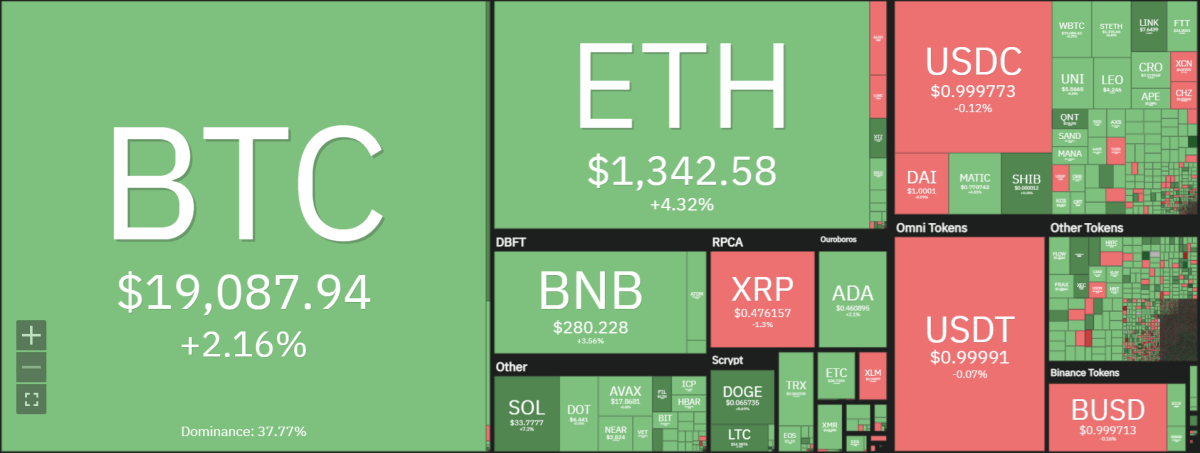

24th September weekly crypto price analysis finds Bitcoin started the week on a strong note, climbing above the $19,000 psychological level. BTC/USD reached an intraday high of $19,110 but faced rejection and pulled back below $19,000.The second largest cryptocurrency, Ethereum started the week in a firm bearish mood. ETH/USD failed to capitalize on the recent positive momentum and dived below the $1,400 level.ETH is currently in a recovery mode and it is trading above the key $1,300 level.

The weekly chart for XRP/BTC shows that the bulls have been in complete control since early September as they pushed prices from the $0.25 low to the current level of $0.4965.The top gainers of the week are SHIB, DOGE, and QNG while the CHZ coin is the biggest loser. The general market looks bullish with a lot of potential for growth in the near term.

Weekly Crypto Price Analysis: Bullish Sentiment Continues as BTC, ETH, and SOL prices surge

The weekly crypto price analysis indicates the market is currently trading green for the last 48 hours and over the weekend this sentiment is expected to continue. The total market cap has surged by a significant value and it is currently at $944 billion. We will discuss the top performers of the past week and what is likely to happen as we enter another week.

