Solana price analysis continues to show a bearish sight, as price trods along a horizontal trend that was set on November 24, around the $13.5 mark. Over the past 24 hours, SOL price jumped as high as $14.42, before receding back to $14.00 at the time of writing. As SOL trades sideways, buyers are expected to wait until price pushes past the immediate resistance at $14.86 before committing. SOL volume has been observed to be on the downside over the course of the horizontal trend, and must improve before price can be pushed up.

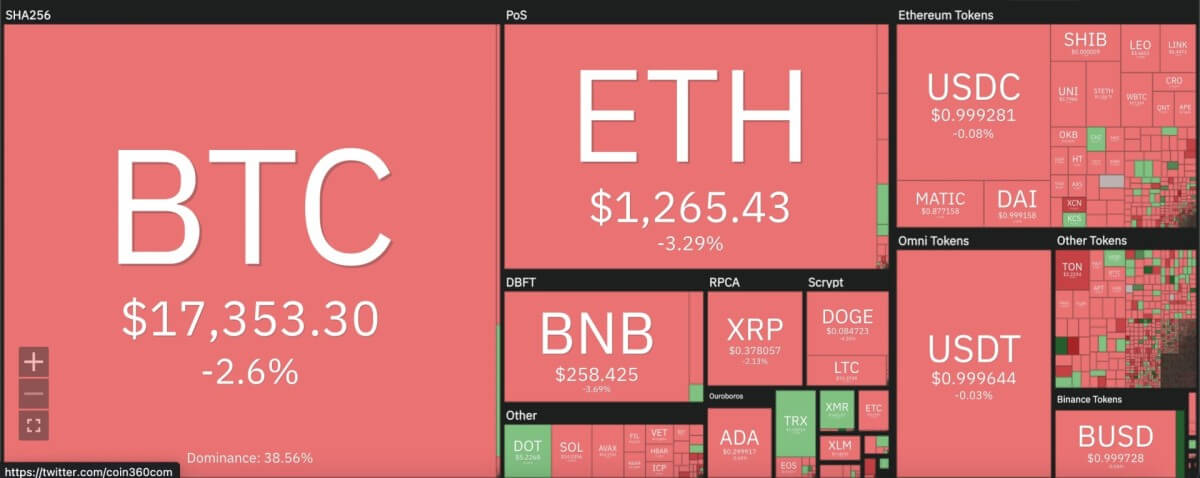

The larger cryptocurrency market showed downtrends across the board over the past 24 hours, as Bitcoin moved down by 3 percent to stay just above $17,000. Ethereum also lowered 3 percent, to move down to $1,200, while leading Altcoins mimicked the downtrend. Ripple dropped 2 percent to sit at $0.37, whereas Dogecoin lost 4 percent in price to move down to $0.08. Cardano also dropped 2 percent to move as low as $0.29, while Polkadot stabilised around the $5.2 mark.

Solana price analysis: RSI shows similar sideways pattern to price on daily chart

On the 24-hour candlestick chart for Solana price analysis, price can be seen extending along a sideways trend without much hint of a breakout over the past 20 days. Combined with low volume, SOL price moved below the 9 and 21-day moving averages, along with the crucial 50-day exponential moving average (EMA) at $13.98. Solana trading volume dropped another 38 percent over the past 24 hours, highlighting the stagnancy in the market for the coin.

The 24-hour relative strength index (RSI) shows a parallel movement to price in moving sideways around the early 40’s, further suggesting of the lack of progression in price. Buyers would be looking out for increased consolidation up to the $15 mark before further investment in SOL. Meanwhile, the moving average convergence divergence (MACD) curve shows a parallel move against the neutral zone, also reminiscent of the sideways trend in price.

Disclaimer. The information provided is not trading advice. Cryptopolitan.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.