As NFTs boom, they have crossed the chasm into mainstream adoption. However, some issues affect the NFT market, such as decentralized immutability and the high minting fees on the Ethereum MainNet. Skale aims to solve this problem. Currently, SKALE can connect to marketplaces such as Rarible, NFT Gateway, and OpenSea. NFTs on SKALE can interact with multiple marketplaces.

Skale started 2022 with decentralized apps, NFTs, and DeFi launches, by partnering with CurioDAO. However, this is part of CurioDAO’s larger strategy to offer end-to-end solutions for tokenizing and launching real-world assets via RollApp, a real-world asset NFT Launchpad.

Today’s SKALE Network price today is $0.044759 with a 24-hour trading volume of $24,921,909. SKALE Network is down 9.48% in the last 24 hours. The current CoinMarketCap ranking is #152, with a live market cap of $165,830,984. It has a circulating supply of 3,704,977,671 SKL coins and a max. supply of 7,000,000,000 SKL coins.

Let’s look into the background of Skale before going into the yearly Skale price predictions and determine whether SKL is good to be in anyone’s investment portfolio.

Also Read: MATIC, SKL, SUSHI soars amid Coinbase Pro listing announcement

Skale Overview

| Coin | Symbol | Price | Marketcap | Change | Last 24h | Supply | Volume (24h) |

|---|---|---|---|---|---|---|---|

SKALE SKL | SKL | $ 0.044908 | $ 166.37 M | 8.98% | 3.70 B | $ 20.80 M |

SKALE Network is a blockchain network designed to be elastic and operates on Ethereum. This network’s first and foremost use case will be for elastic sidechains solely for the Ethereum Blockchain. In this sense, it is referred to as an “Elastic Sidechain Network.” Even though this initiative is young and relatively unexplored, the technologies utilized by this network appear promising and are backed by industry leaders at all levels.

SKALE Network’s modular protocol is the first of its kind to allow developers to easily provide highly configurable blockchains, which provide the benefits of decentralization without compromising computation, storage, or security.

SKALE is a relatively new participant in the crypto space worth keeping an eye on. As dApp development gains momentum, the SKALE Network will likely expand to meet demand. The SKALE Network gives developers access to a decentralized Ethereum-compatible blockchain with sub-second finality and no gas fees once in the SKALE Network.

How does Skale work?

One of the significant unknowns that would significantly affect SKALE’s future is the forthcoming Proof-of-Stake-based consensus acceptance by Ethereum, on which SKALE is based. It will decrease the cost of participating in the system, which would either influence the network to fizzle out, force it to adapt, or attract more blockchain developers to the project.

Another item to keep an eye on is how the SKALE team handles its marketing and network strategy in the long term.

Sidechains on this system are overseen by a collection of virtual subnodes chosen from a fraction of network nodes and operate on all or a portion (multitenancy) of every node’s compute and storage abilities. Every sidechain is exceptionally customizable, and users can select the chain’s volume, consensus mechanism, virtual mechanism, parent blockchain, and other safety procedures.

The SKALE coin works as a utility token. To function in the Network, nodes will have to execute the SKALE daemon and invest a defined number of SKL coins on the Ethereum mainnet via the SKALE Manager, a sequence of smart contracts.

Once the network confirms a node, 24 peers are chosen randomly to evaluate its reliability and latency; these statistics will be reported routinely via SKALE Manager and will impact a node’s incentives for partaking in the network.

Each network is given bounties depending on its performance (as judged by its peer nodes) after each networking period, provided they continue to engage in their allocated Elastic Sidechains. When an Elastic Sidechain reaches the end of its life cycle, its virtual subnodes’ assets (computation, storage) are released, allowing them to participate in freshly created Elastic Sidechains.

SKALE Network Features

The Network of Skale is composed of free SKALE nodes and SKALE Management (present on the Ethereum blockchain).

