Can SOL sustain the momentum after breaking above a 23-month high? Decentralized application volumes surged, but there’s a catch.

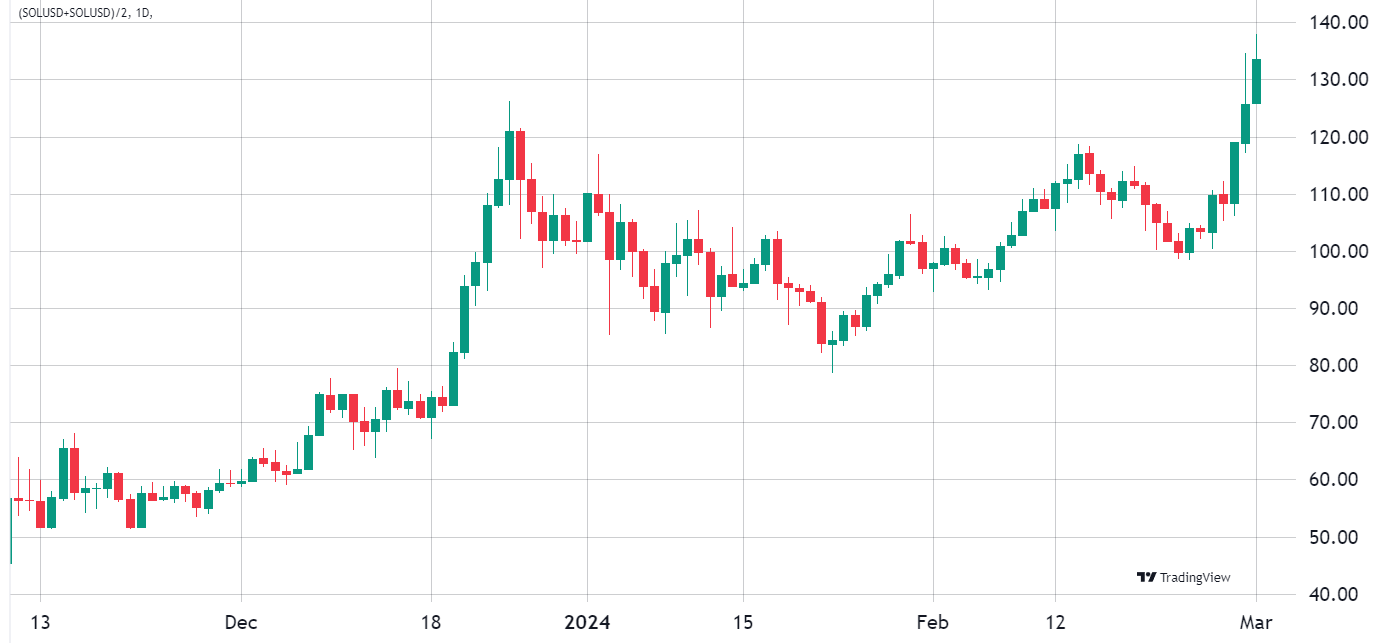

Solana’s native token, SOL (SOL), hit its highest point in 23 months on March 1 and is currently trading up 34.5% in one week. While Solana maintains its position as the fourth-largest cryptocurrency, excluding stablecoins, it has been narrowing the gap with the third-place competitor, BNB (BNB). The key question is: What fueled SOL’s rally, and, critically, can this outperformance compared with competitors be sustained?

SOL’s price had been attempting to solidify the $100 support over the past couple of months. Therefore, it would be inaccurate to claim that the bull run commenced before Feb. 23. In reality, SOL experienced a modest 2% increase between Dec. 23, 2023, and Feb. 23, 2024, whereas Ether (ETH) witnessed a 25.5% uptick during the same period, and Tron (TRX) achieved gains of 31.5%. Essentially, whatever triggered the decoupling in favor of SOL occurred in the past week.

In addition to the substantial gains on SOL, a few Solana SPL memecoins saw a notable surge in demand in the past week. Bonk recorded a 110% increase since Feb. 23, while DogWifHat (WIF) experienced a significant rally of 250% during the same period. It’s worth noting that this trend wasn’t confined to Solana network tokens alone, as Dogecoin (DOGE) and Shiba Inu (SHIB) also registered gains of around 51% since Feb. 23. However, it is likely that some of this demand spilled over from these popular tokens, impacting SOL, as traders sought gains on decentralized exchange (DEX) listings.