Uniswap price analysis indicates UNI prices opened the daily chart trading as low as $6.06 and continue to trade in a bearish trend. After the recent market-wide sell-off, the cryptocurrency has not been able to find any buyers at higher levels and has slipped below the $6.00 level. The bears have taken control of the price action and are pushing prices lower. The next level of support is present at $5.97 and a move below this level could see prices testing the $5.80 support level.

UNI/USD 1-day price chart: Bearish wave extends as price steps to $6.06 low

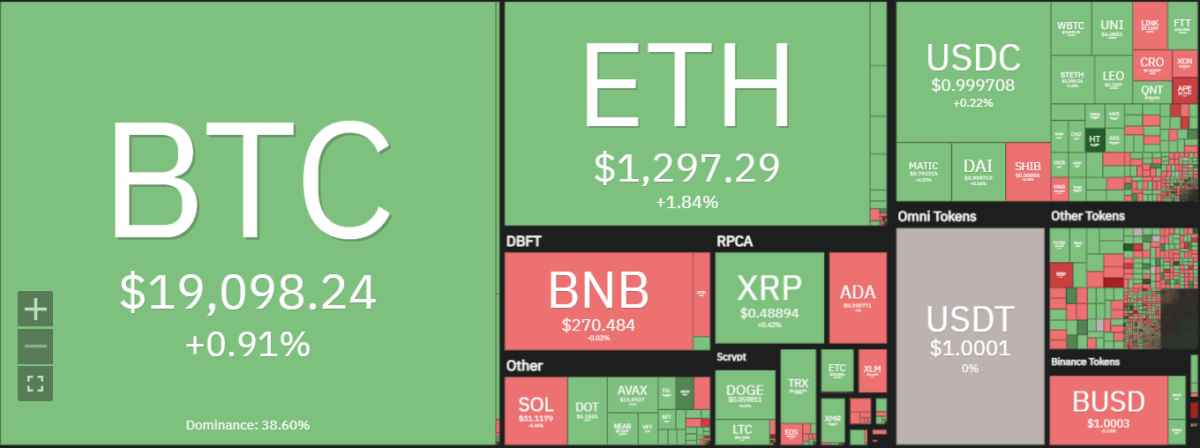

Uniswap price analysis indicates UNI prices have been trading between a range of $5.97 to $6.17 and the prices have declined by 2.74 percent in the past 24 hours. The digital asset has a market capitalization of $4.67 billion while the total trading volume sits at $91 million. The digital asset has a market dominance of 4.19 percent as the digital asset ranks position 18 overall.

The moving averages are all trending lower and the 20-day moving average has crossed below the 50-day moving average, which is a bearish sign. The MACD indicator is also giving oversold readings, which suggests that the bulls might make a comeback soon. The RSI indicator is also in the oversold territory and a move back above 50 could see prices retesting the $53.81 level.

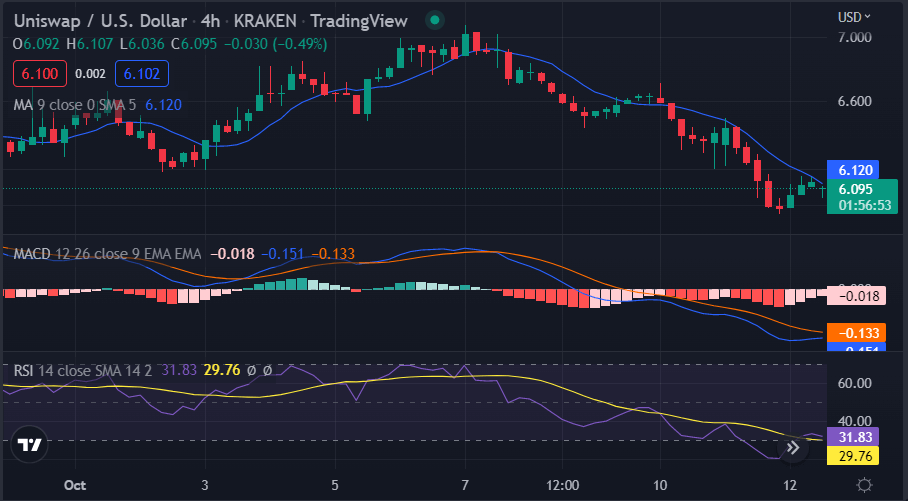

Uniswap price analysis on a 4-hour price chart: UNI/USD faces rejection at $6.17

The 4-hour chart shows that the prices have declined to $6.06 after a bearish spell. The market has faced a strong sell-off and the prices have not been able to find any buyers at higher levels. The next level of resistance is present at $6.17 and a move above this level could see prices testing the $6.20 level.

The MACD indicator is bearish and the RSI indicator is also in the oversold territory, which suggests that the sell-off might continue in the near term. The 50-day moving average is currently at $6.12 and the 200-day moving average is at $6.09, which indicates that the digital asset is in a long-term bearish trend. The digital asset will need to move back above the 200-day moving average to signal a change in trend.

Uniswap price analysis conclusion

Uniswap price analysis shows bearish momentum with strong possibilities of further decline in its price in the coming hours. The bears have captured the market. If the bulls fail to strike back soon, the bears will engulf the market for the long term. However, since the bears show massive potential, they can have a chance to consume the market entirely, but if the price breaks the support. Then, the market dynamics might be shifted in the bulls’ favor.

Disclaimer. The information provided is not trading advice. Cryptopolitan.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.