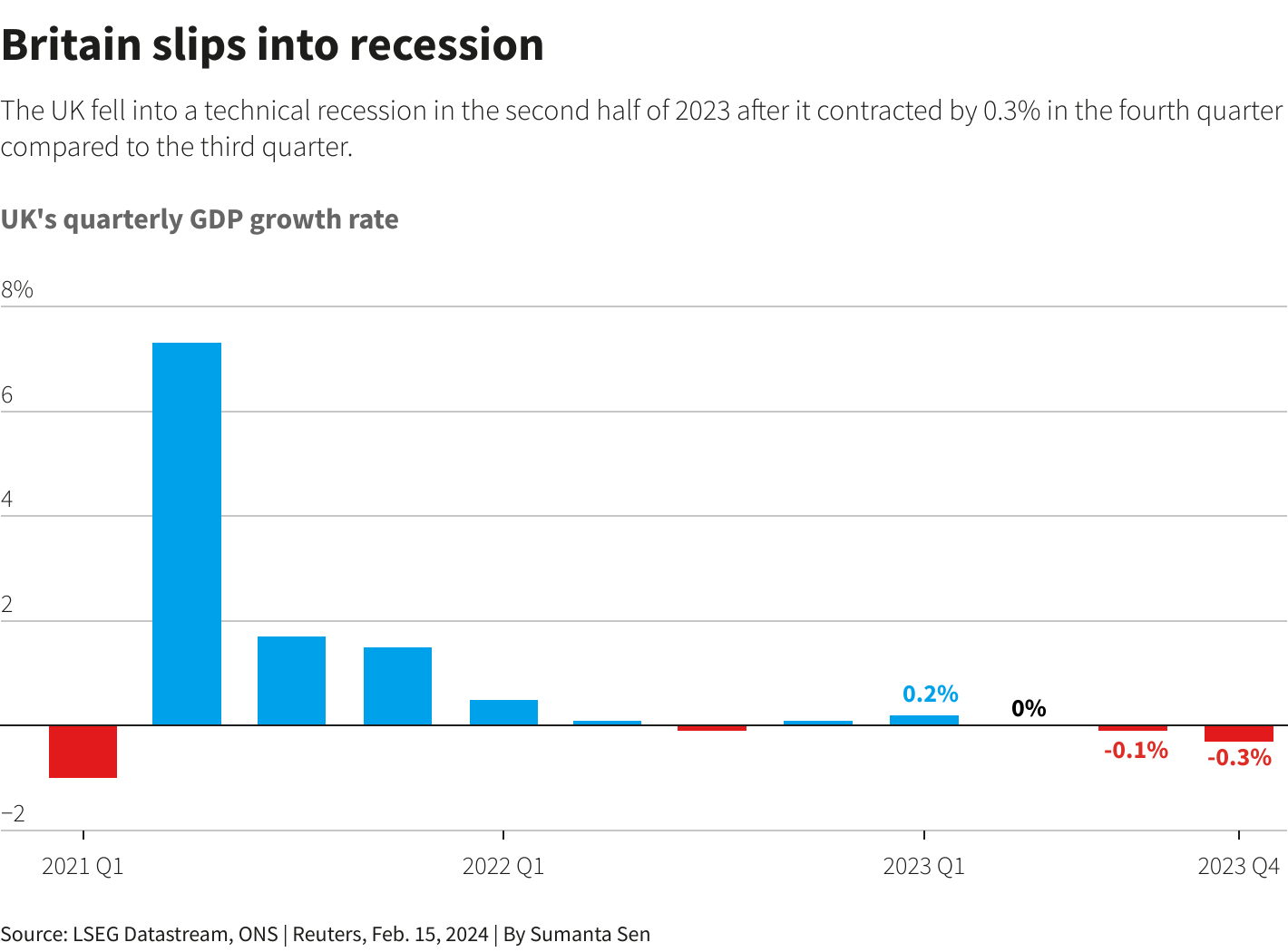

Well, slap my face and call me shocked—the UK’s economy didn’t just stumble on a pebble; it apparently face-planted right into recession territory as of the tail end of 2023. With all the grace of a bull in a china shop, the UK managed to clock in a GDP shrinkage of 0.3% in the last quarter, following a dainty 0.1% decline in the third. For those not in the know, two back-to-back quarters of negative economic growth is what the big brains call a “technical recession.” And guess what? We’re officially in one.

The Devil in the Details

The number crunchers and crystal ball gazers over at Reuters were betting on a modest 0.1% contraction for the final quarter. The reality, however, was a cold slap of 0.3% contraction, courtesy of the Office for National Statistics (ONS). It’s like expecting a sprinkle and getting a monsoon instead. December decided to join the pity party with a 0.1% output dip, proving the economists’ gloomy 0.2% contraction forecast wrong, but not in a way that calls for celebration.

The pound, perhaps sensing the mood, took a nosedive against the dollar and the euro faster than a contestant on a weight-loss reality show. This marked the UK’s economy’s most dramatic performance since early 2021, and not the kind you’d give a standing ovation for.

