Weekly crypto price analysis reveals that most of the cryptocurrencies have been trading in mixed signals, with bullish and bearish trends visible in the market. The top coins like Bitcoin, Ethereum, and XRP have been the most volatile in the past few days. Bitcoin price analysis shows that BTC has seen a significant fall in its price from the high of $31,000 to dropping close to $27,500 by mid-week. However, it was able to recover from there and is currently trading at around $28,500.

Ethereum coin analysis indicates that ETH has been trading in tight ranges between $1,800 and $1,900 levels. It has seen some relief from the bearish trend but is still far away from its all-time high of $3,000. Ripple’s (XRP) price analysis has been struggling to stay above the 0.46 USD mark, but it seems that the coin is slowly finding its footing. The token of Binance Exchange – BNB – price analysis shows a good performance as well with its value staying close to the $325 mark throughout the week. Dogecoin (DOGE) price analysis has also been quite down throughout the week with its value ranging between 0.081 and 0.076 USD – a 5% loss since last week’s trading session.

Finally, Cardano (ADA) price analysis reveals that ADA has lost more than 5% in the past week, with its price falling to the lowest of the week at 0.142 USD. It is currently trading close to the 0.146 level and is looking for a reversal in momentum soon. Looking at the altcoins like AAVE, SNX, and SUSHI also experienced a mixed reaction in the market this week.

BTC/USD

Bitcoin continues to trade inside the symmetrical triangle pattern, indicating indecision among the bulls and the bears. On date 2 May the BTC /USD formed a strong bearish and the price hit a month late of $27,100. But the bulls have managed to protect the key level and push it back to $28,000. Currently, the BTC/USD is currently trading at $28,883, with support present at $27,700 and resistance at $29,000.

Looking ahead, if the buyers manage to break above the $28,500 resistance zone, the BTC/USD pair could start a new bullish trend and may rise towards 30K levels. And if bearish sentiment resumes, the BTC/USD pair could fall back towards $26,000. The weekly technical indicators have given a neutral trading signal. The MACD indicates no clear direction, while the RSI is hovering near the 60 level. The 20-EMA has been trading flat, indicating a lack of trend development, with 50-EMA and 200-EMA also exhibiting the same behaviour.

ETH/USD

Ethereum has been trading at a narrow range between $1,800 to $1,900 since the beginning of the week. The bullish and the bearish forces have been in equilibrium, with neither side able to gain the upper hand. At the time of writing, the ETH/USD pair is trading near the $1,838 level.

The ETH/USD pair has strong support present at $1,870 and resistance at $1,921. If the bulls can break above the resistance zone, it could open up a fresh bullish trend with the price heading towards $2,000 levels or even higher. On the other hand, if the bears gain control, Ethereum could fall back to $1,700 or even lower.

The weekly technical indicators are giving a bullish signal as the MACD is pointing upwards and the Histogram is trending higher. The RSI is also trading in neutral territory, while the 20-EMA and 50-EMA are both headed upwards. The moving average indicator has been trading flat, indicating a lack of trend development.

XRP/USD

Ripple’s XRP has been struggling to stay above the 0.45 USD mark for the most of days this week. The bulls have been able to protect this important support zone in the past few days however the bearish sentiment still persists in the market. The XRP/USD pair is present at $0.4587 with a 24-hour loss of 0.75 percent. The XRP/USD has strong support present at 0.4548 and resistance at 0.4626.

The RSI is currently hovering around 50 levels but is still in a neutral zone – indicating that buyers and the bearish sentiment are in equilibrium. The MACD has given a neutral signal, while the Histogram is trending lower. The 20-EMA and 50-EMA have been headed downwards, suggesting bearish momentum. Currently, the weekly Moving average indicator is trading at the $0.4611 level, indicating a lack of trend development.

BNB/USD

Binance Coin has been trading in positive territory since the beginning of the week, with some bearish correction in the last few days. The buying pressure has been strong in the market, helping the BNB/USD pair rise above $325 levels. BNB/USD is present at $324 with a 24-hour loss of 0.31 per cent.

The RSI indicator is trading in neutral territory, while the MACD has given a bullish signal. The Histogram is trending higher and the 20-EMA and 50-EMA are both headed upwards. The weekly Moving average indicator is trading at the $325 level, indicating a bullish trend. If the bulls manage to break above $325, BNB/USD could gain further momentum and may rise toward $330 or even higher. However, if the bears take control of the market, the Binance coin could fall back to $310 or lower.