SKALE supervisor

The SKALE Controller is a smart contract that resides on the Ethereum mainnet used as the gateway to other payment techniques in the SKALE ecosystem. This contract oversees the coordination of all system components, including Elastic Sidechain development and removal, node development and reduction, withdrawals, and bounties.

- Creating a node

To connect to the system, a potential node will run the SKALE daemon, which will assess the possible node to verify that it meets network hardware compatibility.

If a prospective node meets this verification stage, the daemon will transfer a network join demand to the Skale Manager. This request will include the necessary network deposit and node information gathered by the daemon (e.g., public key, ports, and IP address).

After Ethereum accepts the requisition, the potential node would be installed as a ‘full node’ or a ‘fractional node.’ Full nodes will devote all of their resources to a singular Elastic Sidechain, while fractional nodes will take part in many Elastic Sidechains (multitenancy).

After one node is formed, it is selected at random from a massive group of peer nodes within the network. Peers frequently evaluate node downtime and response time at specified intervals (e.g., five minutes) and finalize these batch processing statistics to the Skale Manager for each network epoch, which are now used to ascertain the node’s bounty compensation.

- Destruction of nodes

When leaving the networks, nodes should first announce their intention and wait for a finalization time. After the entire implementation period (e.g., 2 days), the node would be dormant and eligible to remove its original investment from the system.

Suppose a client cannot complete the full implementation time and immediately leaves a node out of the system. In that case, this will be recognized as a quasi (dead) node by SLA simulated subnodes, as well as the node’s reward will not be paid. It will subsequently be set to be removed from the chain.

- Creating an elastic sidechain

When establishing an Elastic Sidechain, customers choose the design of their link and compensate the Skale Manager for the period they want to rent networking resources to support their Elastic Sidechain.

To suit their organizational/financial needs, customers may choose Elastic Sidechains beginning with a baseline of 16 virtual subnodes, for each virtualized subnode consuming 1/128 (low), 1/16 (moderate), or 1/1 (high) of each network node resource. As the system evolves, users will be able to select the number of virtual subnodes, amount of signers, and volume of the virtual subnodes that will constitute their Elastic Sidechains.

At the moment, all assets in the system are of equal value, and the cost of using these assets is influenced by the size of a chain and its duration. The value of network capacity will be determined periodically as the system develops to cater to network infrastructure circumstances/system load.

After the Skale Manager receives a creation request, a novel Elastic Sidechain is established, and its associated endpoint is provided to the producer. Whether there are insufficient network capabilities to enable the construction of the required Elastic Sidechain, the trade will be aborted, and the client will be informed.

Shuffling of virtualized subnodes

As an additional security precaution, developers choose to activate virtual subnode scrambling when building an Elastic Sidechain. Shuffling is recommended to minimize collusion efforts by virtual subnodes inside each Elastic Sidechain and is enabled via the Skale Manager in the same way as node leaving is.

To prevent consumers from determining which nodes are allocated to respective Elastic Sidechains while constructing or scrambling, the Skale System requires that at least 30% of entire node resources be kept available to act as the networking virtual subnode verifier pool.

- Destruction of elastic sidechains

An Elastic Sidechain is destroyed when a customer’s rental payment for network services is spent or when a consumer flags the Elastic Sidechain for removal. Before the expiry of their lease deposit, the developer would be informed of their chain’s impending deletion and offered the possibility to maximize the chain’s lifespan.

When an Elastic Sidechain’s rental deposit is depleted, it may be destroyed using the SKALE Manager. Before paying the person who commissioned the chain’s demolition, the procedure will send any digital currencies originating from Ethereum to their owners on the mainnet, eliminate any virtual subnodes from the Elastic Sidechain, force a reboot of their storage and memory, and delete the Elastic Sidechain out from Skale Manager.

- Issuance of bounties

After every networking epoch, the necessary rewards and SKALE coins generated for that time are distributed evenly between all nodes active on the Network before the epoch’s start.

