Uniswap price analysis for today indicates that the bears have taken control. The UNI/USD pair has dropped to its current level of $5.02 after hitting a high of $5.13. The sudden plunge in price is attributed to increased selling pressure from investors, which is pushing the price lower and lower. The selling pressure has been so strong that Uniswap’s support level at $5.00 was broken.

The next level of support for Uniswap is located at $4.90, which is around 1.41% lower than the current price. If UNI/USD pair continues to drop and breaks through this support level, it could see an even bigger decline in its price. On the upside, UNI/USD pair needs to break through the $5.13 resistance level in order for it to move higher and regain some of its lost value.

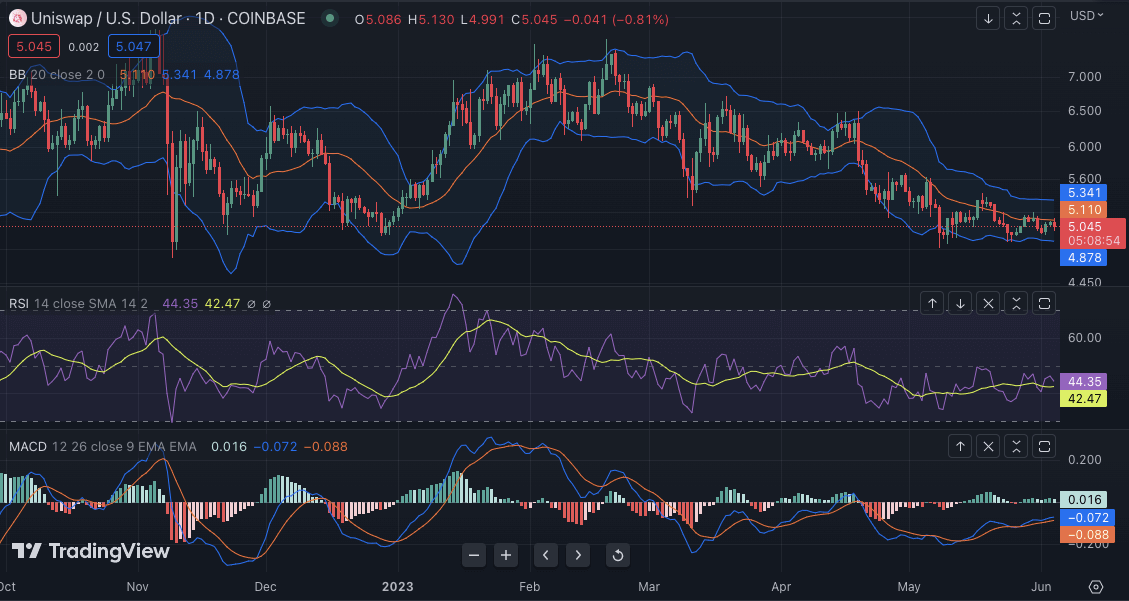

Uniswap price analysis 24-hour chart: UNI extends the losses

Uniswap price analysis of the 24-hour chart reveals that the selling pressure is getting stronger as the day progresses. The decline in price action has been gradual, indicating that the market could remain rangebound for some time yet. The previous day the bullish sentiment had taken hold, with the UNI/USD pair jumping above $5.55. However, in the past 24 hours, the bears have taken hold and pushed the price lower.

The RSI indicator is also indicating a bearish trend, with the current reading at 44.35 points. This suggests that Uniswap could continue to decline in value over the coming days if the bears remain in control. The MACD histogram is also pointing towards an extended downtrend, with a negative divergence in the signal line. The Bollinger bands are starting to narrow, indicating a decrease in volatility. The upper Bollinger band is located at $5.34, and the lower Bollinger band is at $4.87.

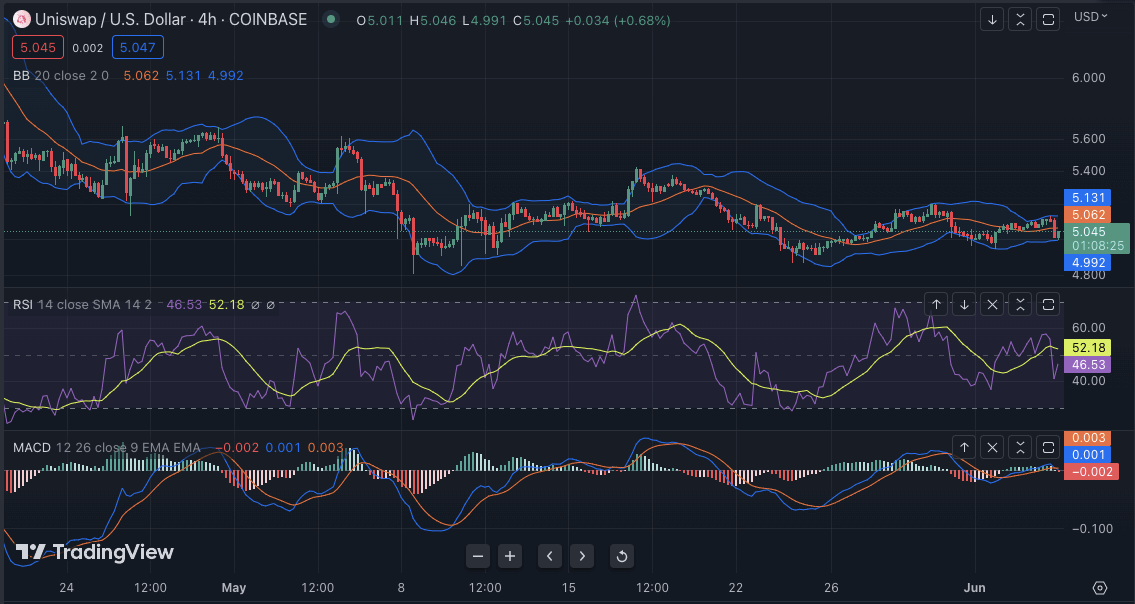

Uniswap price analysis 4-hour chart: Bears continue to dominate

Uniswap price analysis of the 4-hour chart reveals that the bears are still in control over the UNI/USD pair. The 4-hour chart shows a series of lower highs and lower lows, indicating an extended bearish trend. The bulls may try to gain control of the pair in the near term, but they have a tough task ahead if they are to turn things around.

The relative strength index is currently at 46.53 points, suggesting that the bearish momentum could remain in play for some time. The moving average convergence divergence shows a negative divergence in the signal line, suggesting that the downtrend could continue. The upper Bollinger band is located at $5.13, and the lower Bollinger band is positioned at $4.99.

Uniswap price analysis conclusion

Overall, Uniswap price analysis shows that the bears are firmly in control of the UNI/USD pair. The selling pressure is increasing, and the pair has broken through its support level at $5.00. If this downward trend continues, Uniswap could see further losses in value over the coming days. On the upside, bulls need to break through the $5.13 resistance level if they are to gain some momentum and push prices higher again.