In the face of this economic soap opera, the British Chambers of Commerce chimed in, suggesting the government might want to perk up and smell the urgency. Meanwhile, Finance Minister Jeremy Hunt is out here trying to put lipstick on a pig, talking up tax cuts and stronger economies like they’re just around the corner.

Amid the UK’s recessionary backdrop, the focus also intensifies on the public sector’s role in navigating this economic turmoil. Notably, the contraction has spotlighted the critical issue of underinvestment in key areas such as healthcare, education, and infrastructure. Research fellow Pranesh Narayanan from the Institute for Public Policy Research has criticized the government’s approach, highlighting a stark lack of progress despite promises to rejuvenate economic growth. This underinvestment has been described as creating a “crumbling public realm” and exacerbating the economic downturn.

Meanwhile, Across the Pond

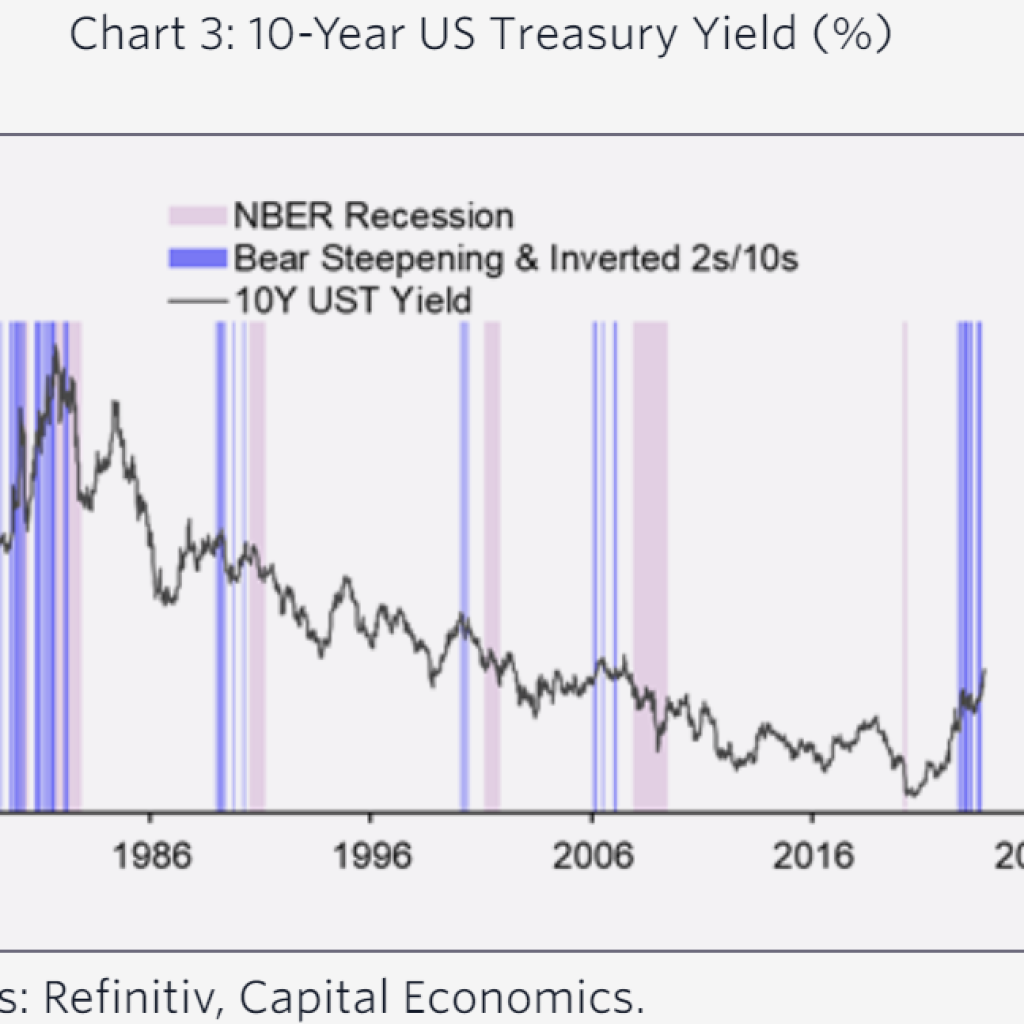

Now, don’t think it’s just the UK sitting in the economic mud pit alone; the European Commission decided to join the “lowered expectations” club by revising down its growth forecasts for the EU and eurozone. Thanks to higher interest rates doing a number on economic activity, they’re now looking at a growth spurt of 0.8% and 0.9% respectively, which is about as exciting as watching paint dry.

Inflation in the eurozone is expected to cut back to 2.7% from a thrilling 5.4% in 2023, which is a bit like saying you’ve gone from being punched in the face to being slapped—it still hurts, but less. Christine Lagarde of the ECB played the cautious card, hinting at rate cuts with all the commitment of a politician pre-election.

To sum it up, the UK’s dive into recession is as welcome as a skunk at a garden party, with economic growth acting more like a mythical creature than a reality. The government’s playbook of tax cuts and austerity feels about as reassuring as a band-aid on a bullet wound. As for the broader European economic landscape, it’s a mixed bag of cautious optimism and bracing for impact.