The amount of these granted tokens that each node may claim is determined by the overall mean of the metrics provided by 16 of its own 24 peers, with the top and lowest four statistics deleted to prevent conspiracy or malicious actions by peer nodes. Any token not delivered to nodes due to low uptime or delay will be sent to the NODE Trust.

SKALE Coin

The SKALE coin – SKL – is a flexible usage token that symbolizes the right to operate in the system as a validator, invest as a delegator, or use a portion of its assets as a developer by installing and hiring an Elastic Sidechain for just a length of time.

People pay SKL on a contractual basis to rent such assets (computation, storage, connectivity) in an Elastic Sidechain for a certain period. Auditors invest Skale further into the Network, gaining the ability to operate nodes and earn fees and coins via rising prices. Delegators may receive incentives by delegating their token to validators.

Distribution

- The total number of coins

a. Upon Network introduction, the total quantity of SKL coins is 4,140,000,000. The maximum supply of coins on the Network is 7,000,000,000.

- Allocation

a. The Validator Communities and Ecosystem received 34.3 percent of the allocation.

b. 25-28 percent given to System Supporters that buy Skale network coin before the Network Launch only to operate Validator Nodes, assigning or using Elastic Sidechains for commercial dApps. All are restricted for a duration of six to thirty-six months after the Network’s debut.

c. Approximately 7.7 percent is set aside to help Protocol Innovation for future funding and grant attempts to support services and contracts that would develop, expand, and maintain the Network.

d. 20% given to Network Producers and Developers with a 3-4 year investing term and a twelve-month lock. Both begin on the Network official launch, bringing the vest duration to 5-6 years depending on the Q3 2019 launch date. i.e., 16% to the broader core team and 4% to the Employee Coins Option Pool to guarantee continued network growth.

e. 10% given to the NODE Society. 10% allocated to the NODE Society. One hundred fifty million coins are generated at Genesis, and 550 million coins are generated at Month 6, with a 24-month activation schedule depending on significant accomplishments such as having a solid operating network and a distributed validator population running nodes.

f. a contribution of 2.5 percent to the community token ceremony

- Lock-ups and allotment plan

a. Tokens bought in previous SAFT cycles remain locked for a period of Nine to thirty-six months, according to SAFT contracts. The lock period begins when the Network becomes live.

b. The squad will be held for one year and will wear a vest for three to four years. The lock and vest phase begins with the Network’s debut.

b. The Foundation’s shares will mature over seven years.

- Inflation

Validator Incentives Method: Validator incentives will be issued after the first year at a rate of 9.3 percent of the total token quantity. The validator incentives percentage will cascade down for the first six years, then half every three years in perpetuity until the Network’s maximum number of tokens is achieved. Depending on economic research and community input, these figures may vary in the run-up to the Mainnet launch.

Faults and attacks

Skale has built several contingency plans for fault recovery at node and chain levels to accommodate network unavailability. These vary from a robotic agent to conduct node restoration to a security crisis management team accessible to all Elastic Sidechain administrators in the system.

- Crashes/Resets

During a reset, the restarting node becomes momentarily inaccessible – this appears to peer nodes appear as a temporally sluggish network link. Messages intended for nodes are sent following a reboot; this system permits a reset to occur without interrupting consensus functioning.

Suppose a node lacks general agreement status due to an equipment failure or a software fault that stops the node from being online. In that case, its peers will convey signals until their outgoing communication queues overflow, forcing them to discard earlier messages. Communications older than one hour are targeted for removal from message queues to minimize the impacts of this.

While a node is experiencing a hard reset, it is recorded as a Byzantine node for each decision round, enabling 1/3 of nodes to suffer a hard crash, causing consensus to stall and the blockchain potentially lose its liveness.

The lack of a new block will identify a catastrophic failure committed for a specific period. At this stage, a failure restoration protocol will be implemented, which will use Ethereum to lead to improvements in coordination. Nodes will pause their decision operations, sync respective blockchains, and decide on a time to resume consensus. Finally, nodes will begin agreement at an agreed-upon moment after a period of enforced quiet.

