Our recent weekly crypto price analysis reveals the entire cryptocurrency is in a state of consolidation. The Total Crypto Market Cap) has decreased since reaching $836 billion and is now totaling $811.2.On the twentieth of December, a bullish engulfing candlestick was established in the cryptocurrency market cap signaling potential for an upswing. Consequently, this could prompt the capacity to reach $825 billion resistance.

On the other hand, if daily closing prices hit below $800 billion in the support area, it would signify a bearish market outlook and nullify this bullish crypto prediction. Bitcoin is down by 65% from its all-time high, marking the third bearish phase since 2014, and 2018.

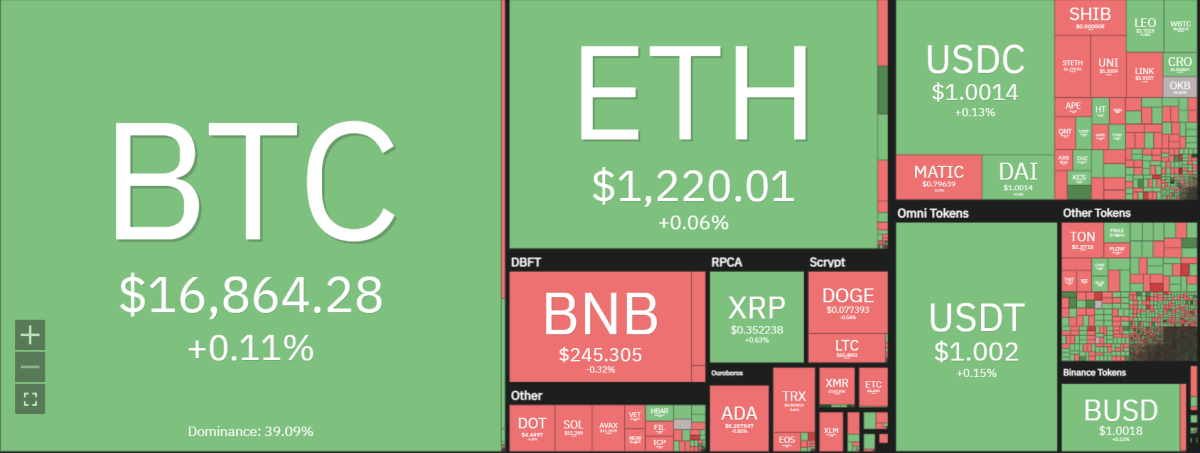

Bitcoin is leading the pack, consolidating around $17,000 key resistance. Ethereum is trading near the key resistance of $1,300.The best performer of the day is Decentraland which has gained by 6 percent while the worst performer is Solana which dropped by 4.42 percent.

Weekly crypto price analysis: Investors pump in money to crypto despite the uncertainty in the market