DOGE/USD

According to the weekly crypto market analysis, Dogecoin has been trading in a sideways range between $0.081 and 0.076 since the beginning of the week. At the time of writing, DOGE/USD pair is present at 0.07708 with a 24-hour loss of 1.45 per cent. The selling and buying pressure have been in equilibrium, with neither side being able to gain the upper hand.

The weekly technical indicators are giving a mixed signal, with the MACD indicating no clear direction and the RSI hovering around 47.11 levels. The 20-EMA and 50-EMA have been trading flat, while the 200-EMA have been headed downwards. The 50-Weekly moving average indicator has been hovering below the 200-EMA, indicating that the bears are in control.

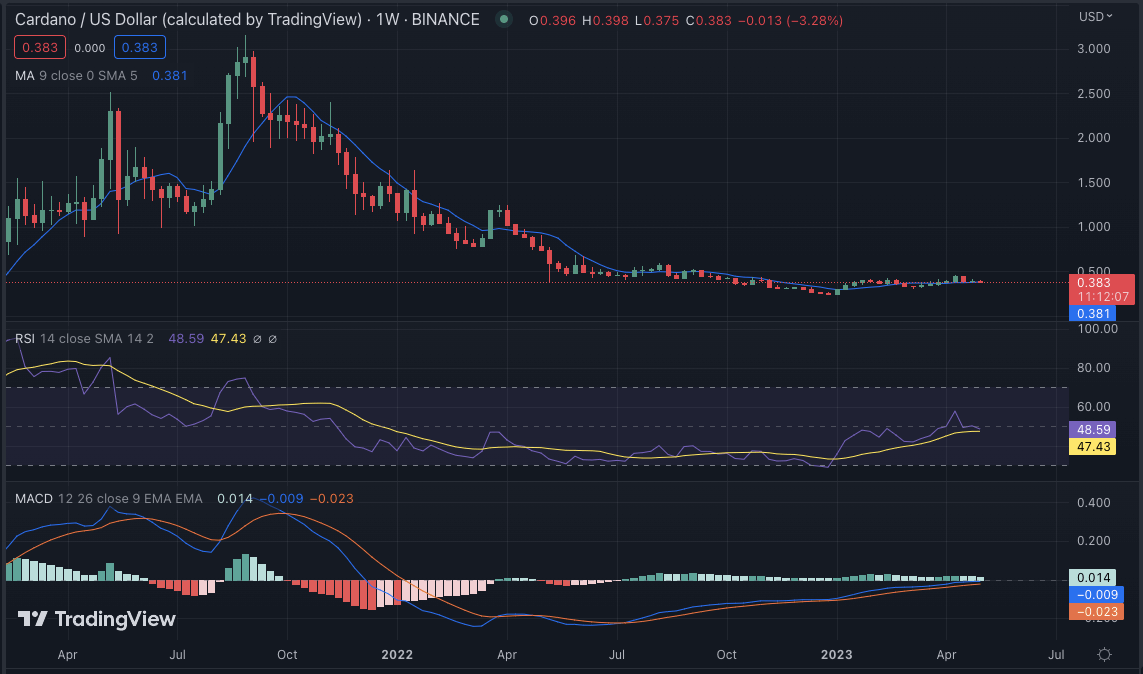

ADA/USD

Weekly crypto market analysis shows that Cardano has been trading mixed reactions this week, with some bearish correction in the last few days. The ADA/USD pair is present at 0.3808, with support and resistance levels present at $0.3766 and $0.3874 respectively. And if the bulls manage to break above the resistance, ADA could gain further momentum and may rise toward $0.40 or higher. on down the other hand, if the bears take control of the market, Cardano could fall back to $0.36 or even lower.

The technical indicators have been in mixed signals. The moving average convergence divergence (MACD) has given a bearish signal, while the Histogram is trending lower. The relative strength index (RSI) is trading in neutral territory and the 20-EMA and 50-EMA are both headed downwards. The weekly Moving average indicator has been trading at the $0.381 mark.

Weekly crypto price analysis conclusion

Weekly crypto analysis shows that many major cryptocurrencies have been trading in a sideways range. The bears and the bulls are locked in a battle for control, while the market is waiting for the decisive factor which can make it move either way. With the technical indicators giving mixed signals, it is yet to be seen whether any cryptocurrency will break out of its trading range or not.