- Agent of catchups

A Catchup Agent operating on every node ensures that perhaps the node’s blockchain & block suggestion database remains in sync with the Network.

The catchup machine is constantly establishing random sync sessions with other nodes. Any node that discovers that it has a lower TIP ID than just its peer will acquire the outstanding blocks, check supermajority limit signatures on the received blocks, and dedicate them to its chain.

When a node re-enters the Network after a hard reset, it will instantly start this catchup process while still engaging in the decision for new blocks by receiving block proposals and selecting according to the consensus method but without submitting block proposals. This reaction is due to each block proposal needing the preceding block’s hash, and a node would only submit its block proposal for a specific BLOCK ID after the catchup process is complete.

Nodes that have suffered a severe crash will quickly participate in block proposals following re-syncing the chains if an agent is active on every node.

- Reactions to security incidents

Security is a primary need for any decentralized system, yet despite advances in crypto and computer programming, most security analysts agree that complete security is impossible to achieve. With all that in mind, engineers must focus on increasing the bar for the level of resources and funds needed to disrupt the system often as feasible.

Because the Skale architecture is built on Elastic Sidechains, a Skale security breach may compromise a specific Elastic Sidechain. A computer virus, for instance, might infect many nodes due to a flaw in the Linux kernel. In such a situation, the following is the standard procedure:

SIRT members are public security specialists chosen by Skale stakeholders and will earn a small stipend from the NODE Organization if elected.

A typical incident reaction would be to locate an intact node and clone its Elastic Sidechain information to a fresh, intact Elastic Sidechain. Once a fresh Elastic Sidechain is created, the consensus process will be resumed, and Elastic Sidechain users will be alerted. After completing the inquiry, SIRT will have the authority to reduce the service charges of violating nodes.

- Extensions

With such a network design and interface, various extensions may be readily implemented to increase the Network’s capability and usefulness. The first two have indeed been developed: improved File storage inside each node and a method for transmitting and processing messages across Elastic Sidechains.

- Storage

Skale has updated the current EVM to provide considerably greater file storage capacities and broaden possible use-cases. Changes that enabled this included larger block sizes (allowing for even more data in each block) and immediate access to every node’s file system via a file Storage executable smart contract.

Users in the Network may now divide files into 1 MB “chunks” and send them to the Storage smart contract to be stored contiguously on each node’s system. Files here on the Network may also be removed in a rent-style manner, allowing the Network to redistribute resources due to state bloat from increased storage capacity.

Communication among chains

Elastic Sidechains’ group signatures allow different Elastic Sidechains to authenticate that a block has indeed been signed and submitted on some other Elastic Sidechain, enabling the fulfillment of smart contracts and the movement of crypto-assets between Elastic Sidechains.

This method is made possible by a set of smart contracts just on the Ethereum mainnet, every Elastic Sidechain, and an agent operating on every virtualized subnode that is in charge of enabling these interchain communications.

Each Elastic Sidechain has a mailbox. Texts sent to other chains are held in the outbox until they have been picked up by a randomly chosen agent, who then sends a clear message to the suitable addressee chain’s inbox, along with any extra metadata that that chain necessitates to verify that the deal was used in the sender’s chain’s blockchain. Once confirmed on the recipient blockchain, the transaction will be sent to the target address / smart contract via an on-chain communication proxy.

In the particular instance of payment transactions from a parent blockchain (for example, Ethereum mainnet), a DepositBox is often used as a funds caching method and two-way peg, whereby vouchers are authorized against this aggregated value on every Elastic Sidechain and flexibly exchanged between attendees in the very same manner as exchanges. When weight is transferred across Elastic Sidechains, it is first erased on the sending chain before being created on the recipient chain to prevent double-spend attacks. This procedure is likewise followed for redemption transactions submitted to the Ethereum mainnet, which releases the locked capital in the deposit box.