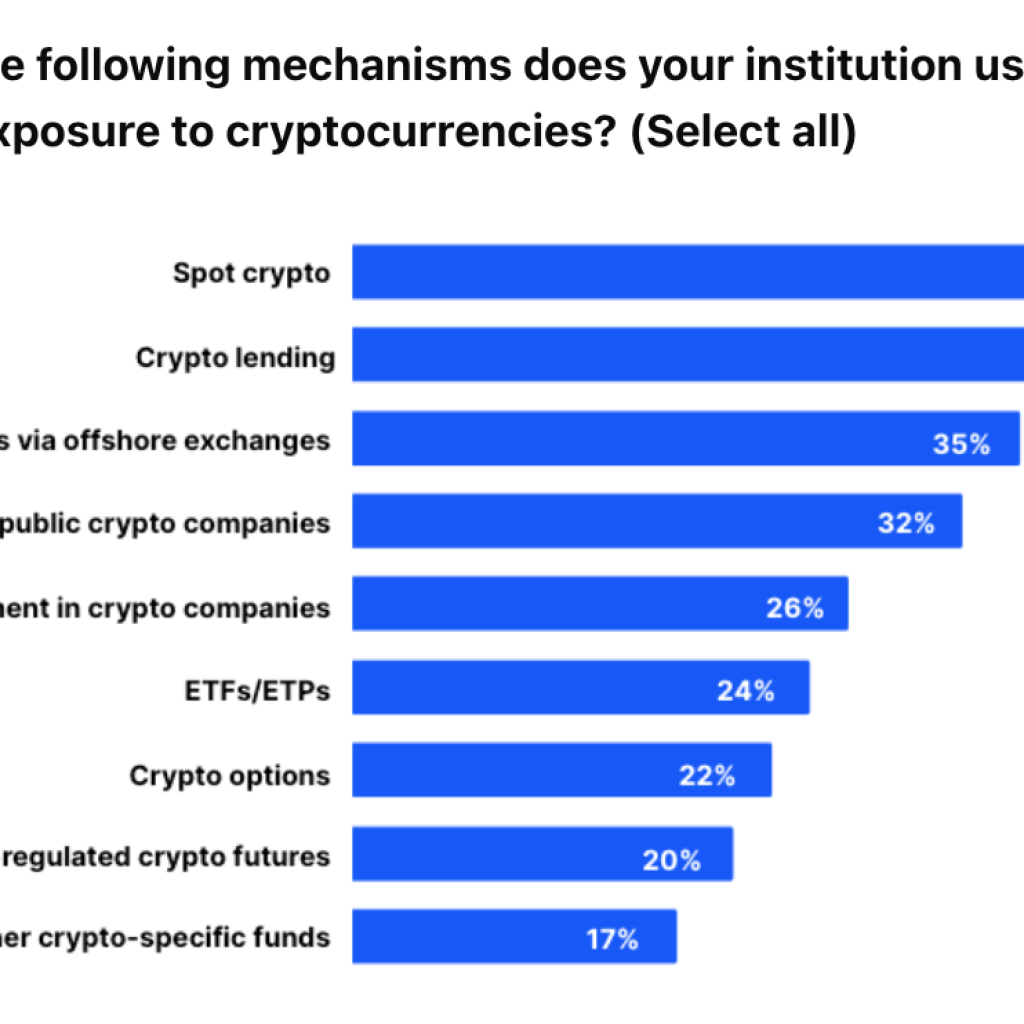

Our weekly crypto market analysis reveals that traders have not been deterred by declining cryptocurrency prices this year, but in fact, continue to invest heavily. Our online survey results from Blockchain.com indicate that an impressive 41% of respondents purchased crypto recently and 40% plan to purchase within the next 12 months – a clear sign that people remain confident in its future potential.

Nevertheless, the market’s recovery may only be sustainable once inflationary pressures begin to subside. This would cause investors to believe that the U.S. Federal Reserve will shift from its aggressive tightening of monetary policy and move towards an expansionist stance instead.

The markets may remain unsteady in the near term due to reduced trading volumes during the holiday season. Will Bitcoin and other digital coins begin a revival? Let’s analyze the graphs of the top 6 cryptocurrencies to find out.

