $0.120 upside and $0.1064 downside. The website terms REQ coin as a bad long-term investment as it expects the price of REQ to fall by over -91.284% in one year.

The website forecasts the REQ market to continue its bearish trend and predicts that by 2023 the price of REQ will be 0.0038 USD, which is a massive -99% decrease from today’s price. The long-term earning potential for investors looks bleak, in their opinion. Wallet Investor’s forecast paints a gloomier outlook for Request than most other sources.

Request Price Predictions by CoinCodex

According to the current REQ price forecast by Coincodex, the current market sentiment is bearish, and the cryptocurrency could decline by -1.99% and reach $ 0.110502 by March 6, 2023.

Based on Coincodex’s technical analysis, Request Network price prediction sentiment is neutral, with 21 technical analysis indicators signaling bullish signals and 9 signaling bearish signals.

The website continues to state that the current sentiment is Neutral, while the Fear & Greed Index is showing 50 (Neutral). Request Network recorded 16/30 (53%) green days with 3.98% price volatility over the last 30 days. Based on their Request Network forecast, it’s now a good time to buy Request Network. Long-term projections are REQ coin to attain a prediction of $3.25 for the year 2026 if it follows Facebook’s growth. If Request Network would follow Internet growth, the prediction for 2026 would be $ 0.372526.

Request Price Predictions by DigitalCoinPrice

DigitalCoinPrice has tracked the past performance of REQ coin, one of the leading cryptocurrencies available on the market. With Coincodex’s extensive technical analysis, over the last 30 days, Request has increased by 4.88%. Due to this, DigitalCoinPrice reveals can expect a slight recovery in the coming month.

DigitalCoinPrice technical analysis also reveals by the end of March, the value of Request increased by 111.11% and reached near around $0.24. Currently, all indicators indicate a Neutral zone, and the fear & greed index shows 26.86 extreme fears. According to their forecast, this is not the right time to Hold a Request for cryptocurrency.

The price of the Request is currently running below the 50-day simple moving average (SMA), and it shows a Buy signal. According to all technical indicators, the 200-day SMA will drop soon, and the price will hit $0.10 by the end of December. By December 2023, 2024, Request’s short-term 50-Day SMA shows a $0.11.

Long-term projections suggest Request REQ cryptocurrency is expected to follow bullish market sentiment, and by 2032, the value of the coin is expected to trade at a minimum price of $2.11, an average price of $2.18, and a maximum price of $2.19.

Request Price Predictions by Market Experts

Request Protocol is set to revolutionize the cryptosphere, making REQ tokens a must-have asset for investors. By dramatically simplifying payment mechanisms and providing conversion services for users’ convenience, the Request protocol can potentially become the cryptocurrency version of PayPal – secure, reliable, and efficient.

The Request is revolutionizing payment operations with its decentralization of services such as B2B payments, governance, and IoT. Its immense growth potential can not go unnoticed; more and more businesses are beginning to recognize the value of this streamlined form of payment and conversion services.

The Request team is constantly pushing the boundaries in order to make their platform incredibly remarkable, transforming it into an unexpected long-term profitable venture. Market experts have become increasingly interested in the Request protocol and its potential to become a leading cryptocurrency.

For instance, Moon33, a market analyst based on Youtube, is optimistic REQ price pump, claiming that if the stakeholders of REQ keep up their momentum, it could reach $1.5 by the end of 2025. The analyst has given a technical analysis using the Elliot Wave Principle, concluding that REQ is on a 5-wave uptrend. Considering all the factors, it is safe to say that Request has the potential to become one of the most impactful cryptocurrencies in the market.

Conclusion

Request Network has several unique features that give it an advantage over its competitors. First, Request Network is built on the Ethereum blockchain and uses ERC20 tokens. This makes it incompatible with other blockchain platforms that don’t use ERC20 tokens. Secondly, Request Network can be used by anyone in the world without any fees charged.

Based on the predictions of several experts and market analysts, we can conclude that Request Network is a solid investment in the long term. There are many other coins that offer higher returns on investment, but REQ could be an excellent choice for investors looking to build a long-term portfolio.

The Request team recently announced a relaunch of the Request Fund. The initiative is led by the Request Foundation and aims to decentralize world trade through a triple-entry payment system.

Overall, there is a lot of optimism surrounding the future price of Request Network. Although predicting prices is never easy, the REQ price prediction looks very promising for long-term price growth. Based on current projections, it could be well worth accumulating some REQ might be a good investment. However, it is always advisable to do your own research before making an investment decision.