SKALE Network (SKL) Price History

The current market price of SKL is $0.31, and SKL is presently rated #144 in the whole crypto industry, among the most recent statistics. Skale Network has a circulating quantity of 1,213,100,288 coins and a market capitalization of $375,591,732.

SKL’s cost has risen by 4.52 percent in the past 24 hours due to increased trading activity and market cap. Polygon (MATIC), SKALE (SKL), and SushiSwap (SUSHI) were the latest cryptocurrencies listed on Coinbase Pro. Following the announcement, these cryptocurrencies, especially MATIC and SKL, started seeing an exponential increase in market value

Lately, SKL is having difficulty gaining traction with the other digital currencies. The SKL has dropped to almost -0.17 percent in the past seven days. The SKALE token has been exhibiting risky framing segments over the last several days. Despite having solid fundamentals, the coin may not be a lucrative asset in the near run.

However, when the current price is compared to the previous 1-month price history, it is shown that the value of Skale Network has risen by 29.396 percent. The month’s average lowest price was $0.20, while the highest pricing was $0.22. This indicates that this token is a good asset and fresh addition to a long-term coin investment.

The price fluctuated between a minimum median price of $0.45 and a high median price of $0.49 in the last 90 days, resulting in a -31.12 percent price change. Skale Network has dropped by -53.95 percent in the previous four months, with the highest average cost of the coin being around $0.58 and the lowest average price being approximately $0.52.

Fundamental Analysis for SKL

SKALE Token (SKL) is just an ETH-based ERC-777 token aiming to boost ETH’s transaction throughput to about 2000 per second while lowering transaction prices. SKALE coins may be used by blockchain programmers to “rent” scalable separate sidechains on the SKALE System. It provides access to the entire Ethereum platform and may be used to develop and scale Ethereum-based services more effectively.

Because the SKALE network is based on the PoS algorithms, the SKL token is required for maintenance service. It enables one to select between being a validator and running a node that verifies blocks and therefore maintains the Network safe for profitability or being a delegator – a token owner who “outsources” his tokens to validators to be used for their job in exchange for a lesser return. Take note of the Network’s reliance on the delegation mechanism: the ERC-777 token standard, rather than the more common ERC-20, is utilized since it allows for token-level delegation (it permits the transfer of a public key and not the coin itself).

SKALE also has several exciting features which make investing in it a good idea, such as the validator node shift mechanism, which assists in reducing the possibility of conspiracy and fraud. Another noteworthy aspect is the availability of a subscription model for providing developers with sidechains for particular applications. Rather than changing gas costs like other Level 2 Ethereum-based services, Skale allows developers to use its resources for a set charge paid in tokens upfront (SKL).

Even though this initiative is young and relatively undiscovered, the technologies utilized by this Network are seen to be very promising and are backed by industry leaders at all levels. It is plausible to anticipate long-term development with such a robust technical basis as more individuals join the Network. Its names show this: Skale is backed by established players, including Winklevoss Capital, Spartan, and others.

Furthermore, on a pretty philosophical note, the main targets of the SKALE creators of increasingly widespread use of blockchain systems and decentralization, in general, would be a “positive” for someone who believes in the same type of future.

How to Buy SKL

- Step 1: Create an account on an exchange that supports Skale (SKL)

First, you will need to open an account on a cryptocurrency exchange that supports SKALE (SKL). You may try the following exchanges based on functionality, reputation, security, support, and fees:

- Step 2 – Deposit funds into your account

Many cryptocurrency exchanges will allow you to purchase SKALE (SKL) with fiat currencies, such as EUR, USD, AUD and others. Furthermore, they will also provide you with multiple deposit methods through which you can fund your fiat account, such as credit and debit cards, e-wallets, or direct bank transfers.

