Our weekly crypto price analysis shows that most of the coins have been trading at their lower levels in the past seven days. For the whole of the week, the top coins have remained rangebound and have experienced some significant volatility intraday. Bitcoin (BTC) triggered a rapid downturn in the cryptocurrency markets, largely due to the woes at Silvergate Bank and Silicon Valley Bank dented investor sentiment. In addition, the holders and miners of most crypto assets sold off their holdings and transferred to fiat currencies, resulting in additional selling pressure.

The selling pressure continued on the 10th of march and pulled the BTC price below the $20,000 level, with another coin trading at their near their critical support levels for the week. Ethereum price has been trading in a tight range between $1,389 and $1,783 for the majority of this week.

Other altcoins have also been under pressure in the past week. XRP price has dropped below its support level at 0.36 USD, and it is now trading well below it at 0.3626 USD. Binance Coin (BNB) has declined to around ~$ 275, Dogecoin (DOGE) to about ~$ 0.065, and Cardano (ADA) experienced the biggest weekly loss, dropping nearly 14%.

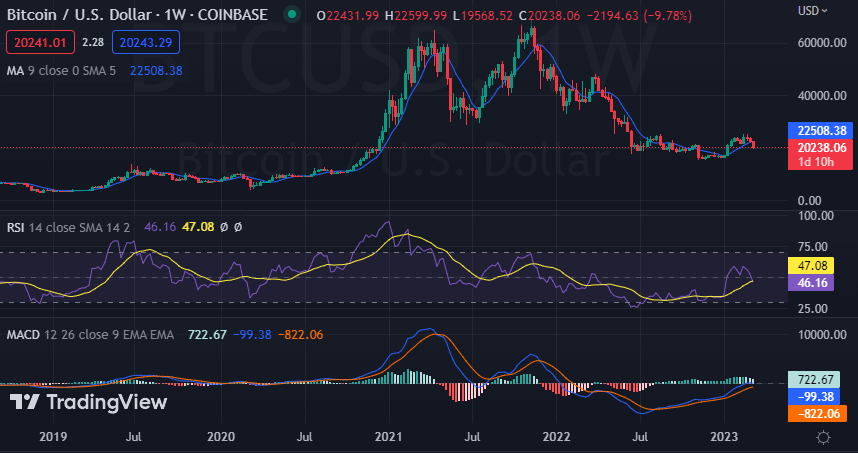

BTC/USD

The Bitcoin price analysis shows that the BTC price has been trading at its lowest levels since the beginning of March. However, today, the price has made some upward correction and is now trading above $20k. At the time of writing, BTC/USD is trading at around $20,154, with an increase of 1.8% in the past 24 hours and a decrease of 9.31% in the past seven days.

The support level of the BTC/USD pair is currently at $19,740, and the resistance level is at $20,792. The bulls will be looking for a break above the resistance level to bring back some optimism in the market. However, if the price makes a lower low below the support, then we can expect downward pressure on the prices.

The market capitalization is $391 billion, and the 24-hour trading volume is $34 billion. The price action of Bitcoin in the coming days will be crucial for the market as a whole to determine which way it’s headed in the near future.

The MACD indicator has seen a bullish crossover, and hence, the market sentiment remains positive. The relative strength index (RSI) is currently at 46.16, which implies a neutral to mildly bearish outlook in the near term. The 50-day moving average crossed above the 200-day moving average, indicating a bullish crossover.

ETH/USD

Ethereum price analysis shows that ETH has been trading in a narrow range between $1,389 and $1,481 for most of the days this week. The selling pressure was quite significant on Ethereum, and it dropped below the crucial $1,500 level. The bulls were able to make a comeback today and pushed the ETH/USD pair back into the range. At the time of writing, ETH/USD is trading at around $1,445, with an increase of 1.69% in the past 24. However, in the past seven days, it dropped by 7.94%. The market cap of Ethereum has increased to $176 billion, and the 24-hour trading volume is at $14 billion as more buying pressure has been seen in the past 24 hours.

Looking at the technical indicators, the MACD shows bullish momentum, with the signal line crossing above the MACD line. The RSI is currently at, indicating that the market could potentially go either way. And for the moving averages for ETH, the 50-day just crossed above the 200-day, showing bullish movement.

XRP/USD

According to our weekly crypto price analysis, Ripple has been on a downward trend since the beginning of March. The XRP price dropped, having been facing strong selling pressure as it broke below its critical support level at 0.36 USD. At the time of press time, XRP/USD is trading at around 0.3626 USD, with a decrease of 0.49% in the past 24 hours.