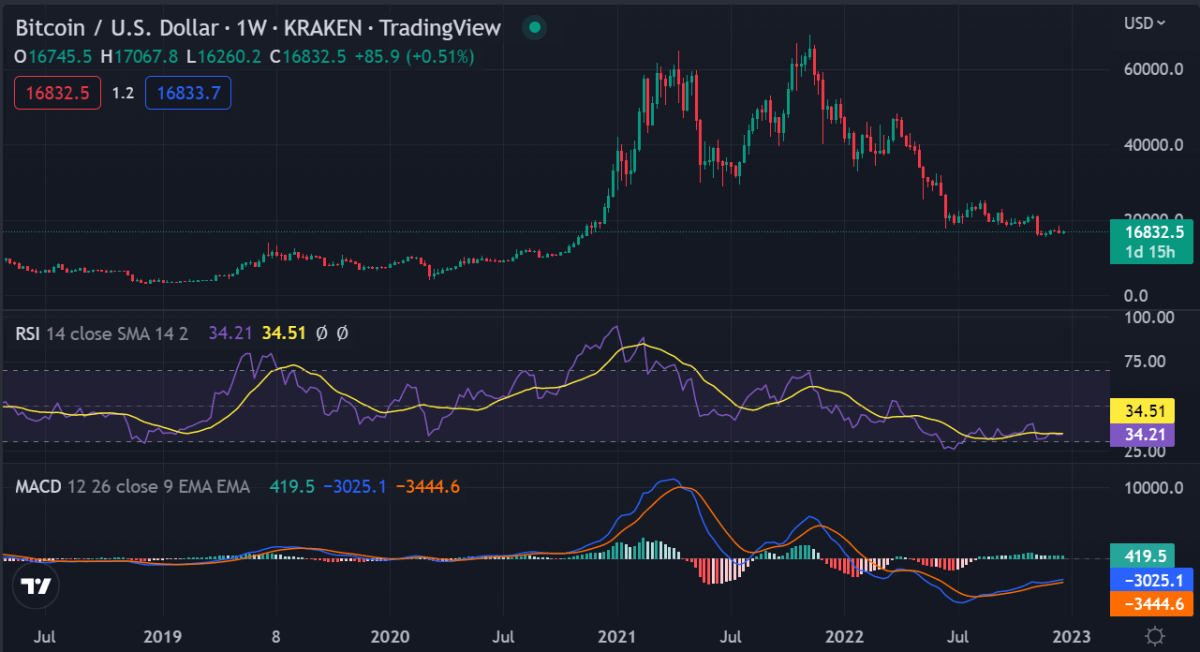

BTC/USD

The weekly crypto price analysis for the BTC/USD pair reveals Bitcoin has sustained above the stiff resistance at $17,700. Bullish action is likely for BTC/USD pair if it closes above the 20-day EMA (Exponential Moving Average). Bitcoin is trading at $16,850.47 and is currently consolidating in a narrow range. The bears made an attempt to push prices lower on Dec 22 but the bulls have regained control.

Looking at the technical indicators, a state of equilibrium is prevailing. The MACD (Moving Average Convergence Divergence) is marginally above the signal line, and the RSI (Relative Strength Index) is just below 50 levels. Furthermore, the bulls are looking to break through resistance formed by the moving averages. If they’re successful at doing so, we could see an increase in trading volume as BTC/USDT pair rockets up toward $18,388 – a crucial level of resistance. A break and close above this point would unleash a flurry of buying activity that could propel prices even higher to $21,500 or beyond.

If the bulls are unable to propel prices beyond the moving averages, it implies that there is a lack of demand for higher rates. Consequently, bears will seize this opportunity and try to drag prices below $16,256; if successful in doing so, then we could see a dramatic drop toward support at $15,476.

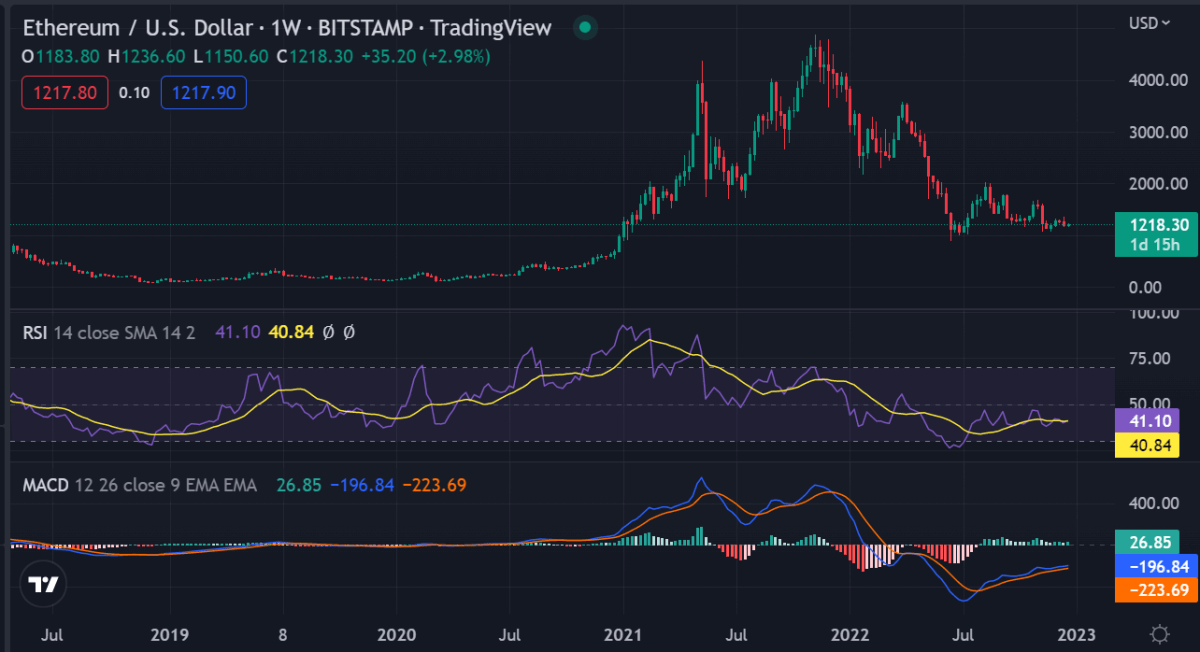

ETH/USD

Ethereum price movement over the last few days has been largely sideways. The bulls have been attempting to break the resistance at $1,300 while bears are trying to keep prices below this level. Despite these attempts, Ethereum is trading near its key resistance at $1,244 and is supported by the 20-day EMA (Exponential Moving Average).