- Step 3 – Buy Skale (SKL)

This process is similar across almost every cryptocurrency exchange. You must find a navigation bar or a search bar, and search for SKALE (SKL) or SKALE (SKL) trading pairs. Look for the section that will allow you to buy SKALE (SKL), and enter the amount of the cryptocurrency that you want to spend for SKALE (SKL) or the amount of fiat currency that you want to spend towards buying SKALE (SKL). The exchange will then calculate the equivalent amount of SKALE (SKL) based on the current market rate.

Skale Technical Analysis

Skale Network technical analysis reveals the digital currency has been following a declining trendline since 15th August 2022. The Skale network reached a high of $0.071 over the last month, and since then, the digital asset has been making lower lows and lower highs. This month of September, SKL reached a high of $0.0512, and since then, it has retraced to lows of $0.04769.

The current market conditions are ripe for a bearish move as the Relative Strength Index is oversold and the price is trading below the moving averages. The next support levels to watch out for are $0.046 and $0.044. A break below these levels could see SKL extend its losses to $0.042. On the other hand, if the digital asset manages to hold above $0.047, it could see a move back to $0.0512.

The moving average convergence divergence (MACD) histogram is also in the negative territory, further confirming the market’s bearishness. The market will likely follow this declining channel before a breakout to the upside or downside can be expected.SKL is moving within the channel. Chances of reversal Low-Mid. Possibility to test previous support now resistance level or even an upper trend line.

To summarize our SKL price analysis, the digital asset is set to continue declining in the near term as the technical indicators are all bearish. However, a break below $0.046 could see it extend its losses to $0.042, while a move above $0.0512 could see it retrace back to highs of $0.0571.

Skale Price Predictions by Authority Sites

Digitalcoin price

The price of SKL is anticipated to surpass the level of $0.0633, according to the predictions by DigitalCoinPrice. The Skale Network is anticipated to reach a minimum price of $0.0614 by the end of the year. Additionally, in their SKL price predictions, SKL might rise as high as $0.0670. The Skale Network is anticipated to attain a minimum price of $0.24 by the end of 2027.

Additionally, the price of SKL might increase to a maximum of $0.25. In 2030, it is expected that the price of Skale Network will range between $0.70 and $0.73. The average forecast trading price for 2030 is $0.71.

TradingBeasts

According to TradingBeasts, despite the challenging nature of the year, a lot may happen in the next three months. Their Skale network forecast that SKL would stabilize and reach $0.29 per token by the end of 2022. By the end of 2027, they believe that SKL should be worth up to $0.985. Cryptocurrencies are expected to go mainstream by 2030. Towards the end of the year, SKL is forecasted to be worth up to $1.970 per token.

Price Prediction net

Price Prediction net anticipates SKL to attain a minimum value of $0.051 in 2022 with an average trading price of $0.021, the SKL price may have a maximum value of $0.053. By the end of 2027, they predict an average value of $0.52, a minimum of $0.50, and a maximum of $0.59.In 2030, the price of Skale is anticipated to be at least $1.49.The average trading price forecast is $1.54 in the year 2030 while the maximum price is likely to be $1.86.