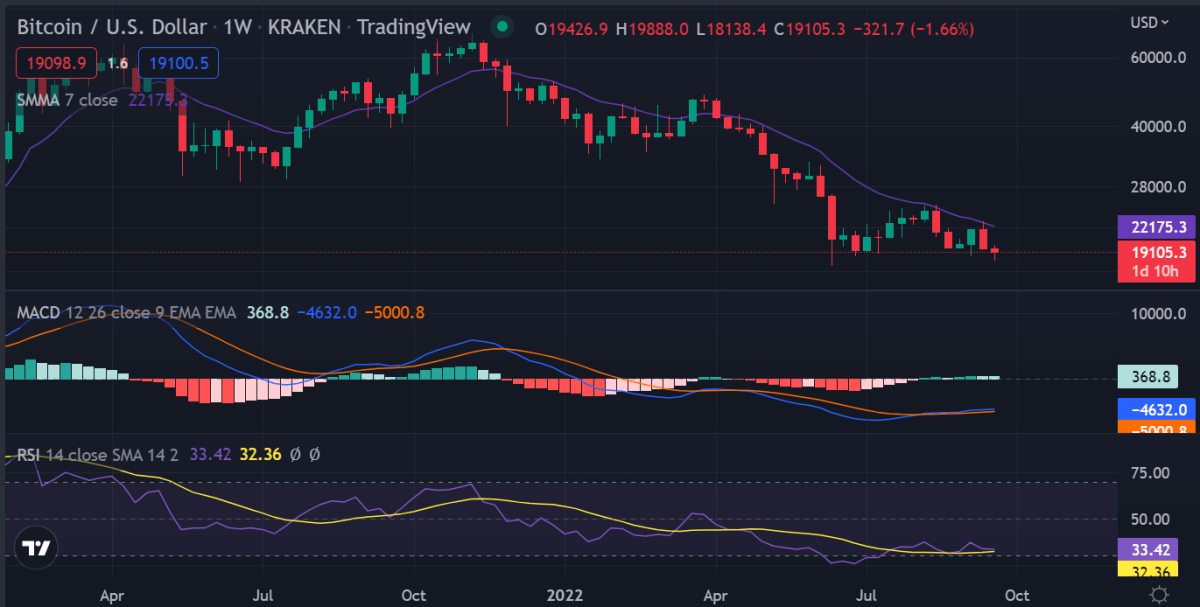

BTC/USD

Bitcoin (BTC) started the week on a strong note, climbing above the $19,000 psychological level. BTC/USD reached an intraday high of $19,110 but faced rejection and pulled back below $19,000. The world’s largest cryptocurrency by market capitalization found support near the $18,600 level and it started a fresh increase. There was a break above the $18,850 level and the price even spiked above the $19,000 resistance area. However, BTC failed to gain traction above $19,100 and it started another downside correction. The price corrected below the 23.6% Fib retracement level of the recent wave from the $18,532 swing low to the $19,102 high.

More importantly, there was a break below a key bullish trend line with support near $18,950 on the hourly chart of the BTC/USD pair. The pair even spiked below the $18,800 level and tested the next major support at $18,600. At the outset, there is a key bearish trend line forming with resistance near $18,950 on the same chart. If there is an upside correction, the price could struggle to climb back above the $18,950 level and the 100 hourly simple moving average. The main resistance for a sustained upward move is near the $19,100 area.

ETH/USD

The second largest cryptocurrency, Ethereum started the week in a firm bearish mood. ETH/USD fell in a continuous downtrend below the $1,400 level and even spiked below the key $1,350 support area. ETH failed to stay above the 100 hourly simple moving average and it dived towards the next major support at $1,300. A swing low was formed near $1,302 and Ethereum started a fresh increase. There was a close above the $1,350 level and the 23.6% Fib retracement level of the recent decline from the $1,422 high to the $1,302 low.

However, Ethereum’s price struggles to gain strength above the key $1,400 resistance area. There was also a failure to break the 50% Fib retracement level of the recent decline from the $1,422 high to the $1,302 low. The main resistance is near the $1,415 area, above which ETH could start a solid upward move in the coming sessions. On the downside, initial support is near the key $1,350 level. If there is a bearish break below the $1,350 level, Ethereum’s price is likely to accelerate lower towards the $1,300 zone. The major technical indicators are pointing to bullish sentiment. Meanwhile, the RSI, MACD, and CCI are well above the 50 levels.

XRP/USD

The weekly chart for XRP/USD shows that the bulls have been in complete control since early September as they pushed prices from the $0.25 low to the current level of $0.4965. There was a sharp increase in buying pressure above the $0.3500 level, which resulted in a sharp upsurge. The bulls even managed to push prices above the $0.40 resistance and the 100-day simple moving average (SMA). There was also a break above the key $0.44 resistance area and prices hit an intraday high of $0.4965 on September 17th.

However, prices failed to sustain gains above the $0.50 level and started a sharp downward move. Prices corrected below the 23.6% Fibonacci retracement level of the recent upsurge from the $0.3513 low to the $0.4965 high. There was also a break below a key bullish trend line with support near $0.4650 on the 4-hours chart of the XRP/USD pair. The price even fell below the $0.45 support area and tested the next major support at $0.4400.

At the moment, the bulls are defending the key $0.4400 support area and they are likely to make another attempt to push prices above the $0.4650 resistance area. If they succeed, there could be a sharp increase in buying pressure and prices might even reclaim the $0.5100 level. The main support is now near the $0.4400 level, below which ripple’s price could extend losses towards the last swing low of $0.3513. The major technical indicators are currently placed nicely in bullish territory.

SOL/USD

The weekly crypto price analysis indicates Solana has made higher highs and higher lows for the past two weeks as it trades above $34.0. These developments suggest that buyers are in charge of price action, pushing prices from the $30.0 low to the current high at $34.17. There was a sharp increase in buying pressure above the 23.6% Fibonacci retracement level of the upward move from the $30.0 low to the $32.21 high. The price even broke the key $33.00 resistance area and climbed towards the next major resistance at $34.17.