Looking at the technical indicators, ETH has been bouncing off the $1,150 support on declining volumes. The MACD indicator is just below the signal line, while the RSI (Relative Strength Index) is around 50 levels. Furthermore, the bulls are attempting to break through the resistance formed by the moving averages. If successful in doing so, we could see ETH surge to $1,500 or beyond.

However, if the bears manage to push prices below $1,150, then we could see a sell-off that could lead ETH/USD to its important support at $1,000.

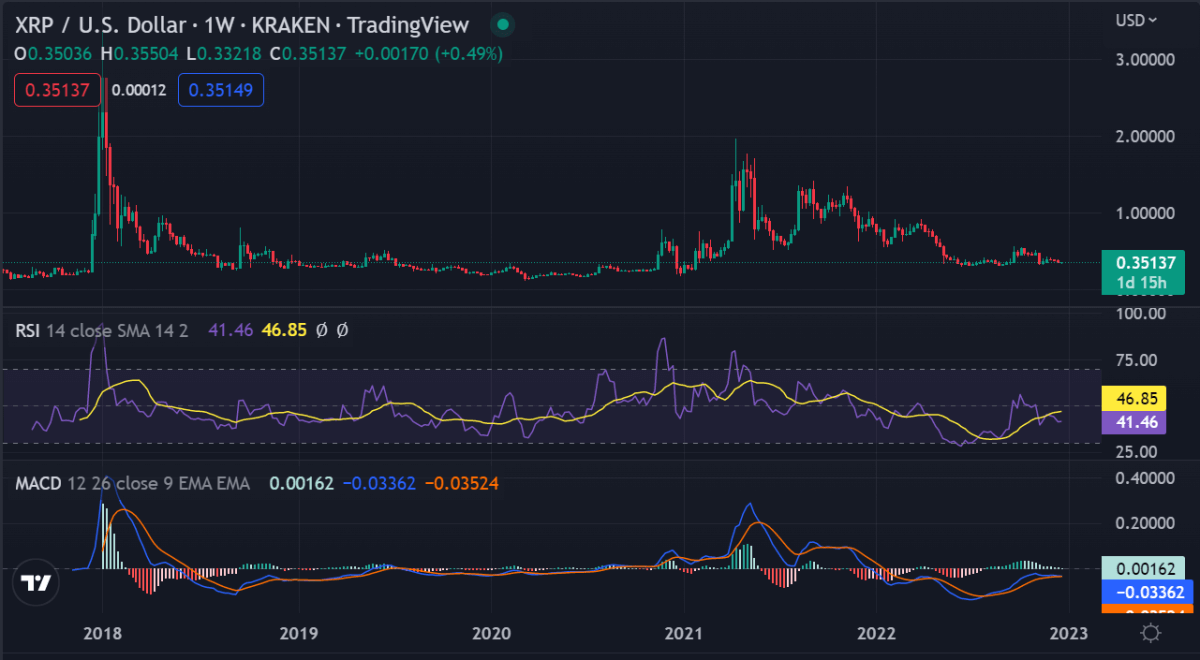

XRP/USD

According to our weekly crypto price analysis, Ripple has been on a declining trendline but has started to show signs of recovery in the last few hours. Ripple’s price is starting to gain momentum and is currently trading at $0.352.

The RSI (Relative Strength Index) is close to 50 levels. Furthermore, the bulls are attempting to break through the resistance formed by the moving averages. If successful in doing so, we can expect a surge toward $0.37 or beyond. However, if the bears manage to push prices below $0.34, then we could see a sell-off that could take XRP/USD all the way down to $0.30 – its crucial support level.

As the price slides below the 20-day EMA, bears will attempt to drive XRP/USDT pair beneath $0.33. If they succeed in their endeavor, we could see a plunge all the way down to an important support line at $0.30 that bulls are likely going to try and defend against further drops.

There is also the possibility that prices could rise from current levels, causing buyers to push the pair past overhead resistance at $0.37. Should this occur, it’s likely that we will witness a rally up as far as $0.41 – an area that could then serve as a formidable barrier.

