Coinspeaker

Solana DEX Volume Jumps to 28.5%, Getting Closer to Ethereum

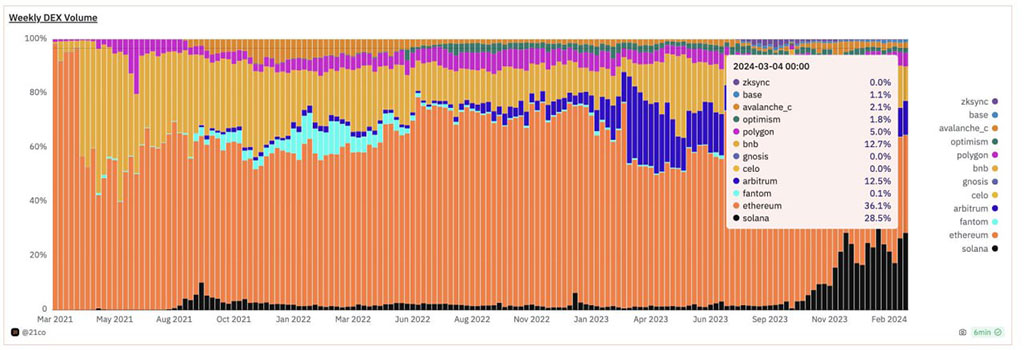

Solana’s (SOL) nickname, “Ethereum Killer”, is coming closer to reality, especially on the DEX (decentralized exchange) volume surge. On the weekly chart, Solana commanded 28.5% of total DEX volumes, as Ethereum (ETH) dominated at 36.1%. BNB Chain and Arbitrum followed closely at around 12%.

Photo: Dune Analytics

Solana has recorded impressive growth in DEX volumes as more projects set shop on the network. A year ago, the network accounted for 1.1% of the DEX market share compared to Ethereum’s +50% dominance, as noted by Tom Wan, an on-chain data and research strategist at 21Co (21Shares parent company).

Solana's Impressive Growth in DEX Volume

Solana today owns 28.5% of the total DEX Volume while Ethereum owns 36.1%

1 Year ago, Solana only had 1.1% marketshare and Ethereum had 50%-70%

Leading DEXs on Solana like @orca_so, @RaydiumProtocol and @MeteoraAG also grown a lot in… pic.twitter.com/HEZFEce9gv— Tom Wan (@tomwanhh) March 6, 2024

Solana-based DEXs like Jupiter (JUP) have been a smash hit since its debut, attracting massive traffic. Other top DEXs on Solana include Orca, Raydium, and Phoenix, each driving +$1.5B trading volumes in the past seven days, per DefiLlama data.

Solana recorded about $15B in DEX volume in the past seven days, translating to a +153% weekly change. The top DEXs surged triple digits based on changes in weekly volumes.

Photo: DeFiLlama

Over the same period, Ethereum DEX volume hit $20.7B, translating to around +55% weekly change. Top DEXs on Ethereum, like Uniswap and Curve Finance, posted impressive results. But the weekly change for its major DEXs was double digits per DefiLlama data. This meant Solana’s weekly DEX volume surged 3X compared to Ethereum’s.

How Solana’s DEX Growth Impacts the Market

Put differently, Solana’s traction increased in the DEX space and seems to have eaten part of Ethereum’s market share. The network was developed to address Ethereum’s scalability and speed issues.

Solana’s lower fees and faster transactions have attracted more users and projects. The traction is also a magnet for more investors.

However, the surge in volume on Solana tends to affect it too. For instance, on March 6, the Binance Exchange opted for intermittent suspension of withdrawals on Solana, citing a spike in transaction volumes on the network.

In the meantime, Ethereum is gearing toward significant upgrades to address scalability, speed, and cost issues. It remains to be seen if the upgrades will give it more leverage on the DEX volume against Solana.

Solana DEX Volume Jumps to 28.5%, Getting Closer to Ethereum