Cryptopolitan

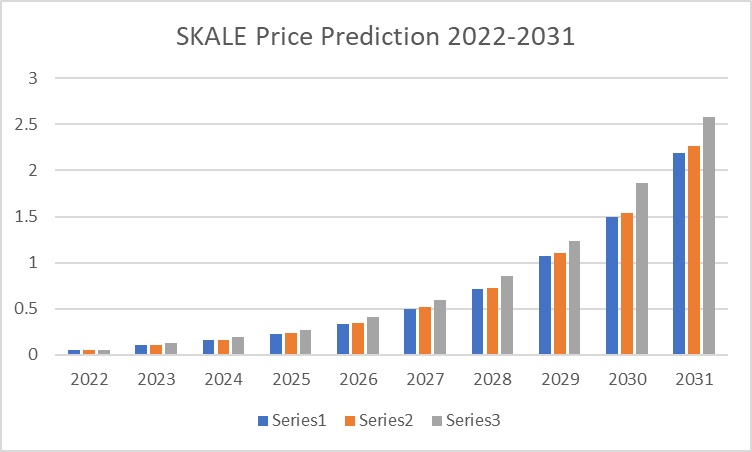

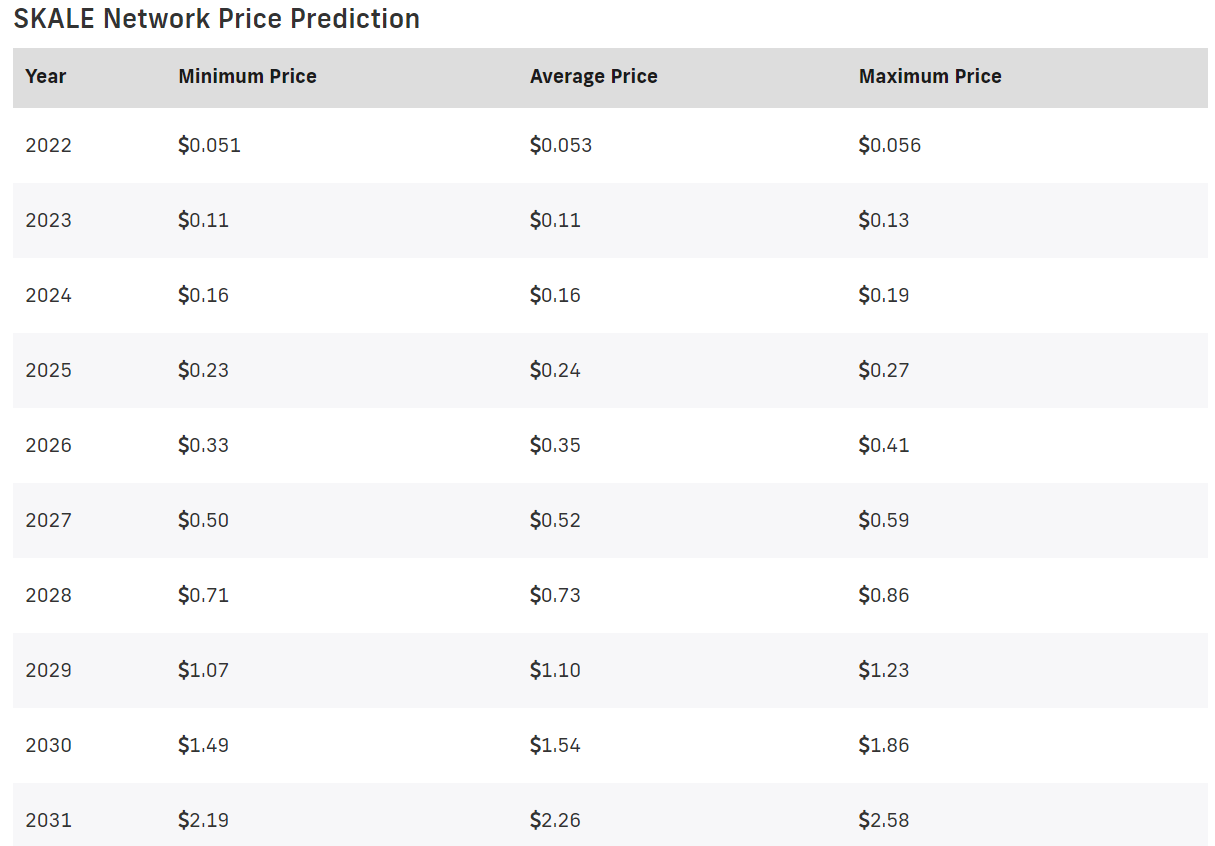

Skale Price Prediction 2022

By the end of 2022, SKL is predicted to have a minimum price of $0.051 and a maximum of $0.056. The average price for the year is expected to be $0.053.