Solana is among the top gainers as a clear uptrend has been seen in the past few sessions. The bulls are currently aiming for a break above the $34.17 high, which could open the doors for a move towards the $35.00 and $36.00 levels in the near term. The technical indicators are currently in bullish territory and they are likely to support a continued rise above the $34.17 high.

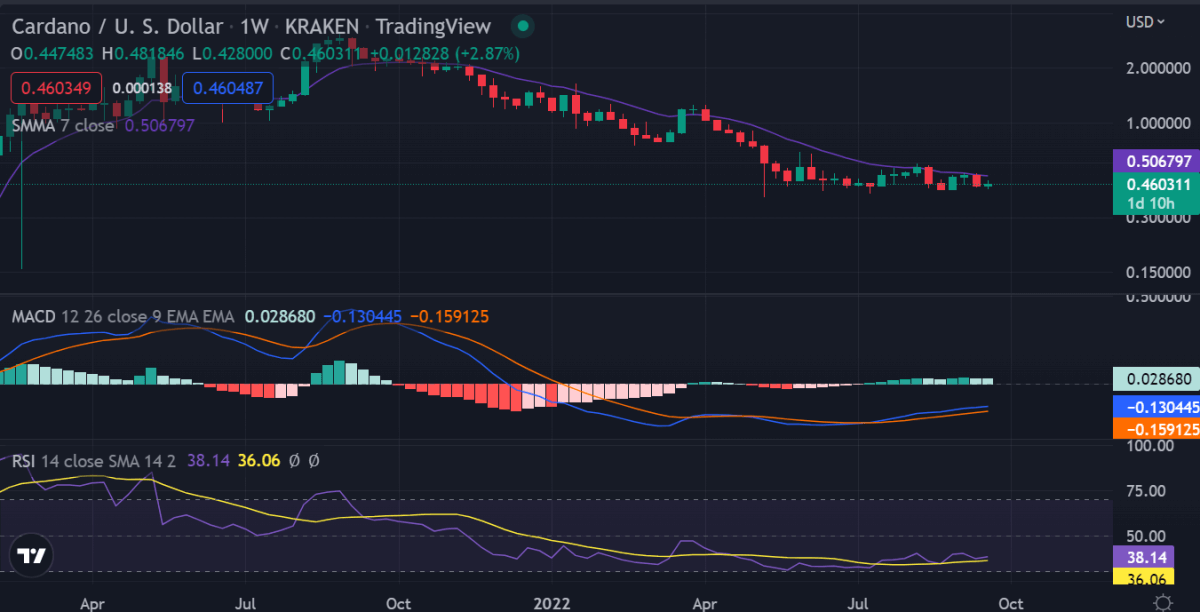

ADA/USD

Cardano has had a bullish week after the network deployed the ‘Vasil’ upgrade, which is designed to improve the efficiency of stake pools and delegations. The cryptocurrency’s price started a strong upward move above the $0.40 resistance area after a successful close above the 100-day simple moving average (SMA). There was also a break above the key $0.0750 resistance area and prices surged towards the next major resistance area near $0.0800.Cardano is currently trading at $ 0.4625509 after a successive daily surge of 2 percent. The market capitalization is $15.83B and the 24h volume traded is $645.91M.

The Fibonacci retracement levels are acting as strong supports in the ADA/USD pair. The 23.6% Fibonacci retracement level of the upward move from the $0.3513 low to the $0.4965 high is currently protecting declines near the $0.4650 area. There was also a break below a key bullish trend line with support near $0.4650 on the 4-hours chart of the XRP/USD pair. The price even fell below the $0.45 support area and tested the next major support at $0.4400.

At the moment, the bulls are defending the key $0.4400 support area and they are likely to make another attempt to push prices above the $0.4650 resistance area. If they succeed, there could be a sharp increase in buying pressure and prices might even reclaim the $0.5100 level. The main support is now near the $0.4400 level, below which ripple’s price could extend losses towards the last swing low of $0.3513. The major technical indicators are currently placed nicely in bullish territory.

Weekly crypto price analysis conclusion

The weekly crypto price analysis shows the market is currently in a bullish continuation as most of the digital currencies are trading above their key resistance levels. The main event this week was the successful launch of the Cardano Vasil upgrade, which is a positive development for the project. The next few weeks are likely to be crucial for the market as we could see some major price movements in the near term.

Disclaimer. The information provided is not trading advice. Cryptopolitan.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.