The RSI (Relative Strength Index) is close to 43.73 levels. Furthermore, the bulls are attempting to break through the resistance formed by the moving averages. If successful in doing so, we can expect a surge toward $0.37 or beyond. However, if the bears manage to push prices below $0.36, then we could see a sell-off that could take XRP/USD all the way down to $0.35– its crucial support level.

BNB/USD

The Binance Coin (BNB) price analysis shows that BNB has been facing strong selling pressure since the beginning of March. The BNB has been trading in a range between $260 and $280 for most of the week. Today, the BNB/USD pair has made some minor gains and is currently trading at around $275, with a gain of 1.49% in the past 24 hours.

The support level of BNB/USD is currently at $269, and the resistance level is set at $281. The bulls will be looking for a break above the resistance to bring back some optimism in the market. However, if the price makes a lower low below the support, then we can expect downward pressure on the prices.

The technical indicators are currently showing neutral to mildly bullish signals. The RSI (Relative Strength Index) is currently at 45.94, and the moving average indicator is on the verge of a bullish crossover. The MACD is also indicating some positive momentum, but it has yet to cross above the signal line. The 50-day moving average is about to cross above the 200-day moving average, indicating that a bullish crossover is possible in the coming days. It will be crucial for BNB/USD to break above its resistance level and maintain that momentum if we are to see any further upside in the near term.

DOGE/USD

The Dogecoin price analysis shows that DOGE has been trading in a narrow range between $0.064 and $0.068 for most of the days this week. The bulls and bears have been in a tug of war, as the market has not seen any major movements up or down. The bearish sentiment was quite significant on Dogecoin, and it dropped below the psychological level of $0.064.

The latest Dogecoin price analysis is currently at $0.065, with an increase of 0.69% in the past 24 hours, the market capitalization is at $8.6 billion, and the 24-hour trading volume is at $446 million. The technical indicators are currently showing a negative bias in the market as the RSI (Relative Strength Index) is close to the 41.79 level.

The MACD lines have crossed below the signal line, indicating bearish momentum in the market. The moving average indicator is currently at $0.0831, with the 20-day moving average slowly crossing below the 50-day moving average, indicating a bearish crossover.

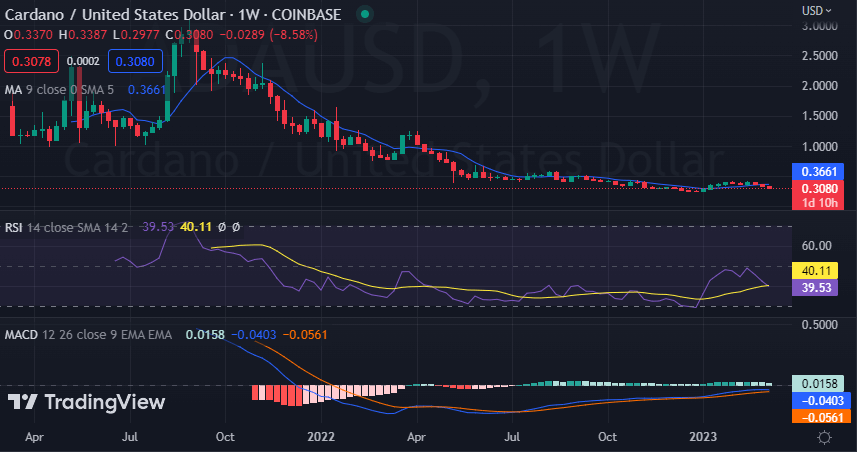

ADA/USD

Cardano price analysis for today shows that ADA/USD has been in a sideways trend since the beginning of March. The selling pressure is still present on the market as the bears are trying to push prices below the key support level of $0.30.

The ADA/USD is currently trading at around $0.308, with a decrease of 1.30% in the past 24 hours. The bulls are still trying to break the resistance of $0.32 in order to bring back some optimism in the market. However, the bears are still in control, and any attempt to break above could be met with further selling pressure.

The technical indicators are currently showing bearish signals. The RSI (Relative Strength Index) is close to 39.53 levels, and the Moving average convergence divergence (MACD) indicator shows a bearish crossover as the histogram decreases. The 50-day and 200-day moving averages are both below the price action, indicating that further downward pressure could be expected in the near term.

Weekly crypto price analysis conclusion

Overall, the crypto market is still facing strong selling pressure, and volatility remains high. Most of the major cryptos have been trading in a sideways trend for most of this week, and investors are cautious about making any big moves. However, today some of the cryptos, including BNB, DOGE, and ADA, have witnessed some slight gains. Crypto investors need to keep a close eye on the technical indicators as well as any news that could affect the market in order to make informed decisions about their trading strategies. The coming days will likely be crucial for determining which direction the crypto market will take.