Skale Price Prediction 2023

Skale is anticipated to reach a maximum trading price of $0.13 and a minimum value of $0.11. The average forecast price for SKL is expected to be $0.11 by the end of the year.

SKALE Price Prediction 2024

SKL is expected to attain a maximum price value of $0.19 by 2024. The Skale network coin forecast suggests the average price for 2024 is $0.16, while the minimum forecast price is $0.16.

Skale Price Prediction 2025

Skale price forecast for the year 2025 indicates the digital asset will be on a bullish trend and may reach a maximum price value of $0.27. The average forecast price might be $0.2, while the minimum price of $0.23 is also possible in 2025.

Skale Price Prediction 2026

The long-term Skale Network price forecast is bullish as the predictions for 2026 suggest that the digital currency could reach a maximum price level of $0.41 while the minimum price is expected to be $0.33. An average trading value of $0.35 is expected before the end of 2026.

SKALE Price Prediction 2027

In the year 2027, SKL is expected to attain a minimum price of $0.5.SKL is expected to reach $0.59 as the highest price while the average price forecast is $0.52.

Skale Price Prediction 2028

In 2028, the price of Skale Network cryptocurrency is anticipated to reach a minimum price value of $0.71. An average trading price of $0.73 is also expected before the end of 2028.SKALE might potentially reach a maximum price level of $0.86.

Skale Price Prediction 2029

Skale is expected to enter 2029 on a bullish note as the digital currency might reach $1.10 as the maximum price. SKALE could potentially retrace to a minimum price of $1.10, while the average price is expected to be $0.987 before the end of 2029.

SKALE Price Prediction 2030

The long-term Skale Network price prediction for 2030 is bullish as the digital asset might potentially attain a maximum price of $1.86. The minimum value that could be reached is $1.49, while the average price is expected to be $1.54.

SKALE Price Prediction 2031

In the year 2031, Skale is expected to reach all-time high prices as the maximum price is anticipated to be $2.58. The average and minimum prices are forecasted to be $2.56 and $2.19.

Skale Price Predictions by Industry Influencers

Market analysts and influencers have given their own Skale Network price predictions. Analyst and crypto trader Jacob Crypto Bury predicted that the price of SKL will reach $0.05 in 2020, $0.1 in 2021, and $0.2 in 2022. Another Youtuber who goes by the username Tyler Murray has given a long-term price prediction for SKL. He believes that digital currency’s price will reach $1 by 2025.

AI Crypto news provides a Skale price forecast and suggests it will average at $0.34 in 2023.

Conclusion

Skale Labs is building on the core values of Ethereum and at the same time bringing in some strong features. Zero fees for instance will be a game-changer for interacting with Eth2.0. While the team works on developing Skaleverse, avoiding friction with Oracles remains a challenge. In the long run, Skylabs is working on bringing in more features such as Skale hubs that will help ensure the smooth running of the Skale network alongside other smart contracts on Ethereum.

Skale is down over 80% in crypto winter, and analysts agree that it is difficult to tell when the price will reach its bottom. Despite the loss of value, Skale has utility and is arguably trading at a significant discount in the cryptocurrency market.

Skale envisions the future of a sustainable Web3. It is highly scalable and decentralized with zero cost to the end user. Skale is gradually stealing Ethereum’s market share with a growing count of smart contracts and dapps deployed. Skale will start recovering in 2023 and will average at $2.57 in 2031. The Skale native token is expected to be bullish from 2023 to 2031; negative news could derail the upward trend.

The next years might be quite challenging for Skale as the global economy is expected to face several headwinds. However, the long-term prospects for digital currency look quite promising as a lot of institutional investors are showing increasing interest in cryptocurrencies. Moreover, the halving event is also expected to impact the price of SKL positively. Therefore, it would not be surprising to see Skale attaining new all-time highs in the years to come

The Skale team has embarked on increasing participants and dAPPS on its blockchain by introducing learning and incentive programs. This will build the value of the Skale blockchain long-term.