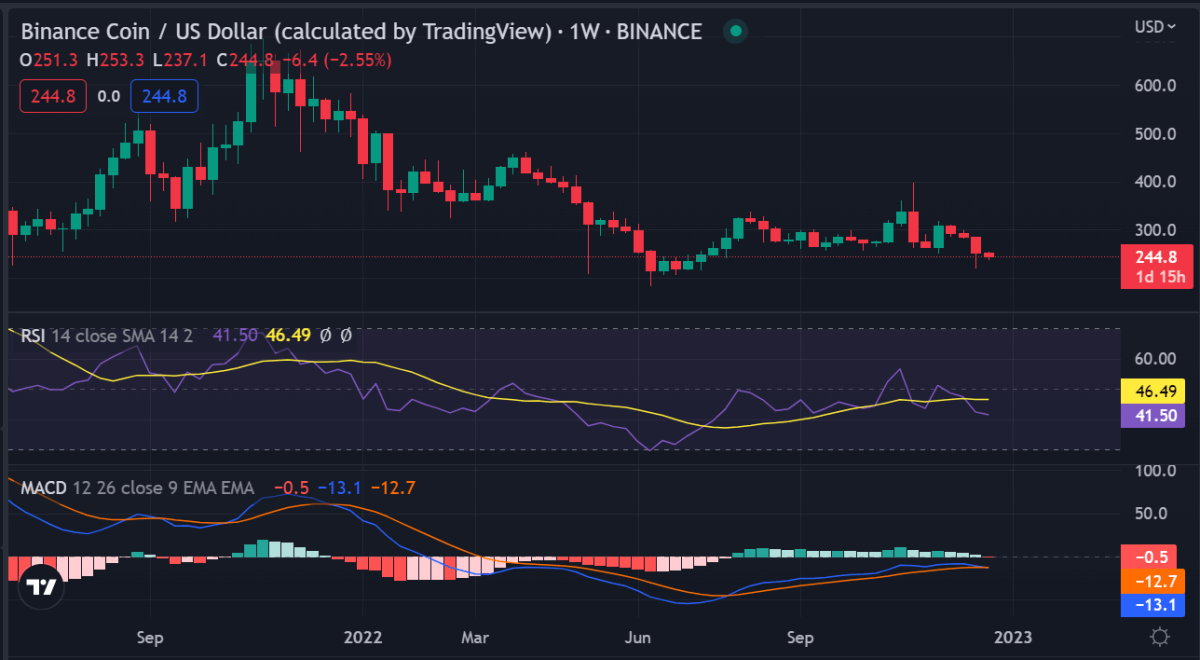

BNB/USD

The exchange coin has been trading around the breakdown level of $250 after falling sharply from the monthly trading level of around $280.BNB coin fell sharply after the recent news surrounding the Binance exchange. Binance coin is trading at $245.05 and is trying to make a move above the previous support of $250.0.The bears were able to break this key support level that the bulls have been defending.

However, the bulls might still see some hope as the MACD indicator is rising near 0 levels. The RSI (Relative Strength Index) is close to 50 levels and trading in a sideways manner. Furthermore, the buyers are attempting to break through resistance formed by the moving averages. If they succeed, we could expect BNB/USDT to rally to its previous high of (SMA 50) $280 or beyond. On the other hand, if the bears manage to push prices below $235, we could see a sell-off that could take BNB/USDT all the way down to $220 – an important support level.

DOGE/USD

Dogecoin has made impressive gains in the last few days after a rebound from the dip of around $0.06.Dogecoin surged to highs of $0.07728, and the buyers are trying to defend this level with vigor.

Dogecoin rebounded and has formed strong support near the $0.06 mark and is currently trading at $0.07729,a decrease of 0.62 percent in the last 24 hours. The MACD indicator is rising close to 0 levels while the RSI (Relative Strength Index) is around 49 levels. The bulls are attempting to break through the resistance formed by the moving averages. If successful, we could see DOGE/USD surge to its all-time high of $0.08 or beyond.

On the flip side, if the bears manage to push prices below $0.06 then we could see a sell-off that could take Dogecoin all the way down to important support at $0.05.

ADA/USD

Our weekly crypto price analysis reveals ADA dipped below the $0.3 mark and is now trading at around $0.258. The price has been on a declining trendline and the bears have managed to break through the support level of the 20-day EMA ($0.28).

The technical indicators are showing a continuous decline as Cardano has declined by 2.28 percent in the last 7 days. The RSI line is headed toward the oversold region and the MACD indicator is bearish. The bulls are attempting to break through the resistance formed by the moving averages but if they fail, we could see ADA/USD go down further toward $0.22 – an important support level. On the other hand, if the buyers manage to defend this crucial support line, then we could witness a rally up to $0.30 – a key resistance level.

Weekly crypto price analysis conclusion

Our weekly crypto price analysis sums up that most of the digital assets are trading close to their key resistance levels. The technical indicators are showing mixed signals, as the bears have managed to break through key support lines in some coins while buyers are attempting to defend crucial support levels in others. Overall, the market volatility is currently low and it looks like we might see a breakout in either direction during the upcoming week.